AA~A-Grade Corporate Bond Yield Spread Re-expansion

Reflecting Credit Risks Such as Deteriorating Corporate Earnings and PF Defaults

Interest in Demand Forecast Results for Companies Rated A and Below

Even after the banking crises in the United States and Europe have subsided, corporate bond yields have not significantly calmed down. In particular, yields on lower-rated non-investment grade bonds have risen sharply, causing the yield spread between investment-grade and non-investment grade bonds to begin widening again. As investors remain cautious about corporate credit risk and real estate project financing (PF) defaults, the interest burden on lower-rated companies is expected to continue increasing for some time.

Yield Gap Between Investment-Grade and Non-Investment Grade Companies Widens Again

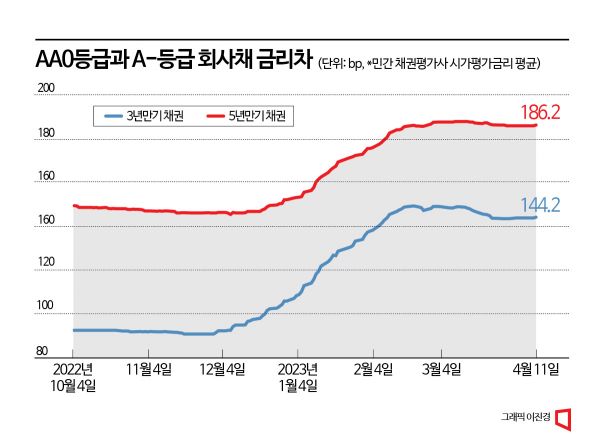

According to the bond market on the 13th, the yield spread between AA-rated and A- rated bonds for 3-year maturity general corporate bonds widened to 144.2 basis points (bp) (1bp = 0.01 percentage points) as of the 11th. The spread had mostly stayed below 100bp until the end of last year but has shown a steady upward trend since the beginning of this year. For 5-year maturity corporate bonds, the yield spread between the two ratings also expanded to around 186.2bp as of the 11th.

Right after the Legoland incident in October last year, yields on public bonds and investment-grade corporate bonds surged simultaneously, so the yield gap between investment-grade and non-investment grade bonds did not widen significantly. However, since the beginning of this year, the spread between investment-grade and non-investment grade corporate bonds has been trending upward. The spread, which had been in a box range since February, has recently started to widen again.

At the start of the year, the government stabilized the bond market by supplying large-scale liquidity, which led to a significant downward stabilization of yields on investment-grade corporate bonds. In contrast, concerns about corporate credit risk, including deteriorating corporate earnings and real estate PF, remain for low-credit companies. A bond market official evaluated, "Investor sentiment toward high-risk bonds with low credit ratings has weakened, causing the market to demand higher yields."

Sangman Kim, a credit analyst at Hana Securities, forecasted, "Although the bond market has generally stabilized following the banking crises in the US and Europe, distrust in asset soundness has increased the likelihood of credit spreads widening." Kim added, "The financial authorities' announcement of their intention to restructure real estate PF has created tension in the market, which is also affecting yields."

Distrust in Asset Soundness Persists

As credit spreads begin to rise again, attention is focused on the demand forecast results for A-rated companies preparing to issue corporate bonds. This could serve as an opportunity to gauge market sentiment toward companies rated A and below.

According to the investment banking (IB) industry, many A-rated companies are currently preparing to issue corporate bonds. Hyundai Kefico (A+), Dongwon Systems (A+), KCC Construction (A-), and Hyundai Construction Equipment (A-) plan to issue corporate bonds this month. HD Hyundai Electric (A) and Pyeongtaek Energy Service (A) are also reportedly preparing to issue corporate bonds.

Korean Air (BBB+) plans to issue 150 billion KRW worth of corporate bonds and will conduct a demand forecast on the 17th. With passenger demand surging explosively and a 'positive' rating outlook, Korean Air is expected to have no difficulty securing demand. Fubon Hyundai Life Insurance plans to issue perpetual bonds to improve its Risk-Based Capital (RBC) ratio, a solvency regulation for insurers.

An IB industry official said, "At least the companies coming to the public corporate bond market are somewhat confident in securing investment demand," adding, "A significant number of companies rated A and below are unable to access the public market and are issuing high-interest private bonds or relying on short-term funding such as commercial paper (CP)."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.