Fixed Interest Rates for Mortgage Loans and Jeonse Loans Both in the 3% Range

Variable Interest Rates for Mortgage Loans Expected to Enter 3% Range After the 15th

Existing Borrowers Likely to Feel Interest Rate Cuts Within the Second Quarter

The lower end of interest rates for both mortgage loans and jeonse deposit loans is recording in the 3% range. The Bank of Korea has kept rates unchanged twice in a row, and with growing expectations that rate hikes have ended, bank bond yields have fallen. New borrowers can now borrow money at much lower rates than when rates peaked in the second half of last year. Those who had been struggling with increased interest payments, such as the "young all-in" borrowers and jeonse tenants, are expected to gradually benefit from falling rates starting from the second quarter of this year.

As of the 12th, the interest rates of the five major banks (KB, Shinhan, Woori, Hana, NH) show that for mortgage loans, fixed rates (5-year fixed then variable) range from 3.69% to 5.85%. The variable mortgage rates range from 4.18% to 6.20%, with the lower end soon approaching the 3% range. A representative from a commercial bank said, "Fixed rates respond more quickly to market influences because they are affected daily by bank bond yields, unlike variable rates which change about once a month," adding, "If the COFIX (Cost of Funds Index) falls on the 15th, variable mortgage rates will also drop into the 3% range."

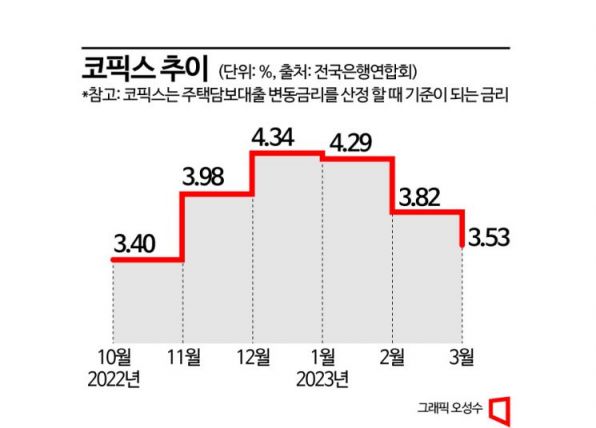

In fact, the COFIX based on new transactions peaked at 4.34% in December last year and fell by 0.81 percentage points over three months until March this year. COFIX is the weighted average interest rate of funds raised by eight domestic banks and determines the movement of loan interest rates. It reflects changes in interest rates of deposit products such as actual deposits, savings, and bank bonds handled by banks.

Currently, the lower end of both variable and fixed interest rates for jeonse loans at the five major banks is in the 3% range. Variable rates range from 3.74% to 5.96%, and fixed rates from 3.46% to 5.86%. Another commercial bank official said, "As interest rates generally decline, there will be changes in household loan balances, which had only been decreasing last year."

New borrowers can borrow at rates as low as the 3% range, but existing borrowers will need more time to feel the effects of rate cuts. This is because variable rate loan products usually adjust rates once every six months. The COFIX and bank bond yields, which are the basis for variable rates, remained high throughout the second half of last year and have been gradually declining since January this year. Considering the variable rate recalculation cycle, existing borrowers are expected to receive notification texts from banks within the second quarter informing them that their rates have dropped compared to before.

The Financial Supervisory Service stated, "New loan interest rates continue to decline, and the upward trend in balance-based interest rates has significantly slowed," adding, "Considering that it takes some time for the effect of falling new loan rates to be reflected in balance-based rates, balance-based interest rates are expected to shift to a downward stabilization trend in the second quarter unless market interest rates turn upward."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.