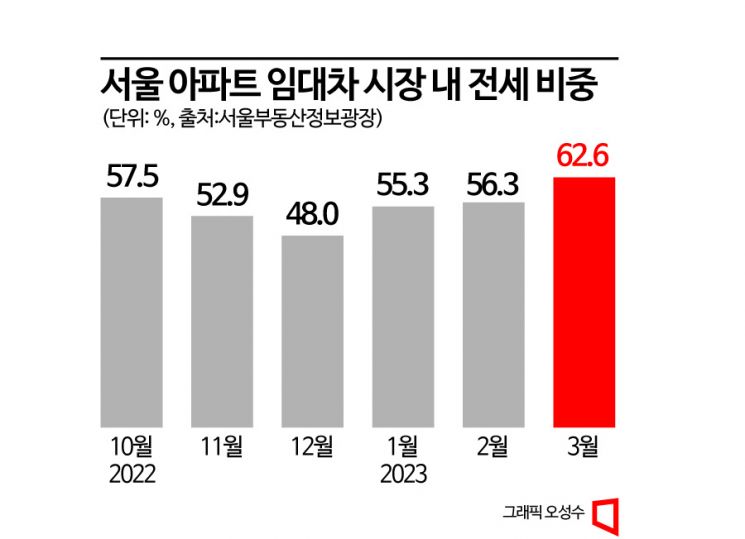

March Seoul Apartment Jeonse Ratio 62.6%

Fell to 40% Range in December Last Year Due to High Interest Rates

Jeonse Listings Also Decreased by 10% Compared to a Month Ago

The jeonse market has revived, overcoming the ‘extinction’ crisis in the era of high interest rates. In March, the spring moving season, the share of jeonse in the Seoul apartment rental market exceeded 60% for the first time in seven months. As tenants who were pushed into the monthly rent market due to interest burdens saw jeonse prices fall amid reverse jeonse difficulties, they are returning to the jeonse market.

On the 13th, Asia Economy analyzed the Seoul Real Estate Information Plaza and found that out of a total of 18,359 apartment lease contracts in Seoul in March, 11,499 were jeonse, accounting for 62.6% of the total. It is the first time in seven months since August last year (60.4%) that the monthly share of jeonse in Seoul apartments exceeded 60%. Previously, due to the impact of US-originated interest rate hikes, the interest burden on jeonse loans surged, causing the jeonse share to drop to 48% in December last year. This led to forecasts that the jeonse system, which is hard to find in other countries, might disappear.

However, as rental demand concentrated on monthly rent, monthly rent prices soared, and landlords who could not find jeonse tenants lowered jeonse prices, the jeonse share has gradually recovered since January. The recent cut in jeonse loan interest rates following the Bank of Korea’s base rate freeze also influenced the recovery of jeonse demand. Accordingly, the jeonse share exceeded ▲55.2% in January ▲56.3% in February ▲62.6% in March, and currently stands at 66.9% in April.

As more people seek jeonse, the number of listings has noticeably decreased. According to Apartment Real Transaction Price, a real estate big data company, the number of jeonse listings for Seoul apartments was 43,349 as of the 12th, exactly 10.0% less than 48,159 a month earlier. By region, Seongbuk-gu saw the largest decrease at -23.9%, followed by Mapo-gu -22.1%, Dongjak-gu -19.8%, Songpa-gu -19.2%, Gangseo-gu -16.4%, Gwangjin-gu -16.2%, Jongno-gu -15.8%, and Yangcheon-gu -15.2%.

With jeonse demand returning to the rental market, prices remain weak but there is analysis that the ‘bottom has been reached.’ According to the Korea Real Estate Board, the decline rate of Seoul apartment jeonse prices in the first week of April was 0.24%, marking the 11th consecutive week of narrowing decline. In fact, in areas like Mapo-gu and Dongjak-gu where jeonse prices plunged due to new supply, there have recently been cases where actual transaction prices were higher than previous deals. For example, a 59.76㎡ unit at Heukseok River Park Xi in Heukseok-dong, Dongjak-gu, which started move-ins in February, signed a jeonse contract for 600 million KRW on the 2nd, 30 million KRW higher than 570 million KRW on the 30th of last month. Similarly, in Mapo-gu Ahyeon-dong, where jeonse prices plunged due to the entry of Mapo The Classy, an 84.59㎡ unit was traded for 800 million KRW on the 8th, higher than 770 million KRW and 750 million KRW on the 14th and 21st of last month, respectively.

However, new supply concentrated in the Gangnam area remains a variable. This year, a total of 38 complexes with 33,338 households will move in across Seoul, of which 27%, or 9,037 households, are concentrated in the Gangnam area.

Baek Saerom, senior researcher at Real Estate R114, said, "The Seoul jeonse market saw increased contracts mainly for low-priced urgent sales as spring moving season and school district and switching demand flowed in. Since interest rates are likely to move within a predictable range, except for some areas with a short-term increase in move-in supply, the trend of narrowing price declines is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.