A survey revealed that cases of not receiving indemnity insurance payments after cataract surgery are increasing.

The Korea Consumer Agency announced on the 11th that among 452 indemnity insurance non-payment relief applications received over the past three years (2020?2022), 151 cases, accounting for 33%, were related to cataract surgery. Of these, 92.7% (140 cases) were filed last year when insurance companies strengthened their insurance payment review criteria. This is a sharp increase from 6 cases in 2020 and 5 cases in 2021.

The most common reason for not paying insurance benefits was "the cataract is mild, so the necessity of surgery cannot be recognized" (67.6%). This was followed by "no side effects or complications were confirmed, so hospitalization necessity is not recognized" (23.8%), and others (8.6%).

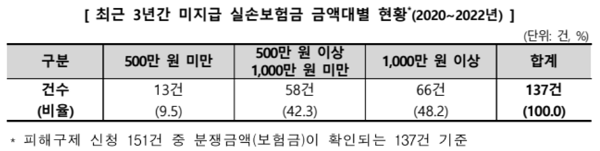

Among 137 cases where the disputed amount related to cataract indemnity insurance could be confirmed, 66 cases (48.2%) involved unpaid indemnity insurance amounts of "10 million KRW or more," 58 cases (42.3%) were "5 million KRW or more but less than 10 million KRW," and 13 cases (9.5%) were "less than 5 million KRW." The average amount of indemnity insurance not received by consumers reached approximately 9.61 million KRW.

Insurance companies strengthened the insurance payment review criteria for cataract surgery last year, citing increased loss ratios due to some medical institutions conducting excessive treatment under imprecise policy terms.

The Korea Consumer Agency urged consumers to check the insurance companies' payment review criteria before surgery and to secure objective test results related to cataracts to prevent disputes related to cataract indemnity insurance.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.