Hanwha Aerospace and Korea Aerospace Industries Heavily Bought

Reflecting Expectations for the Aerospace Sector Considered the 'Last Blue Ocean'

Foreign investors have been net buyers of aerospace-related stocks for more than 10 consecutive days, sending a strong love call. The aerospace sector is receiving high expectations as the "last blue ocean" and is considered the second secondary battery to drive the rise of the domestic stock market. In particular, the upcoming third launch of Nuriho in May is believed to have stimulated foreign investors' sentiment.

According to the Korea Exchange, foreign investors have net purchased Hanwha Aerospace every day for a total of 13 days from March 23 to April 10. During this period, the total amount purchased by foreigners was estimated to be 160 billion KRW. Based on the closing price on the 10th, Hanwha Aerospace closed at 117,300 KRW, up 5.77% from the previous trading day. Especially, Hanwha Aerospace, which participated in the production of the Nuriho launch vehicle, has recorded a rise of more than 55% this year alone. Han Yoo-geon, a researcher at KB Securities, said, “Hanwha Aerospace plans to launch Nuriho a total of four times by 2027 through the Nuriho project orders, putting practical satellites into orbit to perform various missions such as space technology verification and ground observation,” adding, “As the only domestic company providing launch services, it is expected to commercialize private satellites and spacecraft.”

During the same period, foreigners also net purchased Korea Aerospace Industries (KAI) every day without exception. Foreigners purchased a total of 131.9 billion KRW worth during this period. Based on the closing price on the 10th, Korea Aerospace Industries closed at 50,600 KRW, up 0.40% from the previous trading day. Lee Seung-woong, a researcher at Ebest Investment & Securities, analyzed, “Korea Aerospace Industries is a next promising stock in K-defense, and sales growth and profit margin improvement are expected to be achieved simultaneously this year,” adding, “There is sufficient potential for stock price appreciation.”

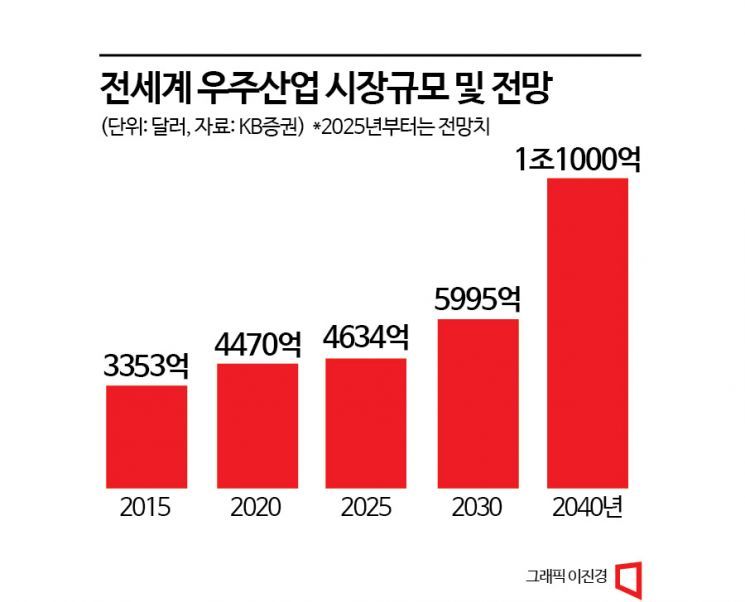

The reason foreign investors focused on buying Hanwha Aerospace and Korea Aerospace Industries is interpreted as the expectation for the aerospace sector, regarded as the "last blue ocean." The Ministry of Science and ICT announced that it will invest 874.2 billion KRW in space development this year, a 20% increase from last year, combined with the anticipation of the third Nuriho launch in May. According to KB Securities, the global space industry market size in 2020 was approximately 447 billion USD (about 523 trillion KRW), growing about 4.4% compared to the previous year. After COVID-19 and the Ukraine-Russia war, the market demand for various communication satellites has expanded due to security, reconnaissance, and internet dissemination, and by 2040, this market is expected to grow to 1.1 trillion USD (about 1,365 trillion KRW), showing a scale about twice that of 2020.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.