Users Are the Most, but Commission Rates Are Among the Lowest in the Industry

Accelerating Offline Strategy by Partnering with Samsung Pay

As the commission rates for simple payment services were disclosed for the first time, Naver Pay, previously considered the largest 'giant,' was found to have the lowest commission rates. Taking this opportunity, it is expanding into the offline sector in partnership with Samsung Pay and is actively targeting the market.

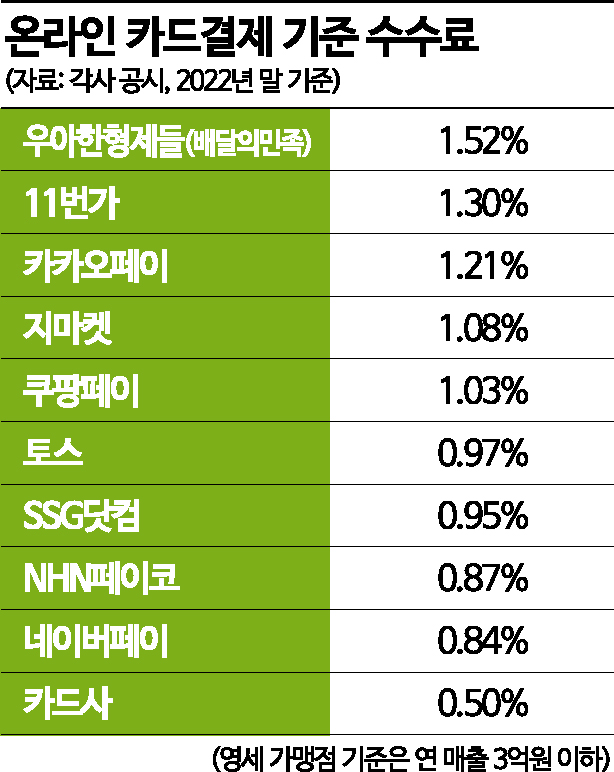

According to the industry on the 9th, the online card payment commission rate of Naver Pay, operated by Naver Financial, was found to be 0.84% (for small merchants with annual sales under 300 million KRW) to 2.18% (for general merchants with annual sales over 3 billion KRW). Among the nine major simple payment providers (Naver Financial, Kakao Pay, Toss, Woowa Brothers, Coupang, NHN Payco, 11st, Gmarket, SSG.com) that are required to disclose their commission rates due to the Financial Supervisory Service's first introduction of the disclosure system, Naver Pay, the largest in scale, showed the lowest commission rates. The gap with the existing card commission rate of 0.5% was the smallest, and it was only about half the rate of Baemin Pay (1.52%) by Baedal Minjok (Woowa Brothers), which has the highest commission rate for small merchants.

In the prepaid electronic payment method where cash is charged and used, Naver Pay also had the lowest commission rate of 0.91% for small merchants. Compared to Woowa Brothers' flat 3.00%, which applies regardless of sales scale, it is less than one-third. Similarly, Coupang Pay (2.50%), SSG.com (2.50%), Gmarket (2.49%), and 11st (2.00%), which apply the same commission rates regardless of sales scale, all exceeded twice that of Naver Pay. Considering that Naver Pay operates programs such as 'Start Zero Commission' for new small businesses exempting commission fees, 'Return Care Free Support' covering return shipping costs, and 'Fast Settlement' paying settlement funds within three days after payment, it is analyzed that the perceived commission rate gap could widen further.

It is also analyzed that this commission strategy influenced Naver Pay's continued top ranking in payment amounts. According to data submitted by the Financial Supervisory Service to Yoon Chang-hyun, a member of the National Assembly's Political Affairs Committee from the People Power Party, the amount paid through Naver Financial in 2021 (including prepaid electronic payment methods and account transfers) was recorded at 44.0188 trillion KRW. This far exceeds the second place Kakao Pay (17.4536 trillion KRW) and Toss (2.1978 trillion KRW).

With the recent partnership with Samsung Pay to expand into the offline sector, there are expectations that its market influence could grow further. Since the 29th of last month, Samsung Pay's on-site payment function was introduced in the Naver Pay application (app). While the number of QR code payment merchants was about 120,000, the introduction of Samsung Pay has greatly expanded the payment area to about 3 million offline merchants nationwide. Unlike online payment commissions, offline payment commissions do not require merchants to bear additional fees beyond the card merchant fees paid to credit card companies, so versatility is expected to improve further. It is also analyzed that Naver Pay could have a comparative advantage for merchants compared to Apple Pay, where Hyundai Card pays about a 0.15% commission to Apple per transaction.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.