Battery Companies Expected to Significantly Increase Profit Margins in Q1

Profit Margins Expand Despite Increased Facility Investments

Battery Costs Down 40%, Cathode Material Companies Also Take Off

Korea's top three battery companies and cathode material companies, which are key battery materials, have begun to rake in substantial profits. Despite concerns over a global demand slowdown, battery companies are demonstrating high growth through their numbers.

An employee at LG Energy Solution's Ochang plant is showcasing a cylindrical battery. The photo is not directly related to the article. Photo by LG Energy Solution

An employee at LG Energy Solution's Ochang plant is showcasing a cylindrical battery. The photo is not directly related to the article. Photo by LG Energy Solution

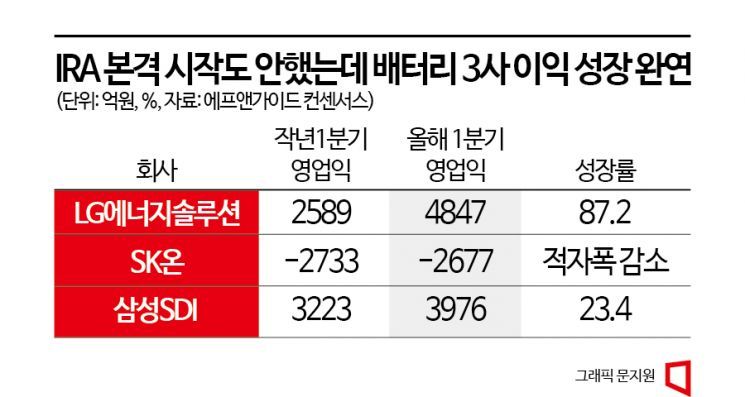

LG Energy Solution's estimated performance for the first quarter of this year shows sales of 8.3707 trillion KRW and operating profit of 484.7 billion KRW. Operating profit is expected to increase by 87.2% compared to the previous year. During the same period, Samsung SDI is expected to report an operating profit of 397.6 billion KRW, up 23.4% from last year (according to FnGuide consensus). Since announcing the full-scale growth of the battery and electric vehicle market in 2020 and successfully turning profitable, LG Energy Solution joined the '1 trillion KRW operating profit club (1.2137 trillion KRW)' last year and is expected to record an operating profit of 2.2956 trillion KRW this year. Samsung SDI also recorded an operating profit of 1.808 trillion KRW last year and is projected to reach 2.1858 trillion KRW this year.

SK On, aiming for a turnaround (profitability) next year, is expected to continue operating losses in the first quarter of this year. The operating loss is estimated to slightly decrease to 267.7 billion KRW compared to 273.3 billion KRW in the first quarter of last year. However, sales are expected to increase by 138.1% to about 3 trillion KRW compared to 1.2599 trillion KRW in the first quarter of last year. SK On CEO Ji Dong-seop said at the shareholders' meeting on the 30th of last month, "This year, SK On's management is focusing on three areas: improving profitability, enhancing capital efficiency, and building a foundation for future growth," adding, "We plan to actively pursue key tasks for profitability improvement to visualize a profitability turnaround."

Although a large amount of money is being spent on building battery factories, the profits of the top three battery companies are increasing significantly. Since 2020, battery companies have focused on quantitative growth as a strategy aligned with the rapid growth of the electric vehicle market. Looking at last year's capital expenditures (CAPEX), LG Energy Solution invested 6.3 trillion KRW, and Samsung SDI invested 2.5181 trillion KRW. SK On, as a non-listed company, is not obligated to disclose capital expenditures, but the industry estimates that it invested more than 3 to 4 trillion KRW last year. It takes 2 to 3 years to increase the operating rate and yield of newly built battery factories. It takes a long time for the money spent on capital investment to return as profit. The higher the capital expenditure, the higher the fixed costs, making it difficult to earn profits in the short term. However, the profits of battery companies are increasing significantly. Although raw material prices have risen, battery prices have increased even more, leading to higher profits. Additionally, the strong dollar has increased profits in KRW terms even with the same export volume. Furthermore, with the full implementation of the U.S. Inflation Reduction Act (IRA) on the 18th of this month, which provides subsidies of up to $45 per 1 kWh of battery production, operating profits are expected to increase further.

Profits of cathode material companies, which account for 40% of battery costs, are also showing rapid growth. LG Chem, a leading cathode material company, is expected to record an operating profit of 153.7 billion KRW in its advanced materials division. This is similar to the same period last year but represents a 754% increase from 18 billion KRW in the previous quarter. POSCO Future M is expected to record an operating profit of 40.3 billion KRW, up 57% from 25.5 billion KRW last year. EcoPro BM is expected to post an operating profit of 119 billion KRW, a 190% increase compared to 41 billion KRW in the same period last year.

Researcher Han Byung-hwa of Eugene Investment & Securities said, "Domestic cathode material companies have secured the ternary market and are rapidly expanding capacity, even capturing the U.S. market," but added, "It is necessary to consider that Chinese companies are directly entering the European market or significantly increasing exports."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.