KRW 15 Billion to 20 Billion Scale... Concerns Over Shareholder Value Dilution

Annual Losses Since 2020 Listing... Operating Cash Flow Negative for 2 Consecutive Years

TS Trillion, which sells TS Shampoo, is reportedly considering issuing bonds with warrants (BW) ahead of the maturity of borrowings worth 38 billion KRW. Since BWs can be converted into shares, the stock value of existing shareholders may be diluted.

According to the investment banking (IB) industry on the 6th, TS Trillion is confirmed to be reviewing the issuance of bonds with warrants (BW). The industry is known to be considering issuing BWs worth between 15 billion and 20 billion KRW.

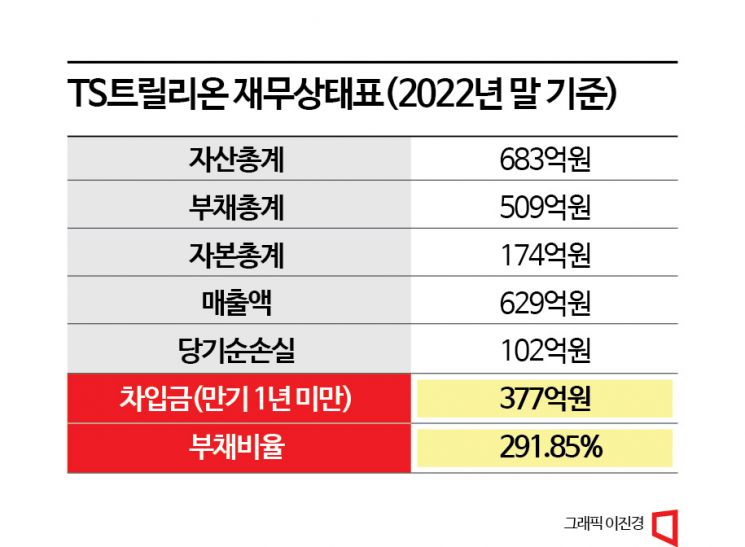

The reason for issuing BWs is presumed to be due to the large-scale borrowings coming due. As of the end of last year, TS Trillion's borrowings with less than one year to maturity amounted to 37.7 billion KRW. This is a 69% increase compared to 22.2 billion KRW the previous year. Some borrowings have already matured, and there are amounts maturing every month starting this month.

The interest rates on the borrowings have also risen sharply. Although TS Trillion took loans from first-tier banks such as Kookmin Bank, Woori Bank, and Shinhan Bank, the interest rates reach up to 14%. This is a significant increase compared to the maximum of about 5% in the previous year.

The increase in asset value of the Paju logistics site purchased using the borrowings is minimal. In 2021, TS Trillion invested 26 billion KRW to acquire a logistics site located in Paju, Gyeonggi Province. Last year, an asset revaluation was conducted to expand capital, but only a difference of 290 million KRW, about 1% of the acquisition price, occurred.

Currently, TS Trillion is in a situation where its performance is insufficient to repay borrowings and interest. TS Trillion recorded an operating loss of 5.8 billion KRW and a net loss of 10.2 billion KRW on a consolidated basis last year. It has posted losses every year since its listing in 2020. Operating cash flow has also been negative for two consecutive years.

TS Trillion produces and sells ‘TS Shampoo,’ targeting the hair loss market. In a situation where competition is intensifying with various products targeting the hair loss market being released recently, it is pointed out that the scale of losses has increased due to large-scale investment solely in advertising and marketing.

As poor performance continues, the financial structure has also deteriorated. As of the end of last year, TS Trillion's debt ratio approached 291.85%. The current ratio is about 26.6%. A higher current ratio indicates greater ability to pay. Generally, 200% is considered ideal.

An investment banking (IB) industry insider hinted, “In the current market where fundraising is greatly contracted, it is questionable whether there will be investors for BWs of companies with such a high debt ratio.”

If BWs are issued, dilution of existing shareholders' stock value is expected to be unavoidable. For example, if BWs worth 15 billion KRW are issued, a potential volume equivalent to about 30% of TS Trillion's current market capitalization of 53 billion KRW will be created. If the stock price is maintained until the warrants are exercised, existing shareholders will face a 30% loss.

Regarding this, a TS Trillion official stated, “We have considered issuing BWs, but nothing has been specifically proceeded with.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.