Chapella Upgrade Scheduled for the 12th of This Month

Staked Ethereum Withdrawal Becomes Possible

“Market Impact Limited” Expected Amid Selling Pressure Concerns

Cryptocurrency investors are on high alert as the schedule for the Shanghai-Capella upgrade, which will allow the retrieval of Ethereum previously locked for a large-scale upgrade, has been released. This update, also known as the Shapella upgrade, could release nearly 42 trillion won worth of Ethereum into the market once completed.

According to the cryptocurrency industry on the 5th, the Ethereum Foundation has announced the Shapella upgrade is scheduled for the 12th of this month (local time). The core feature of this upgrade is enabling the unstaking of staked Ethereum, allowing users to retrieve their previously locked assets. Staking refers to the process of locking cryptocurrency in a blockchain network that uses the Proof of Stake (PoS) consensus mechanism, earning coins as a reward for participating in blockchain operation and validation.

Ethereum transitioned from the Proof of Work (PoW) method, which involves mining through computer computations, to the Proof of Stake method last September with the Merge upgrade. This upgrade is expected to partially resolve carbon emissions caused by mining. To prepare for the Merge upgrade, the foundation began Ethereum 2.0 staking in November 2020, recruiting blockchain validators who deposit a minimum of 32 ETH into the network. Through cryptocurrency exchanges, users could participate with smaller amounts by paying fees.

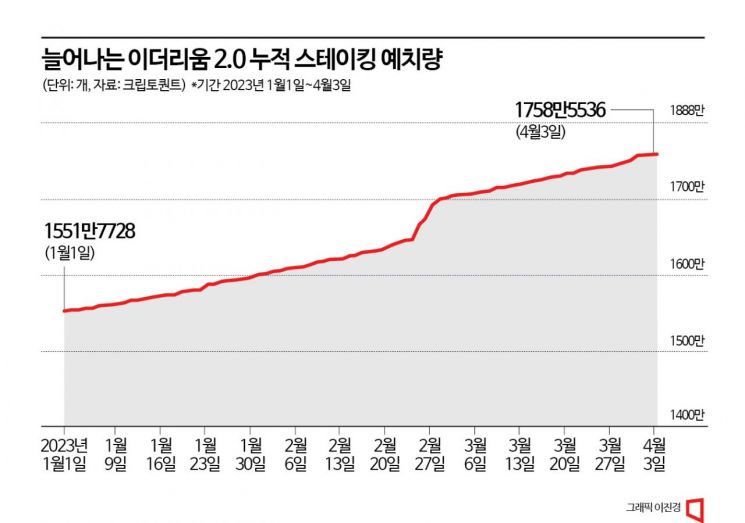

Until the Shapella upgrade is completed, it was impossible to withdraw staked Ethereum. The upgrade will implement the withdrawal function. Despite the cryptocurrency market downturn, the number of investors staking for steady returns has continued to grow. According to cryptocurrency data provider CryptoQuant, as of the previous day, the cumulative amount staked in Ethereum 2.0 was 17,585,536 ETH. Compared to 15,517,728 ETH at the beginning of this year, this represents an increase of 2,067,808 ETH. Considering the price of Ethereum at $1,810 (approximately 2.38 million won) per coin on that day, this amounts to about $31.82982 billion (approximately 41.8403 trillion won), representing about 15% of the total circulating supply.

With such a large volume of Ethereum becoming unstakeable, concerns have arisen about increased selling pressure. However, a withdrawal queue mechanism is in place to prevent such a scenario. To limit the number of validators exiting the network at once and to control network churn, Ethereum will regulate the number of validators allowed to withdraw simultaneously.

Experts predict that while the Shapella upgrade may cause a price drop, the market impact will be limited. Professor Hong Ki-hoon of Hongik University's Business Administration Department explained, "Since the staked supply will be released, the probability of Ethereum’s price falling is high," but added, "Looking at past situations, external negative factors such as interest rate hikes and the bankruptcy of the cryptocurrency exchange FTX have triggered sharp price declines, so the drop is expected to be modest." An industry insider also stated, "Even after the Shapella upgrade is completed, the amount available for sale is not expected to be large," and added, "There is a phased withdrawal process in place to prevent a sudden surge in sell orders, so the impact will not be as severe as feared."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)