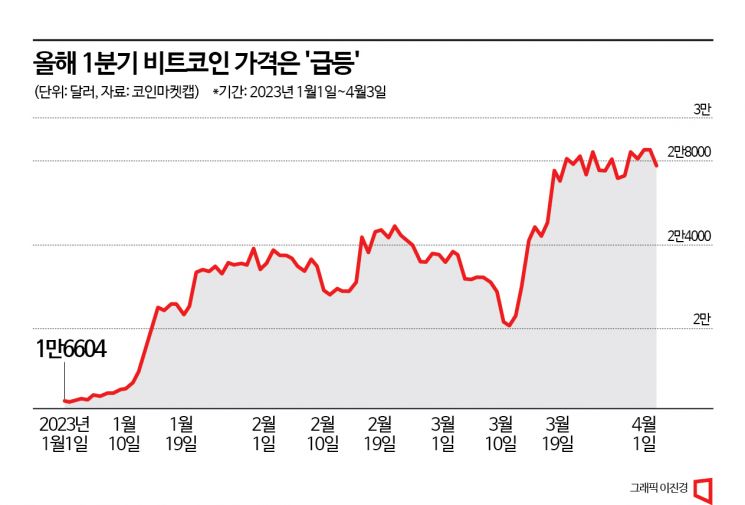

Bitcoin Price Rises from $16,000 to $27,000 Range

Number of Wallet Addresses Depositing Bitcoin to Exchanges Also Decreases

The price of Bitcoin, the leading virtual asset, has surged nearly 70% since the beginning of this year. Despite the market conditions being tough enough to coin the term 'Crypto Winter,' prices have risen as risk asset investment sentiment recovered this year. As Bitcoin prices increased, miners have also started mining again.

According to CoinMarketCap, a global virtual asset market tracking site, as of 2:33 PM on the 3rd, the price of Bitcoin was recorded at $27,728 (approximately 36.53 million KRW), down 2.48% from the previous day. Although it approached the $29,000 range as recently as the 30th of last month, it entered a consolidation phase and has shown a downward trend recently. Nevertheless, compared to the price at the beginning of the year, $16,604 (approximately 21.88 million KRW), it has surged by 67%.

Investment sentiment toward virtual assets has also improved from 'fear' to 'greed.' According to data from Alternative, a virtual asset data provider, the Fear & Greed Index representing investment sentiment was recorded at 63 points (greed) on this day. This is a 37-point increase compared to 26 points (fear) at the beginning of the year. Alternative's Fear & Greed Index ranges from 0, indicating extreme fear and pessimism about investment, to 100, indicating optimism.

The rise in Bitcoin prices and the revival of investment sentiment are analyzed to be due to expectations of easing Federal Reserve (Fed) interest rate hikes and the collapse of traditional banks such as Silicon Valley Bank (SVB), which led virtual assets to be preferred as a safe haven. Joe DiPascal, CEO of BitBull Capital, said, "Bitcoin has shown resilience over the past week or earlier, leading to an overall improvement in market sentiment," noting that Bitcoin prices have remained above the 200-day moving average. He added, "This is historically a strong indicator of a bullish price trend."

As Bitcoin prices recover, miners are also returning to mining. According to CoinWarz, a cryptocurrency mining information site, Bitcoin's hash rate was recorded at 337.45 exahashes per second (EH/s) on this day. This is an increase of 71.03 EH/s compared to 266.42 EH/s at the beginning of the year. On the 24th of last month, it even surged to 401.48 EH/s, setting an all-time high. The Bitcoin hash rate indicates the speed at which Bitcoin is mined. The higher this value, the greater the mining participation and the fiercer the competition.

Additionally, the number of wallet addresses depositing Bitcoin into virtual asset exchanges has decreased. This is interpreted as an increase in investors expecting future price rises. According to data from CryptoQuant, a virtual asset data company, the number of Bitcoin deposit addresses to exchanges, which ranged from 36,000 to 58,400 since the beginning of the year, began to sharply decline after recording 50,650 on the 31st of last month. It dropped to 39,288 the previous day and further to 14,780 on this day. A decrease in the number of addresses depositing Bitcoin into exchanges is interpreted as many investors expecting price increases and preferring to hold Bitcoin in personal wallets rather than selling.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.