④Samsung Electronics and SK Hynix Strategy Formulation

Efforts on Production Cuts and R&D Investment Amid Industry Downturn

Yongin Industrial Complex Development Following Special Tax Treatment Act Amendment Passed

The global economic downturn has brought an unprecedented cold wave to the semiconductor market since last year. Domestic semiconductor companies are enduring the harsh winter by implementing different production cut strategies and focusing on R&D investment. Recently, positive signals related to market recovery have boosted these efforts. The fact that the National Assembly and the government are working to raise the semiconductor tax credit rate and establish clusters is also a positive factor. There is also the effect of China's reopening (resumption of economic activities).

Samsung Electronics and SK Hynix saw their earnings shrink from the third quarter of last year. Samsung Electronics' semiconductor (DS division) operating profit recorded 270 billion KRW in the fourth quarter of last year, a sharp decline of 96.94% compared to the same period the previous year. SK Hynix posted an operating loss of 1.7012 trillion KRW, turning to negative growth. In the market, the vicious cycle of 'IT demand decline → oversupply → inventory increase → price drop → earnings decrease' continued, with the memory semiconductor industry, which is highly sensitive to economic conditions, being particularly hit.

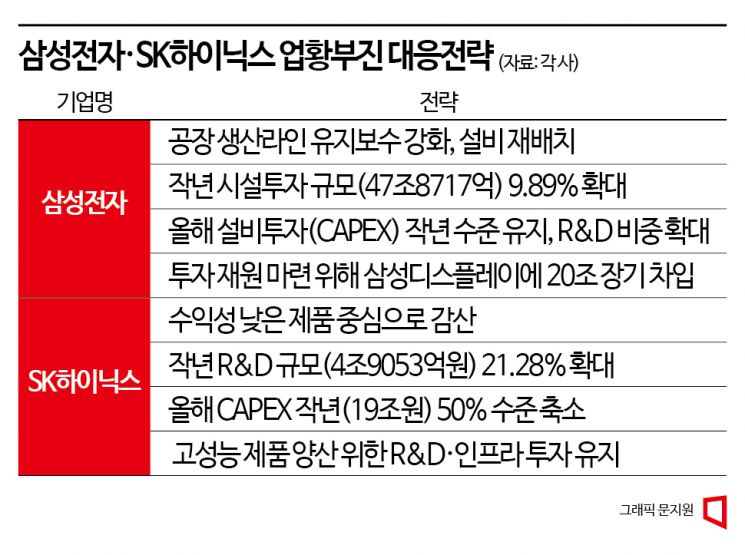

Samsung Electronics and SK Hynix presented similar yet different strategies in this situation. As the number one in the memory industry, Samsung Electronics leveraged its scale as a weapon. Unlike competitors who reduced wafer supply to control semiconductor production, Samsung did not implement artificial production cuts. Instead, it conducted indirect production cuts by strengthening factory production line maintenance and equipment reallocation, minimizing the scale of production cuts. This was a strategy to maintain market share. Through this, in the fourth quarter of last year, Samsung held a 45.1% share of the DRAM market (according to TrendForce), an increase of 4.4 percentage points from the previous quarter.

On the other hand, various investments and research & development (R&D) scales were increased. Last year, Samsung Electronics' semiconductor facility investment amounted to 47.8717 trillion KRW, up 9.89% from the previous year. This year, the company plans to maintain the CAPEX scale at last year's level and increase the R&D proportion within CAPEX. Of course, it is true that securing investment funds has become difficult as earnings have shrunk. Samsung Electronics has borrowed 20 trillion KRW from its affiliate Samsung Display to address this.

In the case of SK Hynix, direct production cuts began from the fourth quarter of last year. Instead, production was reduced mainly for low-profit products to minimize the impact of production cuts, as they believed demand for high value-added advanced products would inevitably increase. The prediction has materialized. SK Hynix President Kwak No-jung said to reporters after last week's shareholders' meeting, "Demand for some Double Data Rate (DDR) 5 products and High Bandwidth Memory (HBM) is tight, so we are increasing (factory) utilization rates."

SK Hynix invested a total of 4.9053 trillion KRW in R&D last year, increasing the investment scale by 21.28% compared to the previous year. As a result, the R&D ratio to sales increased by 1.6 percentage points from 9.4% in 2021 to 11.0% last year. This year, CAPEX will be reduced to about 50% of last year's scale (19 trillion KRW) due to unfavorable market conditions. Operating expenses (OPEX) will also be cut. However, essential investments for mass production of high-performance products, R&D, and infrastructure investments will continue.

The reason Samsung Electronics and SK Hynix are focusing on investment including R&D despite the difficult times is the expectation of demand for advanced memory. The market expects an increase in the use of high value-added memory products starting this year. With the ChatGPT effect, the speed of launching artificial intelligence (AI) services is accelerating, leading to expectations of a sharp increase in the use of high-performance, high-capacity, and high-efficiency memory.

Sanjay Mehrotra, CEO of Micron, said during a conference call last week, "The future is AI, and the AI future is the memory future." He also expressed expectations that the semiconductor industry could achieve record earnings by 2025 due to this effect.

In the semiconductor competition, which has become a state-led confrontation, the government's and National Assembly's support is also a positive factor. On March 30, the National Assembly held a plenary session and passed an amendment to the Restriction of Special Taxation Act. The amendment mainly raises the tax credit rate for facility investments in national strategic technologies such as semiconductors. Going forward, the credit rate for large corporations will increase from 8% to 15%.

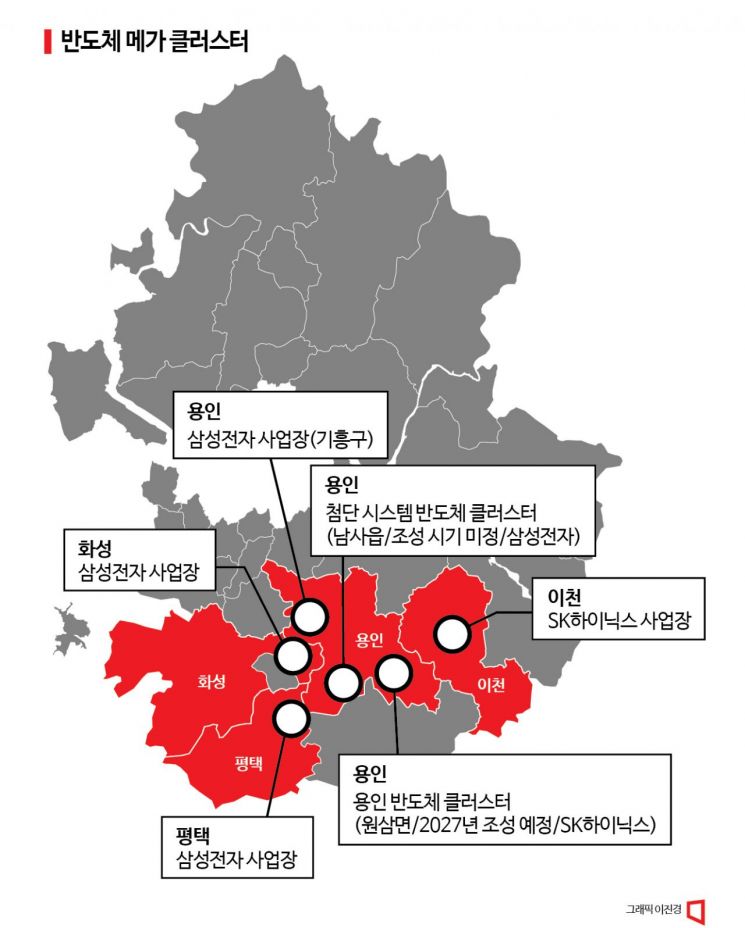

Last month, the government announced plans to establish a national industrial complex in Yongin, Gyeonggi Province, to create a large-scale system semiconductor cluster. The cluster is expected to gather fabless (semiconductor design) and materials, parts, and equipment (SoBuJang) companies centered around Samsung Electronics. Yongin also hosts a cluster being developed by SK Hynix, which is advantageous for creating a large-scale semiconductor ecosystem.

Additionally, the effect of China's reopening is raising industry expectations. As smartphone demand recovers locally in China, semiconductor demand may also increase. SK Hynix Vice Chairman Park Jung-ho said at last week's shareholders' meeting, "The market size in the second half is expected to increase by 10% compared to the first half, reaching 62 billion USD," adding, "With increased IT demand due to China's reopening, we expect to see tangible effects."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)