Net loss of 260 billion KRW with 70% allocated to loan loss provisions

Stable net interest margin growth... approaching profitability

Securities valuation loss limited to 0.65%... "No concern of bank run"

Toss Bank recorded a net interest income exceeding 200 billion KRW last year. Although it posted a deficit in the 200 billion KRW range due to conservatively setting aside loan loss provisions with a reserve ratio exceeding 400%, Toss Bank expects to turn profitable starting from the second half of this year as profitability is rapidly improving.

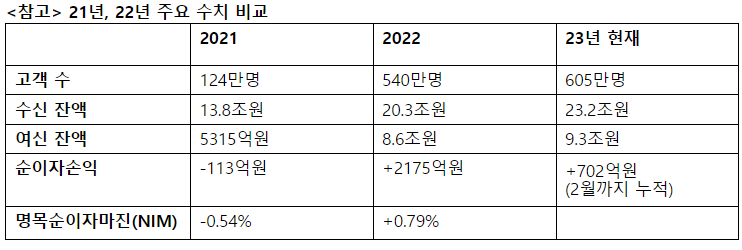

On the 31st, Toss Bank reported a net interest income of 217.4 billion KRW for last year. Compared to a loss of 11.3 billion KRW in its first year of operation in 2021, profitability improved significantly. Last year, the nominal net interest margin (NIM) was 0.79%, an improvement from -0.54% the previous year.

The scale of loans and deposits also grew rapidly. As of the end of last year, the loan balance was 8.6 trillion KRW, and the deposit balance was 20.3 trillion KRW, increasing by 1.47 times and 16.2 times respectively compared to the previous year. Based on this, the loan-to-deposit ratio was recorded at 47.6%, a ninefold increase from the previous year.

However, the overall net loss for last year was 264.4 billion KRW. This is interpreted as a result of setting aside provisions more conservatively than other banks. Toss Bank set aside 186 billion KRW in loan loss provisions last year, with a reserve ratio reaching 405%. This is 1.8 times the banking sector average of 227%.

Toss Bank expects to turn profitable from the second half of the year, as cumulative net interest income reached 70.2 billion KRW by February.

Meanwhile, total capital stood at 1.65 trillion KRW, with 900 billion KRW raised last year alone. This resulted in a Basel III (BIS) ratio of 12.7%, securing the capacity to continue loan growth.

Concerns about a 'bank run' (massive deposit withdrawals) recently raised on some online communities were dismissed. Toss Bank stated that it has already strengthened loan-to-deposit ratio growth and asset structure stability by reducing the proportion of securities holdings.

As of this month, the evaluation loss rate on all securities held by Toss Bank is 0.65%. The evaluation loss on available-for-sale bonds is in the 68 billion KRW range, which has decreased by more than 30% compared to the end of 2022. As a result, the BIS ratio also increased by 0.47 percentage points. The evaluation loss on held-to-maturity bonds is in the 16 billion KRW range, and even when combined with all securities evaluation losses, it totals approximately 84 billion KRW.

A Toss Bank official stated, "The scale of evaluation losses is continuously decreasing, and about 40% of the securities held are short-term government bonds maturing within two years, allowing for quick profit realization. To proactively respond to interest rate risks, in the fourth quarter of last year, we sold securities worth 4 trillion KRW (about 25% of previously held securities) at a low loss rate of 1.6%," he explained.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)