Up to 3 Times More Expensive for Franchise Stores with Annual Sales Under 300 Million Won

Authorities Say "Transparent Disclosure Will Create Competitive Effects"

Following government guidelines, the fee rates for simple payment services were disclosed for the first time. In some cases, the fees charged by certain simple payment providers were more than three times higher than those of traditional cards.

First Implementation of Disclosure System... Published Semiannually

According to the Financial Supervisory Service (FSS) on the 31st, the average online card payment fee rates of nine simple payment providers subject to disclosure ranged from 1.09% (for small businesses with annual sales under 300 million KRW) to 2.39% (for general businesses with annual sales over 3 billion KRW). These rates remain higher compared to traditional credit card fees, which range from 0.5% to 2.3%.

The FSS stated that with the semiannual fee disclosure system in place, the fee rates of the 'Big 3'?Naver Financial (Naver Pay), Kakao Pay, and Viva Republica (Toss)?have decreased compared to 2021. Specifically, the average credit card-based simple payment fee rate, which accounts for a significant portion of the 'Big 3' companies' simple payments, dropped from 1.95% in 2021 to 1.46% as of the end of January this year, a decrease of 0.49 percentage points.

An FSS official explained, "Considering the increasingly challenging economic environment due to the base interest rate hikes, this is seen as a result of the industry's efforts to reduce the fee burden on small business owners."

However, a closer look reveals a somewhat different situation. For small businesses, some fees were more than three times higher than existing card fees. According to the financial authorities' fee adjustments, small merchants with annual sales under 300 million KRW are subject to a card fee of 0.5% (online basis). However, Baemin Pay, offered by Woowa Brothers, the operator of the delivery platform 'Baedal Minjok,' charges a payment fee rate of 1.52% for small merchants (online card payment basis), which is more than three times the existing fee. Coupang Pay (1.03%) and Gmarket (1.08%) also applied fees nearly double the standard. Since simple payment providers generally cover the payment gateway (PG) area as well, which includes the existing card fee of 0.5% (for small businesses), these rates have been criticized as high.

High Fees Persist, Especially in E-commerce

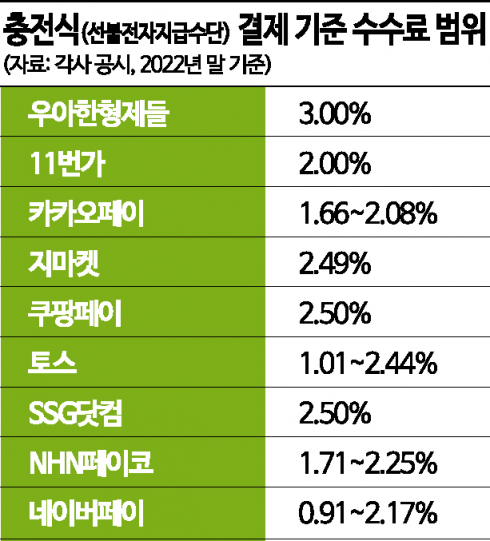

Additionally, e-commerce companies tended to have higher fee rates compared to specialized simple payment providers. In the case of prepaid electronic payment methods, which require users to charge cash in advance, many did not apply differentiated fees based on sales volume. Woowa Brothers uniformly applied a 3.00% fee regardless of annual sales size. Coupang Pay (2.50%), SSG.com (2.50%), Gmarket (2.49%), and 11st (2.00%) followed similar practices. In contrast, Naver Pay, Kakao Pay, and Toss apply differentiated fees based on annual sales volume even when payments are made using prepaid balances, similar to traditional card fees.

Regarding this, Woowa Brothers explained to the authorities, "We provide services such as daily settlement systems necessary for improving restaurant operation and management environments, exemption from packaging brokerage fees, expert consulting, and education to small restaurant owners using the Baedal Minjok platform." However, similar services are also provided to other merchants.

Notably, unlike simple payment specialized services like Naver Pay, Kakao Pay, and Toss, which had disclosed average fee rates on their websites before the full introduction of the disclosure system, this is the first time that fees from e-commerce companies such as Coupang, SSG.com, and Gmarket have been disclosed. An industry insider said, "Although the simple payment fees are disclosed separately for payment and other fees, the actual burden on merchants often increases due to the other fees. When adding various store-related fees beyond simple payments, the fee rates imposed by e-commerce-based platforms could be much higher than the disclosed figures."

An FSS official said, "Considering the increasingly challenging economic environment due to base interest rate hikes, this is seen as a result of the industry's efforts to reduce the fee burden on small business owners. With the introduction of the disclosure system, the classification and management system for fee rates has been established, promoting autonomous competition among providers and gradually reducing the fee burden on merchants by alleviating the asymmetry in bargaining power."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.