Amendment to the Restriction of Special Taxation Act Passed in the Plenary Session on the 30th

FKCCI, KITA, KCCI, and Korea SMEs and Startups Agency Announce Positions on the Day

"Positive Evaluation as a Foundation for Expanding Global Leadership"

The amendment to the Restriction of Special Taxation Act, known as the K-Chips Act, along with the revision of the National Advanced Strategic Industry Act, passed the National Assembly plenary session on the 30th through bipartisan agreement. As the long-awaited industry bill cleared the National Assembly hurdle, major economic organizations immediately expressed their welcoming stance.

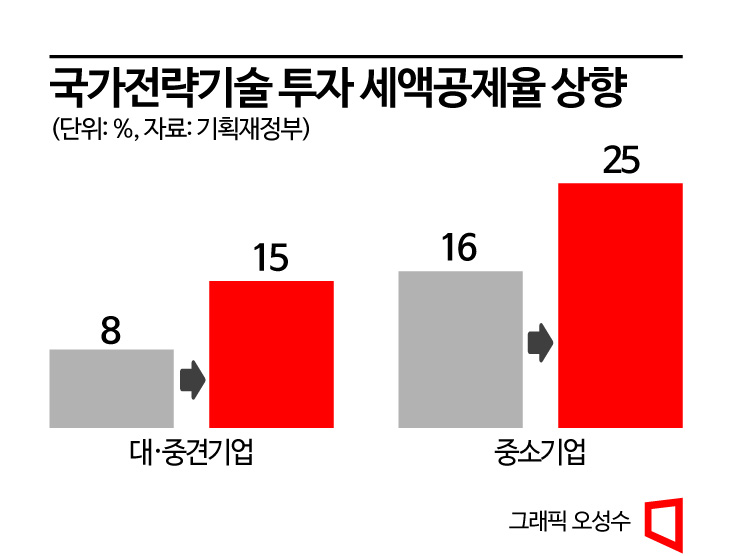

On that day, the National Assembly held a plenary session and passed the amendment to the Restriction of Special Taxation Act with a 77.49% approval rate (179 votes) out of 299 members. The purpose of the amendment is to increase the tax credit rate for facility investments in national strategic technologies such as semiconductors. With the passage of this bill, the tax credit rate benefits available to large and medium-sized enterprises increased from 8% to 15%. For small and medium-sized enterprises, it can be up to 25%.

The amendment to the Restriction of Special Taxation Act has been a long-standing request from the economic sector, including the semiconductor industry. This is because semiconductors have emerged as a core national asset, and various countries have been rolling out support measures to foster the industry. A representative example is the United States providing a 25% tax credit to companies building semiconductor-related facilities domestically.

On the afternoon of the 30th, the National Assembly plenary session passed the 'K-Chips Act (Amendment to the Restriction of Special Taxation Act)' to foster the domestic semiconductor industry.

On the afternoon of the 30th, the National Assembly plenary session passed the 'K-Chips Act (Amendment to the Restriction of Special Taxation Act)' to foster the domestic semiconductor industry. [Image source=Yonhap News]

The economic sector unanimously welcomed the passage of the amendment. The Federation of Korean Industries stated, "The semiconductor industry is a core of national competitiveness, requiring a response at the national level beyond the corporate level," and "We welcome the bipartisan agreement leading to the bill's passage in the National Assembly plenary session." They also explained, "Through this amendment, companies have gained the ability to invest timely even in crises, expand global leadership in the semiconductor field in the long term, and respond to supply chain restructuring."

The Korea International Trade Association expressed expectations, saying, "It is expected to induce domestic investment in future export industries such as semiconductors, secondary batteries, and displays, thereby increasing the potential growth rate of our economy," and "It can contribute to maintaining Korea's technological gap as the world's number one in memory semiconductor export competitiveness and strengthening economic security by increasing semiconductor production."

The Korea Employers Federation also stated, "(This bill) will enhance the competitiveness of advanced strategic industries, including semiconductors, amid fierce global hegemony competition," and "It can greatly contribute to promoting investment and revitalizing corporate vitality across industries facing difficulties due to recent deteriorating domestic and international economic conditions."

The Korea Federation of SMEs said, "The passage of the bill supporting investment in difficult economic conditions will restart the engine of small and medium manufacturing businesses that sustain our economy," describing it as "a timely rain to increase small and medium enterprises' investment in advanced industries."

According to the report "Corporate Investment Incentives and Measures for Investment Tax Credits" released by the Korea Chamber of Commerce and Industry last month, in the case of national strategic industries, every 1 percentage point increase in the tax credit rate results in an 8.4% increase in facility investment for large and medium-sized enterprises and a 4.2% increase for small and medium-sized enterprises. The Korea Chamber of Commerce and Industry explained that applying this formula to the amendment could increase strategic industry facility investment by 59% for large and medium-sized enterprises and 38% for small and medium-sized enterprises.

The amendment includes a provision to support a 10% tax credit this year for the increase compared to the average of the previous three years on a temporary basis. There is also a plan to temporarily raise the tax credit rate for investments in new growth and original technologies that are not national strategic technologies this year. The government plans to prepare follow-up enforcement ordinances and rules once the amendment is promulgated early next month.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.