한국금융지주 subsidiary Korea Investment & Securities announced on the 30th that the concentration of bond investments among ultra-high-net-worth individuals with financial assets exceeding 3 billion KRW continued in the first quarter of this year.

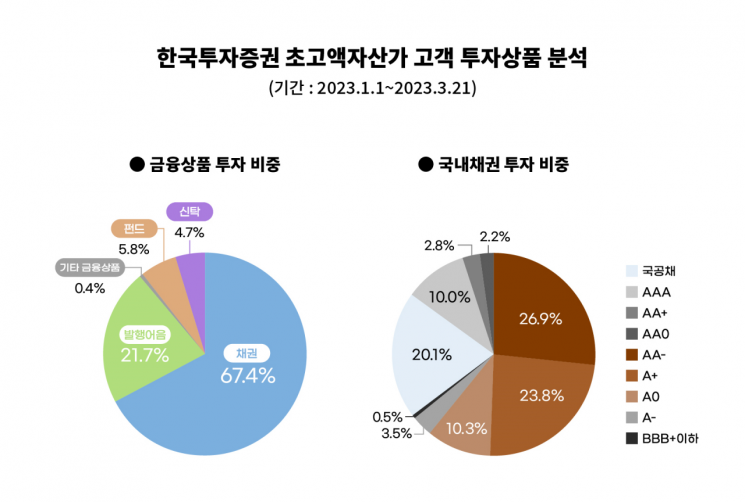

As of the 21st, an analysis was conducted on financial products invested in this year by customers with balances of 3 billion KRW or more deposited at Korea Investment & Securities. Approximately 67.4% of new investment funds were allocated to bonds. Investment in issued notes followed at 21.7%. As financial market uncertainty increased, preference for relatively stable investment products continued.

With the popularization of bond investments, not only stable government and public bonds but also corporate bonds, which can expect relatively higher yields, increased. For domestic bonds, the proportion invested in corporate bonds with credit ratings between AA- and A0 rose from 25.5% last year to 61% this year. Cases of investing lump sums of 1 billion KRW or more in bond products at once also more than doubled compared to last year.

Since the beginning of this year, Korea Investment & Securities' retail bond sales have exceeded 8.5 trillion KRW. This is a rapid inflow of investment funds compared to last year’s 33.5 trillion KRW in retail bond sales. Sales of bond investments through online channels increased 4.2 times compared to the same period last year.

Korea Investment & Securities is strengthening its bond product lineup to meet customer needs. It offers a variety of maturities of carefully selected stable high-interest bonds by experts. To enhance investment convenience, it is also focusing on non-face-to-face channels such as MTS. Risk management is thoroughly implemented by checking product characteristics and deciding on sales through a product selection committee.

Kim Seong-hwan, Head of the Individual Customer Group, said, "We will strive to provide the optimal investment portfolio that meets customer needs by combining the best product competitiveness, investment infrastructure, and PB expertise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.