Shareholders "How can we trust the turnaround at the end of last year?"

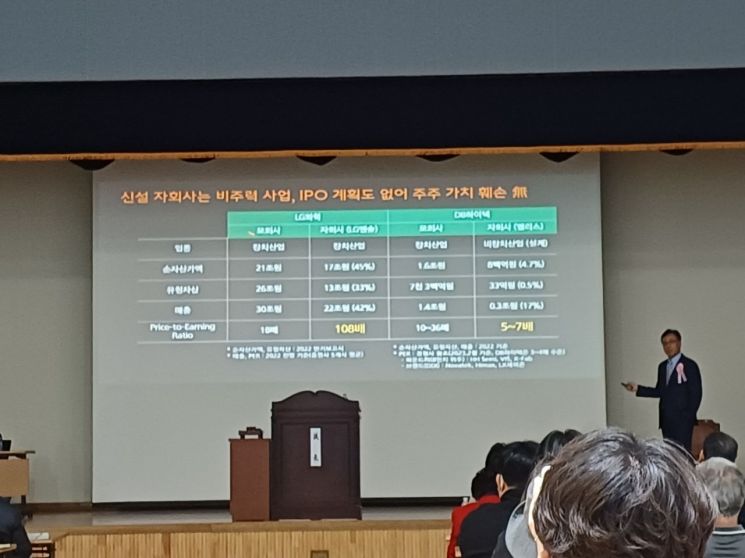

Company "Unlike LG, where parent and subsidiary assets were similar,

DB HiTek subsidiary's net assets are 5% of the parent company"

"Now is a time when the trust and support of our shareholders are needed more than ever. We will continue to do our best to repay the expectations of our shareholders with better performance."

"The spin-off of LG Energy Solution from LG Chem and DB HiTek’s separation of its Brand Business Division (fabless semiconductor design) are completely different." - Choi Chang-sik, Vice Chairman of DB HiTek

"How can we trust management that withdrew the physical spin-off plan last year and then reversed their words?" - DB HiTek shareholders

On the 29th, shareholders attending the regular general meeting held at DB HiTek’s Bucheon Campus in Sudoro, Bucheon-si, Gyeonggi-do, asked the management 10 questions and submitted one shareholder proposal with highly charged expressions. The most contentious topic was undoubtedly the agenda on the physical spin-off of the subsidiary. Vice Chairman Choi Chang-sik broke a sweat trying to persuade shareholders to trust that this case is different from the LG Chem-LG Energy Solution example.

The DB HiTek general meeting started at 9:20 a.m. and ended at 11:08 a.m. About 140 shareholders attended on site. Many shareholders expressed distrust in the company, creating an overall tense atmosphere. The first Q&A session was chaotic. Ten questions were raised, and there was even a dispute between shareholders who wanted to speed up the process and those who insisted on receiving all questions. Photography was not allowed for general shareholders.

The company announced the day before that it would physically spin off the Brand Business Division, which operates the fabless (semiconductor design) business, and stipulate in the parent company’s articles of incorporation that a special resolution at the general meeting would be required if the subsidiary is listed within five years. They also said that even when pursuing listing after five years, a special resolution obligation at the parent company’s general meeting would be newly established in the subsidiary’s articles of incorporation. Vice Chairman Choi said at the general meeting, "The five-year standard is a government guideline."

Vice Chairman and CEO Choi Chang-sik of DB HiTek speaking at the regular shareholders' meeting on the 29th.

Vice Chairman and CEO Choi Chang-sik of DB HiTek speaking at the regular shareholders' meeting on the 29th. [Photo by DB HiTek]

The plan is to separate the non-core fabless business into a subsidiary and have the parent company focus on the highly profitable power semiconductor foundry (semiconductor contract manufacturing). If the fabless business entrusts work to the foundry within the same company, there are concerns about design technology leakage and conflicts of interest, which could weaken sales capabilities, so they are separating the two. The plan is to create corporate value of 4 trillion KRW for the foundry and 2 trillion KRW for the fabless business.

Vice Chairman and CEO Choi Chang-sik said, "The foundry will resolve customer conflict issues to expand its client base and product lineup, and the Brand Business Division will pioneer a new path through the recruitment of professional management and establishment of an independent management system."

The company had previously abandoned the physical spin-off plan at the end of last year due to opposition from minority shareholders.

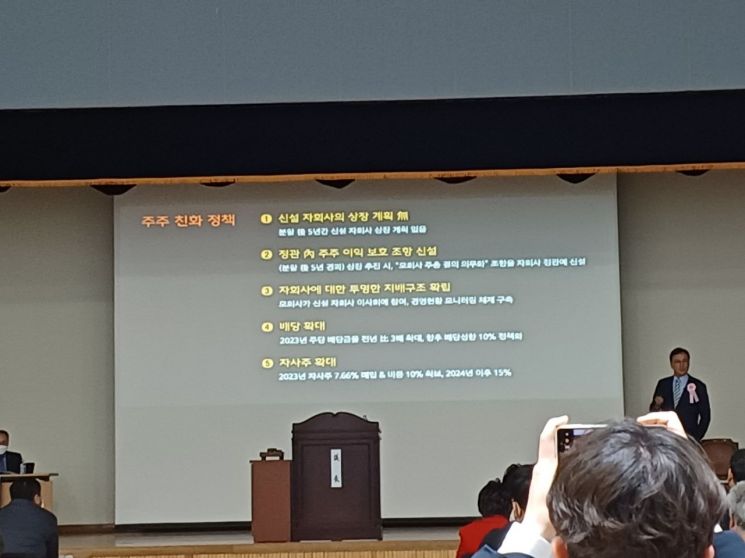

At the regular shareholders' meeting of DB HiTek, a shareholder took out a mobile phone and started filming as Vice Chairman and CEO Choi Chang-sik explained the shareholder-friendly policy.

At the regular shareholders' meeting of DB HiTek, a shareholder took out a mobile phone and started filming as Vice Chairman and CEO Choi Chang-sik explained the shareholder-friendly policy. [Photo by Moon Chae-seok]

Most shareholders on site raised concerns about the reversal of the decision not to proceed with the physical spin-off last year. They said, "We cannot trust the management." They suspected that the company was trying to use a 'trick' to list the fabless subsidiary after five years.

In response, Vice Chairman Choi said, "The decision to stop reviewing the physical spin-off in October last year did not mean 'we will not do it,' but rather that we were considering how to implement shareholder-friendly policies," adding, "There are no plans to list the newly established subsidiary within five years after the spin-off." He continued, "If the subsidiary establishes transparent governance, the parent company will monitor the subsidiary’s management and provide support where necessary."

A physical spin-off means that the parent company A holds 100% of the shares of the newly established company B. Even if existing shareholders hold shares in the parent company, they are not recognized as shareholders of company B. If DB HiTek spins off the fabless business and lists it, the value of the shares held by existing DB HiTek shareholders will decrease proportionally to the spun-off shares. DB HiTek’s closing price on the 28th was 61,400 KRW, down 21.4% from a year ago. DB HiTek is a stock with strong minority shareholder influence. As of the end of last year, 74.21% of DB HiTek shareholders were minority shareholders. Even when combining DB Inc. and related parties (17.85%) and the National Pension Service (7.94%), the total is only 25.79%.

Shareholder Jeong Yang-young (65), who holds about 40,000 shares, said, "How can we trust a company that suddenly changed its stance after saying last year that it would not do a physical spin-off?" Shareholder Kang Gak-seong (80), who holds 870 shares, said, "I am 80 years old and not trying to speculate, just investing to earn a little pocket money, but I am stuck with a low stock price," adding, "Although sales exceeded 1 trillion KRW last year, the stock price has not risen and dividends are meager. Isn’t this just a money party among themselves?"

Vice Chairman Choi Chang-sik, CEO of DB HiTek, explaining the differences between the company's physical division and the LG Chem-LG Energy Solution case at the regular general meeting of shareholders on the 29th.

Vice Chairman Choi Chang-sik, CEO of DB HiTek, explaining the differences between the company's physical division and the LG Chem-LG Energy Solution case at the regular general meeting of shareholders on the 29th. [Photo by Moon Chae-seok]

In response, Vice Chairman Choi spent about 10 minutes explaining that the situation is different from LG Chem when LG Energy Solution separated, seemingly aware of the shareholder value decline in that case. He emphasized that there is no intention to list the subsidiary after the physical spin-off.

He explained that LG Energy Solution had secured net asset value comparable to LG Chem even before the spin-off, whereas DB HiTek’s Brand Business Division did not. If the large LG Energy Solution separated, LG Chem’s corporate value could decline, but in DB HiTek’s case, the impact on corporate value would be minimal even if the Brand Business Division separates. As of the end of last year, LG Chem’s net asset value was 21 trillion KRW, and LG Energy Solution’s was 17 trillion KRW, almost the same. In contrast, DB HiTek’s parent company (foundry) was 1.6 trillion KRW, and the subsidiary (fabless) was 80 billion KRW, showing a large difference.

Vice Chairman Choi said, "LG Chem and LG Energy Solution are both capital-intensive industries for the parent and subsidiary, but DB HiTek’s parent company (foundry) is capital-intensive, while the subsidiary (fabless) is a design industry," adding, "The subsidiary is a company engaged in a labor-intensive industry, not a capital-intensive industry with enormous assets."

At the general meeting, the physical spin-off proposal was approved with 87.1% of attending shareholders and 53% of voting shares in favor.

The proposal for dividends of 1,300 KRW per common share and 1,350 KRW per preferred share was also approved. The 1,300 KRW per common share corresponds to a dividend payout ratio of about 10%. This is about half of the shareholder proposal of 2,417 KRW for common shares and 2,467 KRW for preferred shares. Shareholder Jeong Yang-young said, "The company made so much money last year, but is this a dividend? They should at least pay 2,500 to 3,000 KRW per share; this is not even a dividend."

Additionally, the agenda to appoint Jo Gi-seok as the new CEO and reappoint Yang Seung-ju as CFO and Vice President passed. The agenda to reappoint Kim Jun-dong, advisor at the law firm Sejong, as an outside director, and to newly appoint Jeong Ji-yeon, assistant professor at Kyungpook National University; Bae Hong-gi, CEO of PKF Seohyun Accounting Firm; and Han Seung-yeop, assistant professor at Hongik University, also passed. However, the proposals to appoint Han Seung-yeop as an audit committee member (outside director) and to introduce a cumulative voting system were rejected.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)