"Unlike LG, whose parent and subsidiary assets were similar,

DB HiTek subsidiary's net assets are 5% of the parent company"

Regarding criticism that last year’s statement differs from now,

"It did not mean we would not do a physical division"

"LG Chem's spin-off of LG Energy Solution and DB HiTek's separation of its brand business division (fabless·semiconductor design) are completely different."

Choi Chang-sik, Vice Chairman and CEO of DB HiTek, broke a sweat trying to appease shareholders at the regular general meeting held on the 29th. He emphasized that there is no intention to list the subsidiary after the company's physical spin-off. Above all, he stressed that the physical spin-off of LG Chem's battery business division into LG Energy Solution and the subsequent listing of LG Energy Solution on the stock market is a completely different case from DB HiTek's physical spin-off.

Vice Chairman and CEO Choi Chang-sik of DB HiTek speaking at the regular shareholders' meeting on the 29th.

Vice Chairman and CEO Choi Chang-sik of DB HiTek speaking at the regular shareholders' meeting on the 29th. [Photo by DB HiTek]

Vice Chairman Choi cited examples such as Taiwan's TSMC and fabless MediaTek. He said that if these companies had been integrated device manufacturers (IDM) operating both foundry and fabless businesses, they would not have shown explosive growth. Choi said, "There was also speculation about Samsung Electronics' foundry spin-off (in July last year) raised by Samsung Securities, etc.," adding, "Looking at pure foundry companies like TSMC and UMC and fabless companies like MediaTek and Novatek, you can see how separating companies to avoid mutual influence significantly accelerates business growth."

Vice Chairman Choi Chang-sik of DB HiTek explaining the differences between the company's physical division and the LG Chem-LG Energy Solution case at the regular general meeting of shareholders on the 29th.

Vice Chairman Choi Chang-sik of DB HiTek explaining the differences between the company's physical division and the LG Chem-LG Energy Solution case at the regular general meeting of shareholders on the 29th. [Photo by Moon Chae-seok]

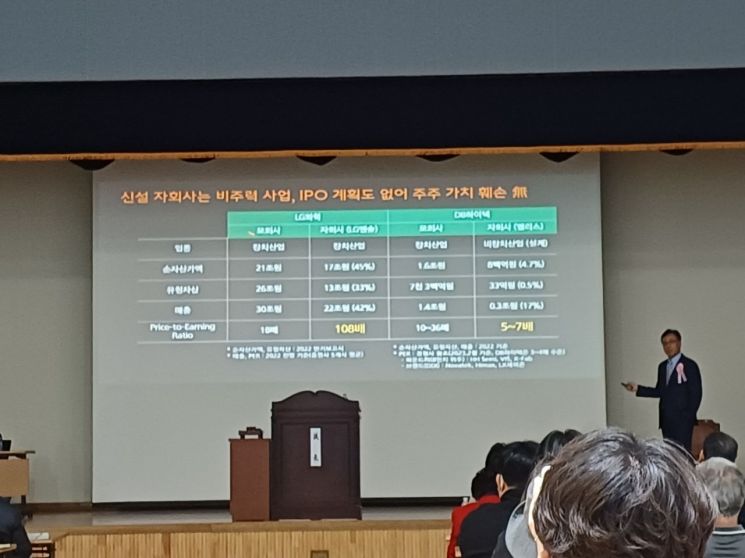

What drew attention was that Vice Chairman Choi himself announced that DB HiTek's physical spin-off is different from the LG Chem-LG Energy Solution case. He said that LG Energy Solution secured net asset value comparable to LG Chem even before the spin-off, but DB HiTek's brand business division did not. While the departure of the large-scale LG Energy Solution could lower LG Chem's corporate value, the departure of the brand business division would have minimal impact on DB HiTek's corporate value.

As of the end of last year, LG Chem's net asset value was 21 trillion won, and LG Energy Solution's was 17 trillion won, almost similar. In contrast, DB HiTek's parent company (foundry) was 1.6 trillion won, and the subsidiary (fabless) was 80 billion won, showing a significant difference.

Vice Chairman Choi said, "Both the parent and subsidiary of LG Chem-LG Energy Solution are capital-intensive industries, but DB HiTek's parent company (foundry) is capital-intensive, while the subsidiary (fabless) is a design industry," adding, "The subsidiary is a company engaged in a labor-intensive industry, not a capital-intensive industry with enormous assets."

Vice Chairman Choi Chang-sik of DB HiTek explaining the differences between the company's physical division and the LG Chem-LG Energy Solution case at the regular general meeting of shareholders on the 29th.

Vice Chairman Choi Chang-sik of DB HiTek explaining the differences between the company's physical division and the LG Chem-LG Energy Solution case at the regular general meeting of shareholders on the 29th. [Photo by Moon Chae-seok]

Shareholders expressed doubts about why the company is pushing for a physical spin-off instead of a personnel spin-off and why it reversed its decision after saying it would halt the physical spin-off review last October.

Lee Sang-mok, representative of the DB HiTek Small Shareholders Alliance, criticized, "MediaTek grew bigger than its parent company UMC after spinning off from UMC," and said, "The claim that DB HiTek's subsidiary physical spin-off is different from the LG Energy Solution case is inconsistent." He also questioned, "Why insist on a physical spin-off instead of a personnel spin-off, thereby increasing uncertainty?"

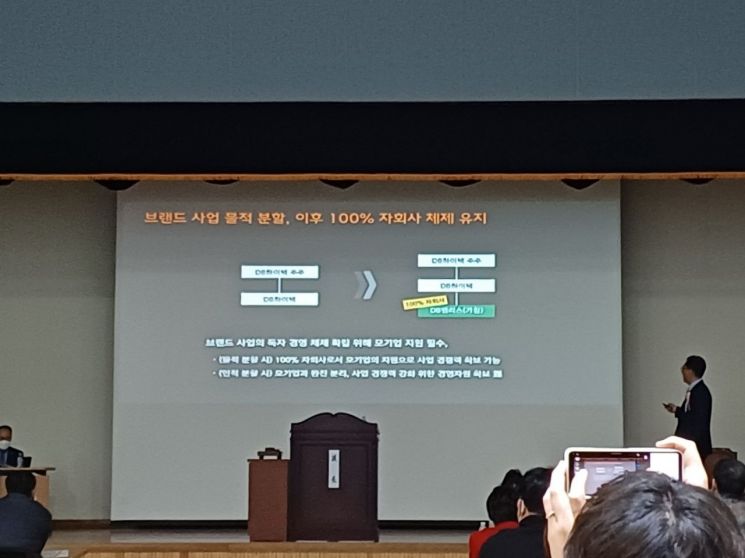

In response, Vice Chairman Choi said, "The brand business will maintain a 100% subsidiary system after the physical spin-off," adding, "If it were a personnel spin-off, the capital strength would weaken, making it vulnerable to hostile M&A, but support from the parent company is essential to secure business competitiveness."

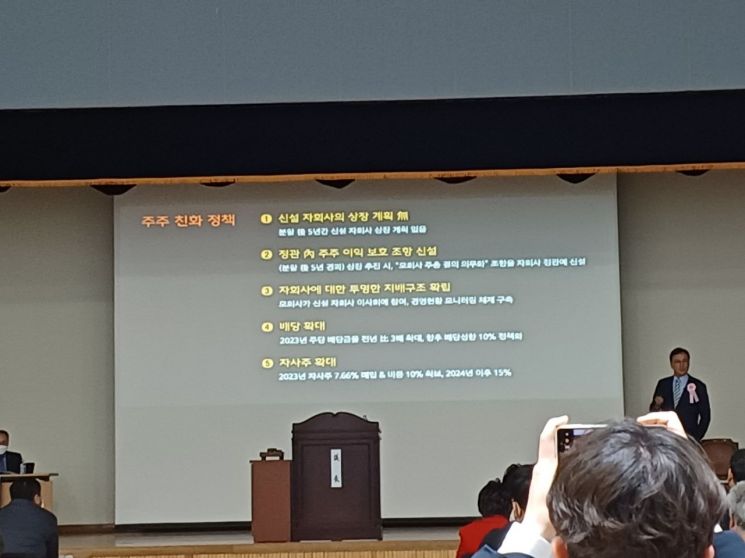

At the regular shareholders' meeting of DB HiTek, a shareholder took out a mobile phone and started filming as Vice Chairman and CEO Choi Chang-sik explained the shareholder-friendly policy.

At the regular shareholders' meeting of DB HiTek, a shareholder took out a mobile phone and started filming as Vice Chairman and CEO Choi Chang-sik explained the shareholder-friendly policy. [Photo by Moon Chae-seok]

Regarding shareholders' remarks that the stance is different from last year, Vice Chairman Choi said, "When we said in October last year that we would halt the (physical spin-off) review, it did not mean 'we won't do it,' but that we were considering how to implement shareholder-friendly policies," adding, "There are no plans to list the newly established subsidiary for five years after the physical spin-off." He continued, "If the subsidiary establishes transparent governance, the parent company will monitor the subsidiary's management and provide support where necessary."

At the general meeting, the physical spin-off proposal was approved with 87.1% of attending shareholders and 53% of voting shares in favor.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.