UNIST Joint Research Team Proposes Long-Term Economic Activity Criteria

"Contributing to Policy Decisions through Rational Decision-Making"

Is the Optimal Retirement Age for the Middle Class in Their Late 30s?

Amid the era of 100-year lifespans, a latest study seeking the optimal solutions for asset investment, consumption, and retirement for ‘humanity’ has attracted attention.

Recently, consumption of luxury goods has steadily increased due to rising economic income levels. Considering individual asset allocation, consumption, retirement issues, and the dualistic consumption patterns along with their economic utility is regarded as an essential factor in this changing era.

Also, calculating an individual’s labor income and expenditures over their entire lifetime on a periodic basis plays a crucial role in long-term asset management in the era of 100-year lifespans.

Professor Hyunjin Jang of the Department of Management Science at UNIST (President Yong-Hoon Lee), in collaboration with Harry Zheng from Imperial College London (ICL) and Zuo Quan Xu from Hong Kong Polytechnic University (HKPU), has published a study on a new form of consumption utility function addressing consumption heterogeneity (basic consumption vs. luxury consumption).

Based on this, the joint research team established rational decision-making criteria for asset allocation, consumption, and retirement timing throughout an individual’s lifetime.

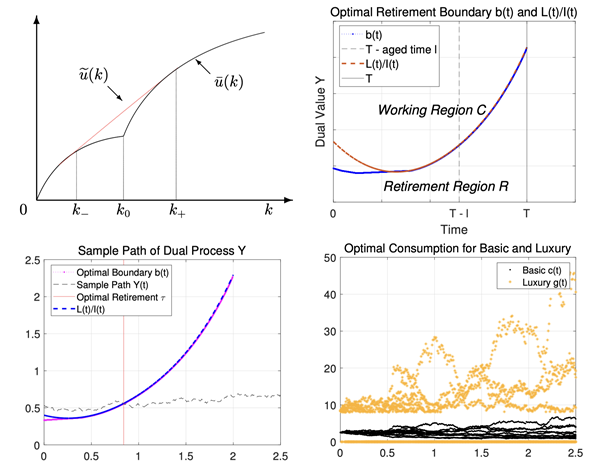

Research illustration of the utility function of asynchronous consumption (top left), domain construction for optimal retirement timing calculation (top right), optimal retirement timing simulation (bottom left), and simulation of optimal consumption and non-consumption areas for basic and luxury goods (bottom right).

Research illustration of the utility function of asynchronous consumption (top left), domain construction for optimal retirement timing calculation (top right), optimal retirement timing simulation (bottom left), and simulation of optimal consumption and non-consumption areas for basic and luxury goods (bottom right).

Realistically assuming changes in consumption patterns and labor activity cycles is an essential element for decision-making aimed at stable asset management. However, these assumptions act as constraints in establishing optimal asset allocation, consumption, and retirement models.

This complexity arises because deriving the stochastic control problem that maximizes utility of choice and the corresponding variational inequality becomes complicated, increasing the difficulty of theoretically modeling the phenomena.

The joint research team proposed a new methodological approach to solve this non-standard optimization problem.

It is the convexification of the asynchronous utility function of dualistic consumption. They theoretically proved that convexifying the asynchronous consumption utility function does not affect the given outcomes, allowing the optimization problem to be defined.

Furthermore, they separated the given optimization problem into pre-retirement and post-retirement phases, transforming it into a simpler form. This approach significantly reduced the complexity of the problem, enabling various theoretical simulations to be implemented.

According to the simulations in this study, the optimal retirement age for the middle class, who belong to an average economic environment, was found to be from the late 30s to early 40s.

This indicates that the commonly set retirement age of 60 by companies holds little significance under the assumption of rational individual decision-making. In advanced countries including the United States, companies do not set official retirement age limits.

This can be interpreted to mean that even if workers make rational choices regarding voluntary resignation, the average retirement age can be maintained at an appropriate level. Such policies provide freedom of choice for workers and reduce unnecessary costs for companies caused by setting retirement ages, resulting in mutually beneficial outcomes.

Additionally, this study confirmed that the middle class with high consumption utility for luxury goods experiences a wider ‘consumption cliff’ period, where the proportion of consumption drastically decreases.

They tend to increase the proportion of asset investments such as stocks rather than consumption. Such excessive reduction in consumption and increase in asset investment can serve as an indicator of the social atmosphere and policy direction the government should adopt for proper asset management and consumption expansion.

Professor Jang Hyunjin, Department of Management Science, UNIST.

Professor Jang Hyunjin, Department of Management Science, UNIST.

Professor Hyunjin Jang of the Department of Management Science explained the research results, saying, “Decision-making methods based on economic models can provide clearer theoretical grounds for evaluating the appropriateness of corporate retirement ages, which is a social issue, and for related policy decisions.”

Professor Jang added, “I believe this will also offer implications for policy decisions related to expanding consumption by the middle class to promote a virtuous cycle in Korea’s economy.”

The research findings were published online on October 31, 2022, in the world-renowned journal Operations Research.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.