Survey on Business Outlook Index of 2,257 Manufacturing Companies

Negative Outlook Stronger in Large Enterprises than SMEs

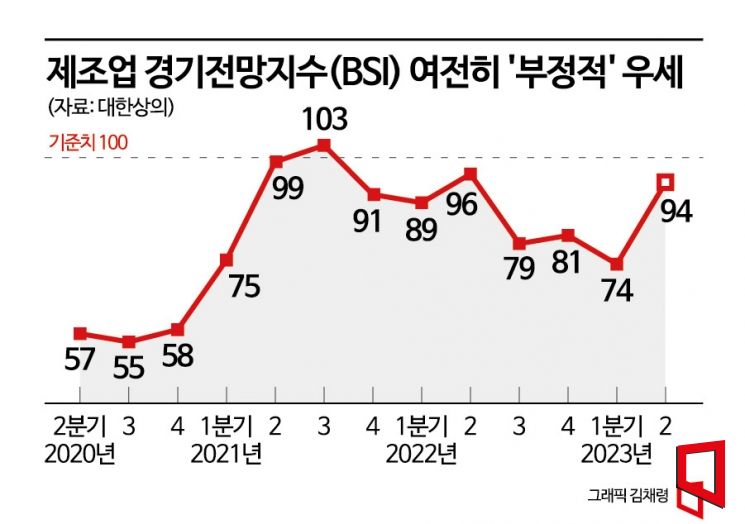

The manufacturing business sentiment index (BSI) for the second quarter returned to the level of one year ago after three consecutive quarters of decline, but negative outlooks still prevailed.

According to a recent survey by the Korea Chamber of Commerce and Industry (KCCI) of 2,257 manufacturing companies nationwide on the Business Survey Index (BSI), the second-quarter outlook rose by 20 points compared to the previous quarter but fell by 2 points year-on-year, recording a score of '94'.

Large enterprises (84) showed a more negative outlook than small and medium-sized enterprises (95). Although expectations such as China’s reopening and the lifting of indoor mask mandates improved the index, it appears insufficient to reverse the simultaneous slump in exports and domestic demand.

The Business Survey Index (BSI) indicates that if the score is above 100, more companies view the business conditions for the quarter positively compared to the previous quarter. If it is below 100, the opposite is true.

A KCCI official said, “It is a fortunate result that the BSI, a leading economic indicator, has stopped declining.”

He added, “From the export perspective, companies had high expectations due to increased demand and production activities in China following the reopening. On the domestic front, seasonal factors and the no-mask effect boosted optimism. Policy support such as the increase in investment tax credit rates and the freeze on the base interest rate, as well as changes in monetary policy stance, also seem to have contributed to the rise in the business sentiment index.”

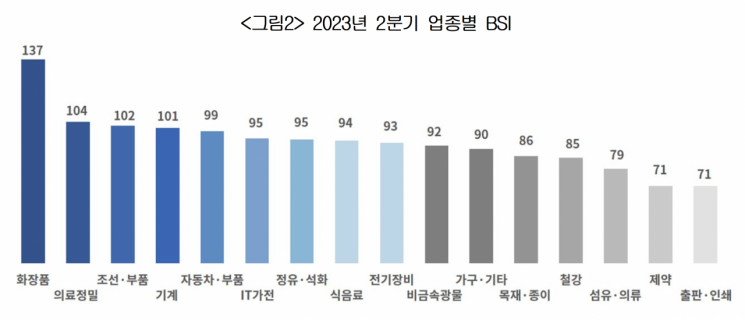

By industry, the cosmetics sector (137), which is expected to benefit from the full lifting of indoor mask mandates and the China special demand, scored the highest. The medical precision sector (104), which saw medical device exports exceed 3 trillion won for the first time last year, also maintained a favorable trend. The shipbuilding and parts sector (102), experiencing a boom in orders, and the machinery sector (101), expected to see increased demand due to rising production activities in China, also exceeded the baseline.

On the other hand, export-driven sectors such as IT and home appliances (95), where semiconductor demand and prices continue to decline, petroleum and petrochemicals (95), and steel (85) remained below the baseline of 100. Industries that lost the COVID-19 special demand, including pharmaceuticals (71), publishing and printing (71), and textiles and apparel (79), also showed weak second-quarter outlooks.

By company size, small and medium-sized enterprises had the highest business sentiment score at 95.1, followed by mid-sized companies (94.9), and large enterprises (84.5), with large enterprises having the most pessimistic outlook. For large companies, the sluggish recovery in business sentiment appears to be due to continued export slumps and inventory surpluses in Korea’s key industries such as steel, semiconductors, petroleum, and petrochemicals.

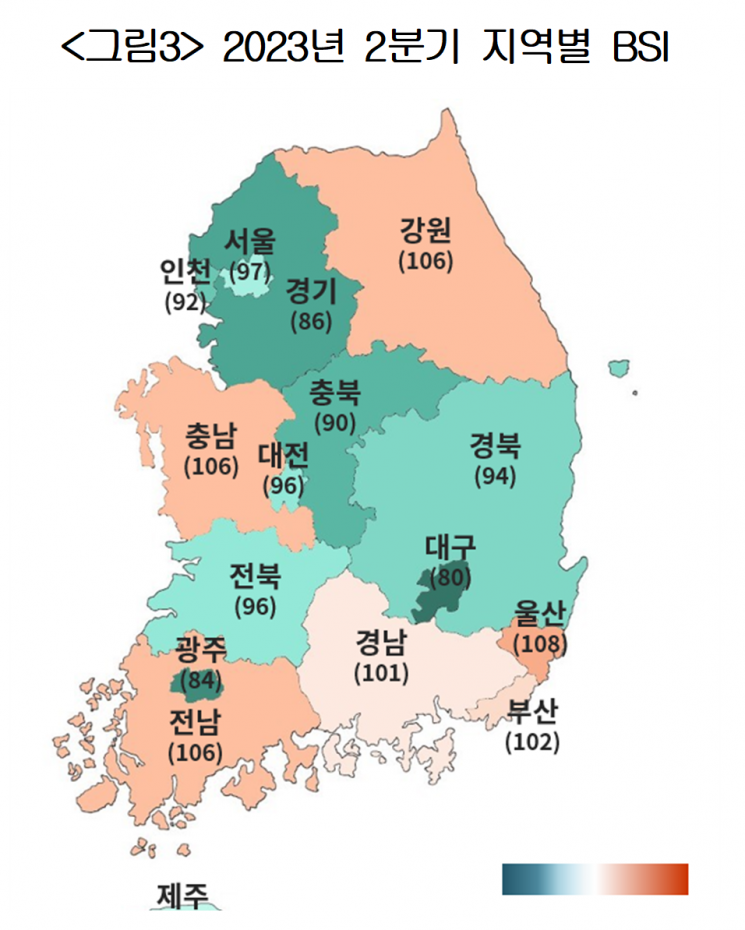

By region, Ulsan (108), Busan (102), and Gyeongnam (101), where shipbuilding industries and industrial complexes are concentrated, showed positive business sentiment exceeding the baseline of 100. Six regions including Gangwon (106), Jeonnam (106), and Chungnam (106) also surpassed 100. However, 10 regions including Daegu (80), with a high proportion of textile industries, and Gwangju (86), with many automobile suppliers, scored below 100, indicating that more regions failed to exceed the baseline.

Companies cited the following as management risk factors for the first half of this year: ▲rising raw material prices (65.9%) ▲cost burdens due to high interest rates (51.2%) ▲slowing domestic consumption (28.5%) ▲economic downturns in major export countries (19.7%) ▲instability in supply of raw and subsidiary materials (18.1%).

Kim Hyun-soo, head of the KCCI Economic Policy Team, stated, “The Korean economy is now at a crossroads between transitioning to a recovery phase and continuing a downward trend in the COVID-19 endemic situation. It is necessary for the government to seek tailored measures to stimulate consumption and resolve difficulties faced by export companies so that external and internal positive factors such as China’s reopening, improvement in Korea-Japan relations, and mask mandate lifting can lead to actual activation of domestic consumption and export growth.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.