Decline Reversal After 3 Months

Consumer Sentiment Index Hits 9-Month High

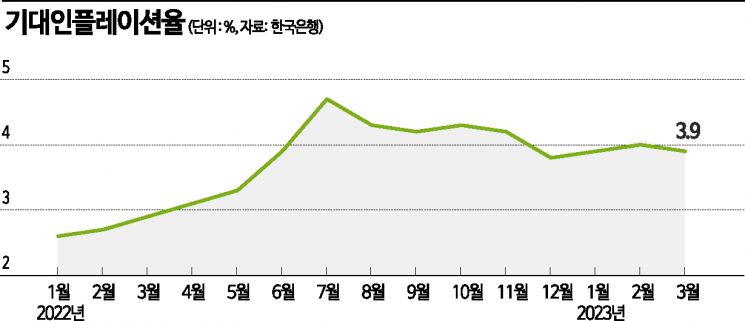

International oil prices have fallen, and with the consumer price index (CPI) showing a slowing trend, the general public's expected inflation rate for the next year slightly decreased to 3.9% this month.

According to the "March Consumer Sentiment Survey Results" released by the Bank of Korea on the 29th, the expected inflation rate was recorded at 3.9%, down 0.1 percentage points from the previous month. The expected inflation rate surged to 4.7% in July last year but fell to 3.8% in December due to interest rate hikes and other factors. It then rose to 3.9% in January and 4.0% in February this year before turning downward this month after three months.

Hwang Hee-jin, head of the Statistical Survey Team at the Bank of Korea's Economic Statistics Bureau, explained, "Although the price increases for processed foods, dining out, services, and transportation fares remain high, recent declines in oil prices and the overall drop in CPI have led to expectations that the inflation trend will slow down." He added, "News suggesting that prices will fall in the second half of the year due to base effects also influenced the slight decline in the expected inflation rate."

Expected inflation refers to the anticipated inflation rate one year ahead based on information currently known by economic agents such as businesses and households. The Bank of Korea conducted the survey from the 14th to the 21st of this month, targeting 2,500 households (2,372 respondents).

This month, the Consumer Sentiment Index rose due to the slowing pace of price increases and expectations of a return to normal life following the full lifting of mask mandates. The overall Consumer Sentiment Index (CCSI) for March was 92, up 1.8 points from the previous month, marking the highest level in nine months since June last year (96.7).

The CCSI is an indicator calculated using six major individual indices out of the 15 that make up the Consumer Sentiment Index (CSI): current living conditions, expected living conditions, expected household income, expected consumption expenditure, current business conditions, and expected business conditions. A figure above 100 indicates optimistic consumer sentiment compared to the long-term average (2003?2021), while a figure below 100 indicates pessimism.

The Interest Rate Level Expectation CSI (120) rose by 7 points due to the global monetary policy tightening stance and persistent high inflation. Team leader Hwang said, "At the beginning of March, expectations were high that global monetary policy tightening would continue, especially in the U.S., but the financial instability caused by the Silicon Valley Bank (SVB) incident dampened expectations for rate hikes, resulting in significant fluctuations. However, many respondents still believe there is room for interest rates to rise, leading to an increase after four months."

The Housing Price Expectation CSI (80) rose by 9 points. Although the housing market remains sluggish, the narrowing decline in housing prices and the easing of mortgage loan regulations contributed to the increase.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.