Korea International Trade Association Announces Related Statistics Through Briefing

In the domestic exports this month, a significant decline was observed in exports to China, which holds an important share, and in the semiconductor industry. The decrease was larger than in January and February. The deficit ratio compared to this year's trade volume from January to March recorded the highest level in 40 years, surpassing levels seen just before the foreign exchange crisis and during the oil shock.

On the morning of the 28th, the Korea International Trade Association (KITA) held a briefing titled 'Diagnosis of Recent Export Slump Factors and Response Directions' at the Trade Tower in Samseong-dong, Seoul, where it announced these findings.

According to KITA, the export amount recorded up to the 20th of this month was $127.4 billion, a 13.4% decrease compared to the same period last year. Imports decreased by 1.3% to $151.5 billion. As a result, the trade deficit reached $24.1 billion, showing an increasing trend.

Jung Manki, Vice Chairman of the Korea International Trade Association, is conducting a briefing presentation. /

Jung Manki, Vice Chairman of the Korea International Trade Association, is conducting a briefing presentation. / The deficit ratio relative to trade volume was 8.4%, marking the highest level in 40 years. This figure is higher than 7.4% in 1996, just before the foreign exchange crisis, and 8.2% in 1978 during the second oil shock.

Jung Manki, Vice Chairman of KITA, said, "As the economy is expected to recover in the second half of the year, the annual ratio is unlikely to reach 8.4%, but if this situation continues, it will be serious."

KITA cited the global economic downturn as the background for the recent export slump. With the global economic growth rate slowing and protectionism rising, market conditions are unfavorable, causing trade volume to shrink faster than economic growth, according to KITA.

They also pointed to specific factors unique to Korea. Vice Chairman Jung explained, "The factors affecting Korea are China and semiconductors," adding, "For the first time, the share of China in exports fell below 20% this year." He also noted, "From the trade balance perspective, China shifted from being the largest surplus country to the largest deficit country, which had an impact."

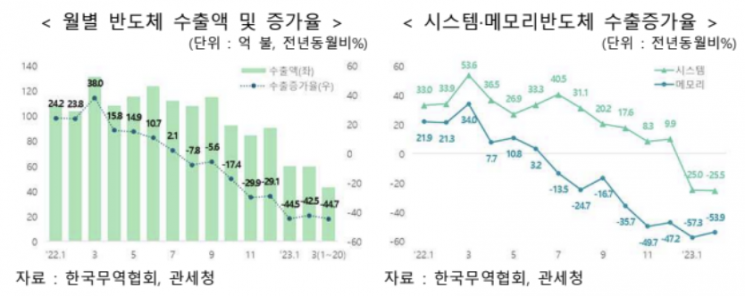

Looking at the regions, exports to China, which holds the largest share in domestic exports, decreased by 36.2% year-on-year in this month (1st to 20th). This decline was more pronounced than in January (-31.1%) and February (-24.3%). Semiconductor exports this month fell by 44.7% compared to the same month last year. Following decreases of 44.5% in January and 42.5% in February, the decline continued this month. KITA explained that if this trend continues until the end of the year, the decrease could surpass that seen during the financial crisis.

In particular, semiconductor items are experiencing export declines not only in memory products but also in system semiconductor products due to continued price drops. Memory products have seen consecutive export declines since July last year due to accumulated inventory caused by reduced demand and falling prices. System products, which were relatively less affected by the economy, are now facing order reductions and price drops due to shrinking demand in downstream industries, leading to a sharp decline in exports starting this year.

Vice Chairman Jung said, "Looking at the contribution rate of export decreases by item for January and February, semiconductors are leading the domestic export slump," adding, "Exports to the top five semiconductor export countries are all declining." He also stated, "Especially, semiconductor exports to China decreased by 39.7% in February," indicating that the factors of China and semiconductors are having a combined impact.

Due to this situation, Taiwan, which also focuses on semiconductors, is experiencing a significant drop in export amounts. Taiwan's exports in January and February decreased by 19.2% compared to the same period last year, a larger decline than South Korea's (-12.0%). Vice Chairman Jung explained, "Asian countries, especially those centered on semiconductors like Korea and Taiwan, are facing difficulties," and added, "When looking at the semiconductor share, Taiwan is more affected than we are."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)