Surge in Electric Vehicle Demand Leads to Deficit This Year

Peak Surplus of $3.4 Billion in 2019 Followed by Decline

Sharp Increase in Imports from China... Battery Deficit Tops List

Essential for EVs... Intermediate Goods Contribute to Exports

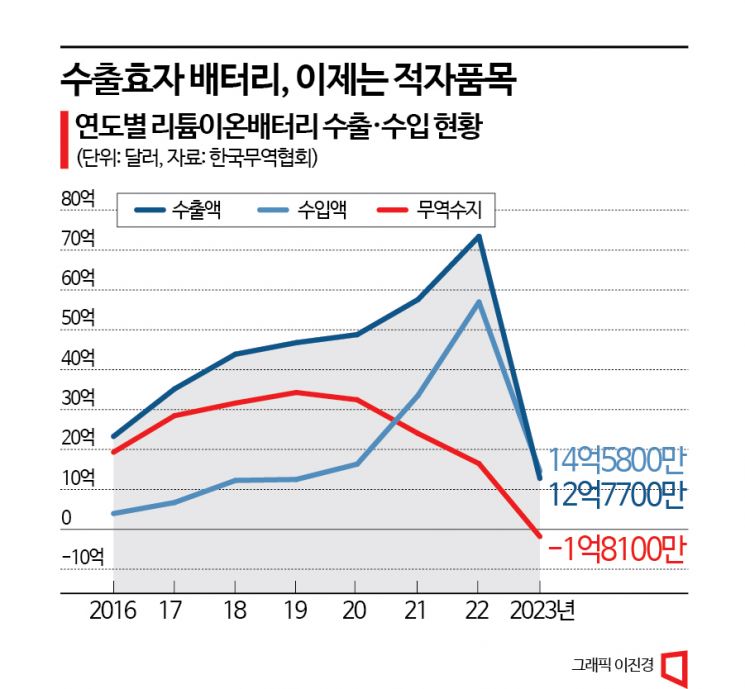

As the import volume of batteries used in electric vehicles and other applications has increased, it has been revealed that the import value has surpassed the export value this year. Batteries are one of South Korea's major export items, but this is the first trade deficit recorded since related statistics began. Since domestic self-supply is expected to remain difficult for the time being, the trade imbalance is likely to worsen going forward.

According to domestic trade statistics on the 28th, the import value of lithium-ion batteries from the beginning of this year until last month was $1.458 billion. During the same period, the export value was $1.277 billion, resulting in a trade deficit of $181 million. Lithium-ion batteries are used in products such as home appliances, IT devices, electric vehicles, and energy storage systems (ESS), and until last year, they recorded a surplus exceeding $1.6 billion.

Originally developed in Japan and successfully mass-produced by domestic companies in the 1990s, lithium-ion batteries have remained one of the key export items. In 2019, when export volumes were rapidly increasing, the surplus exceeded $3.4 billion, but as imports quickly rose afterward, the surplus shrank and turned into a deficit this year. Although exports in January and February of this year increased by more than 18% compared to the same period last year, performing well despite challenging export conditions, imports more than doubled.

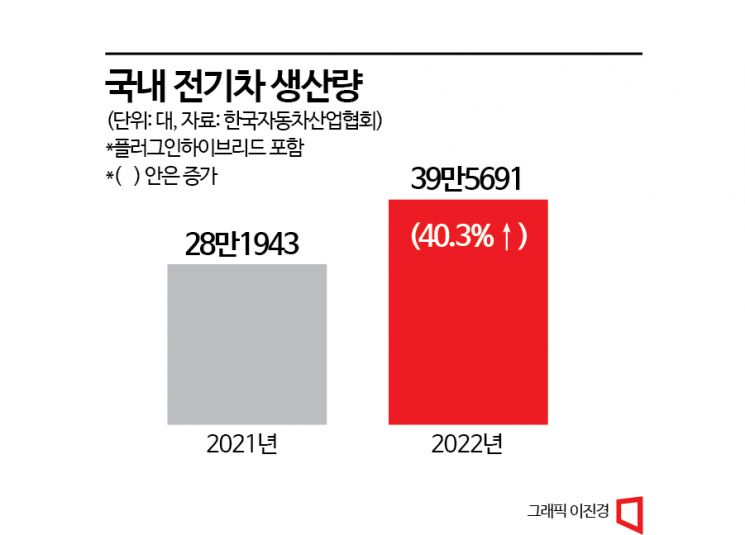

The increase in battery imports is due to rising demand that cannot be met solely by domestic products. With the rapid expansion of electric vehicle adoption and increased utilization of renewable energy sources such as solar and wind power, the demand for batteries has surged. The domestic production volume of electric vehicles by Hyundai Motor Company and Kia, which practically produce all domestic electric vehicles, rose by more than 40%, from 281,943 units (including PHEVs) in 2021 to 395,691 units last year.

Hyundai Motor Company and Kia source batteries used in electric vehicles from domestic battery manufacturers such as LG Energy Solution and SK On, as well as from China's Contemporary Amperex Technology Co. Limited (CATL). Not only CATL but also LG and SK import batteries produced at their Chinese factories into South Korea to supply Hyundai, which has significantly increased import values.

Domestic battery companies like LG and SK have battery cell production facilities in South Korea, China, Eastern Europe, and the United States, but have primarily focused on expanding overseas factories rather than domestic ones. Due to the considerable volume and weight of batteries, it is advantageous to locate factories near the final product consumers.

The battery trade deficit is seen as an additional burden on South Korea's already challenging trade situation. Last year, due to the war and other factors, energy prices such as crude oil and gas surged sharply, causing import values to rise rapidly and resulting in a continued trade deficit. Especially in the second half of the year, the export market was shaken as semiconductor prices, a major export item, plummeted.

In trade with China, South Korea's largest trading partner, batteries have become a representative "foreign currency outflow" item. From the beginning of this year until last month, the trade deficit with China was about $5.1 billion, with lithium-ion batteries accounting for $1.4 billion and lithium oxide and lithium hydroxide, commonly used battery raw materials, accounting for $1.2 billion?making up nearly half of the deficit. This indicates that batteries are the main cause of the trade deficit with China.

On the other hand, considering that intermediate goods like batteries are imported and finished products such as electric vehicles and ESS are exported, some argue that the battery trade deficit should be viewed as a "benign deficit." The argument is that although a large amount of batteries is imported, electric vehicle exports have increased even more. South Korea ranks fourth globally in electric vehicle exports, following Germany, the United States, and China.

An industry insider said, "It would be ideal to have the entire production base from battery raw materials to final products domestically, but realistically, there are limitations considering the manufacturing processes."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)