Transaction Volume of Occupancy and Pre-sale Rights Plummets 83% Compared to 5 Years Ago

Attention is focused on whether the relaxation of resale restrictions on pre-sale rights, which came into effect this week, will activate transactions of pre-sale rights. Some expect that pre-sale and move-in rights from existing pre-sale complexes will flood the market due to the retroactive application of the revised enforcement decree. However, there are also forecasts that the effect will be limited to an improved environment for resale rather than a significant increase in transaction volume. This is because those holding pre-sale rights in Seoul are more likely to hold onto them rather than sell.

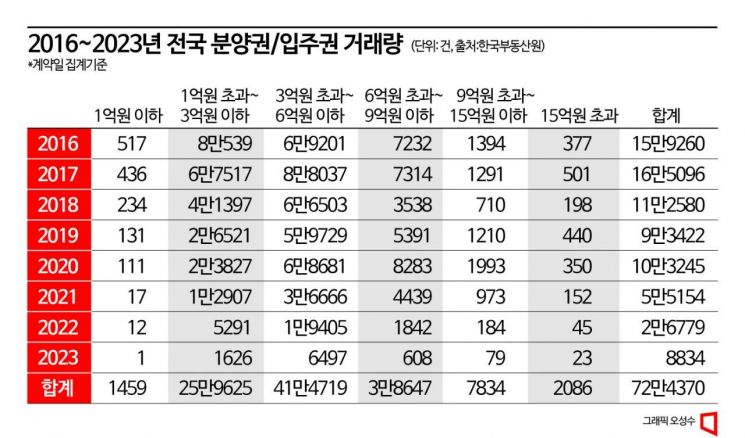

According to the Korea Real Estate Board on the 28th, nationwide transactions of move-in and pre-sale rights decreased by 37% from 165,096 cases in 2017, a real estate boom period, to 103,245 cases in 2020, and then sharply dropped by 74% from the previous year to 26,779 cases in 2022, an 83% decline over five years. The sharp decline in move-in and pre-sale rights transactions was due to government regulations. Following resale restrictions in regulated areas, the government extended the resale restriction period for private land in the metropolitan area’s overconcentration control zones and growth management zones, as well as urban areas of local metropolitan cities, until the ownership transfer registration date starting September 22, 2020. This limited both selling and buying, significantly shrinking the pre-sale rights transaction market and causing a balloon effect where demand for pre-sale rights flowed into the apartment sales market.

With the regulatory barriers that had stifled the pre-sale rights market significantly lowered from this month, attention is on whether the sharply decreased transaction volume will increase. On the 24th, the revised enforcement decree of the Housing Act, which focuses on easing resale restrictions on pre-sale rights, passed the vice-ministerial meeting. In the metropolitan area, resale restrictions are eased to 3 years for public land (subject to the price ceiling system) and regulated areas, 1 year for overconcentration control zones including all of Seoul, and 6 months for other areas. For non-metropolitan public land (subject to the price ceiling system), the period is eased to 1 year, 6 months for urban areas of metropolitan cities, and abolished for other areas. The revision is retroactively applied to apartments that had already completed pre-sale before the decree change.

There is also a view that a significant amount of pre-sale rights will be released into the market as resale restrictions are lifted. Ham Young-jin, head of the Zigbang Big Data Lab, said, "Since the revised enforcement decree is retroactively applied to existing pre-sale complexes, a considerable number of pre-sale rights listings are expected to be released into the market," adding, "Pre-sale rights have merits such as lower initial capital burden and the ability to purchase new apartments without a subscription savings account, so it is worth watching whether the pre-sale rights transaction market will regain vitality."

Nevertheless, there are also concerns that the pre-sale rights released into the market may not necessarily lead to an increase in actual transaction volume. The significance lies more in the improved resale environment rather than a large increase in transactions, especially since it is difficult for pre-sale rights in Seoul to be listed for sale unless they are urgent sales. Yoon Ji-hae, senior researcher at Real Estate R114, said, "For non-homeowners who subscribed with the purpose of owning a home in Seoul, it is an opportunity to own a house at a price lower than market value, so unless the financial burden is significant, there is no reason to sell."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)