Financial Authorities Improve Insurance Claims Adjustment System

Prohibit Unfair Assessments Such as Inducing Benefit Reductions

Prevent Favoritism in Subsidiary Work Allocation

The financial authorities are reforming the system related to insurance companies' loss adjustment. While restricting the practice of funneling work to subsidiaries, they have decided not to allow the reflection of contents that induce insurance claim reductions when evaluating loss adjustment corporations.

On the 27th, the Financial Services Commission and the Financial Supervisory Service announced that they will promote revisions to the "Model Code on Outsourcing Loss Adjustment Work (Insurance Association Model Code)" after consultations with the insurance industry, loss adjustment industry, and others. This is based on the judgment that additional institutional improvements are necessary for the current loss adjustment system to protect the rights and interests of insurance consumers. Loss adjustment involves investigating and analyzing insurance accidents, calculating the amount of loss, and determining the scope of compensation.

First, they decided to establish clear principles that insurance companies must follow when outsourcing and evaluating loss adjustment work. This is to improve unreasonable practices such as unjustly refusing to pay insurance claims or inducing reductions. Accordingly, when insurance companies evaluate outsourcing of loss adjustment work, the following are prohibited: ▲ reflecting criteria unfavorable to consumers such as insurance claim reductions or non-payment records ▲ unreasonable discrimination or arbitrary evaluation among loss adjusters.

For example, they aim to prevent loss adjusters from being assigned a practical limit on insurance claim payments by presenting target loss ratio limits. In addition, acts of arbitrarily applying differential scores to evaluation indicators, or qualitative and quantitative evaluation weights without fair and reasonable grounds are also prohibited.

Regarding outsourcing, unfair acts that may occur throughout the entire process of ▲ bidding ▲ contracting ▲ performing work will be specifically enumerated and prohibited. This includes requiring a significantly lowered bid price by favoring a specific company during evaluation or unjustly terminating contracts for reasons not specified in the contract. Examples related to outsourcing loss adjustment include pre-determining results, inducing insurance claim reductions, forcing performance of tasks other than the outsourced work, and withholding or delaying payment of fees without justifiable reasons.

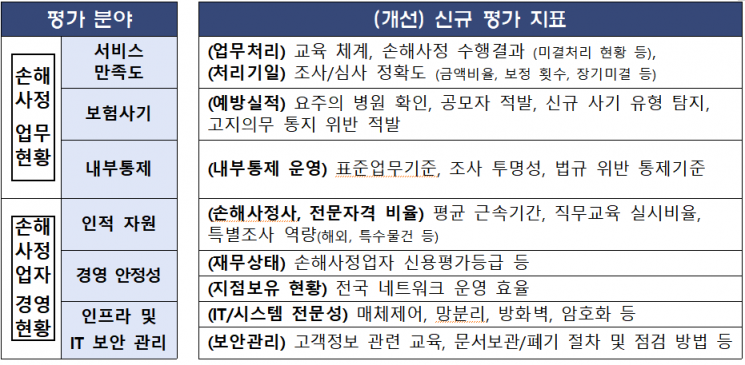

To this end, the financial authorities have established common standards for selecting and evaluating loss adjusters. They have introduced specific standard evaluation indicators (6 fields, 23 indicators) to ensure comprehensive work capabilities such as service satisfaction, insurance fraud prevention, infrastructure, and security management are properly evaluated.

The disclosure system to prevent 'self' loss adjustment will also be strengthened. If more than 50% of the work is outsourced to a loss adjustment subsidiary, the selection and evaluation criteria will be reported to the board of directors and disclosed.

The improvements will be implemented from July after going through the revision of the Insurance Association Model Code and incorporation into insurance companies' internal regulations in the first half of this year. Additionally, efforts will be made to legislate related contents. A Financial Supervisory Service official stated, "We will review and supplement measures to strengthen consumer protection autonomously within the industry through task forces (TF) involving the insurance and loss adjustment industries."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)