Forecasting Record Performance Again This Year Following Last Year

Expanding Investments to Prepare for Full-Scale Order Growth

Major defense companies, which are expecting their best performance this year due to the strong export of K-defense products, are pouring money into facility and research and development (R&D) investments in preparation for a full-scale expansion of orders. K-defense companies signed weapon export contracts worth $17.3 billion in 2022 alone. They sold K2 tanks, K-9 self-propelled howitzers, FA-50 light attack aircraft, and multiple launch rocket systems (Cheonmu) overseas.

According to business reports submitted to the Financial Supervisory Service by the defense industry on the 27th, Hanwha Aerospace invested 586.7 billion KRW in R&D last year. The R&D ratio to sales reached 9%. Large-scale facility investments are also underway. Hanwha Aerospace plans to expand the production line at Changwon Plant 3, which manufactures the K9 self-propelled howitzer, in the first half of this year. Since June last year, it has already started investing 25.3 billion KRW in facilities at Changwon Plant 2. Hanwha Systems also spent 34.1 billion KRW on new and expanded machinery for the manufacture and sale of various military equipment.

Korea Aerospace Industries (KAI) has set a goal to achieve 40 trillion KRW in sales by 2050 and will invest 1.5 trillion KRW over the next five years in six major projects: ▲6th generation fighter jets ▲transport aircraft (eco-friendly aircraft) ▲next-generation high-mobility helicopters ▲dual-use AAV (future aircraft) ▲independent satellite platforms and services ▲space exploration, mobility, and utilization solutions.

Hyundai Rotem is also increasing its investment in the defense sector. The investment amounts were 3.7 billion KRW in 2019, 8.1 billion KRW in 2020, 10.2 billion KRW in 2021, and 11 billion KRW last year, increasing every year. This year, an additional 24.6 billion KRW will be invested, and 22.8 billion KRW next year. Last year's investment in Hyundai Rotem's defense sector exceeded the 10.6 billion KRW invested in its other main business, the rail solutions (railroad) sector. This is the first time in five years since 2017 that defense sector investment has surpassed that of the railroad sector. The industry interprets this as Hyundai Rotem's main business shifting from railroads to defense. LIG Nex1 has acquired land for its Gimcheon Plant 2 to build production facilities necessary for developing advanced weapon components and large-scale export and mass production projects. LIG Nex1 stated, "We are considering additional investments depending on future business progress."

The defense industry's active increase in investment stems from newfound confidence that the era of K-defense exports has just begun. The Korea Institute for Industrial Economics and Trade expects the defense industry to break its record performance again in 2023, with second and third phase contracts worth $30 billion to $35 billion anticipated for four items including the K2 tank for Poland.

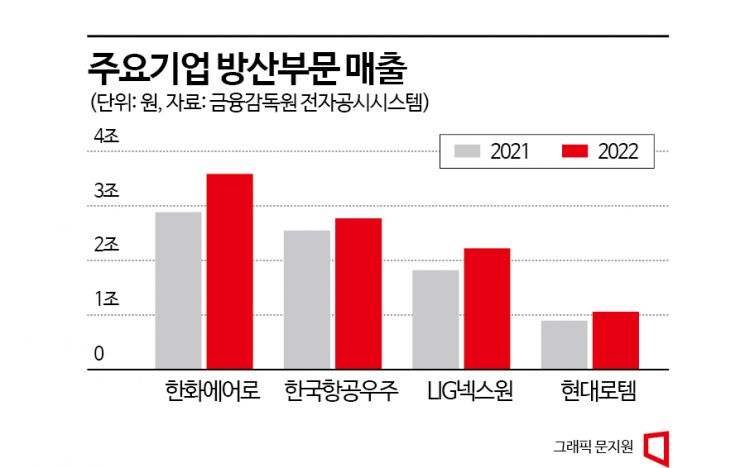

In fact, last year's performance of the defense industry clearly reflects the early-stage overseas order achievements. Hanwha Aerospace recorded defense sector sales of 3.5863 trillion KRW last year from self-propelled howitzers, armored vehicles, launchers, and air defense weapons. This is about a 30% increase from the 2.8842 trillion KRW achieved in 2021. The significant expansion of exports, which grew to 507.7 billion KRW?four times the 138.9 billion KRW in 2021?was a major factor. Hanwha Aerospace signed contracts worth 3.2 trillion KRW for K-9 self-propelled howitzers and about 5 trillion KRW for Cheonmu with Poland last year, and with sales recognition expected to begin in earnest this year, the defense sector is likely to break its record performance once again.

Korea Aerospace Industries (KAI) also posted record-high sales of 2.8 trillion KRW and orders of 8.6 trillion KRW last year. KAI has set a sales target of 3.8 trillion KRW this year, a 35.7% increase from last year. Hyundai Rotem contributed to the timely deployment of the latest ground equipment by supplying K2 tanks and wheeled armored vehicles, achieving defense sector sales of 1.0592 trillion KRW last year. This was the first time defense sales exceeded 1 trillion KRW. The defense sector's sales ratio rose to 33.5% last year from 31.2% in 2021.

In 2021, exports accounted for only 300 million KRW out of total defense sales of 896.5 billion KRW, with the remaining 896.2 billion KRW coming from the domestic market. However, thanks to the success of exporting K2 tanks to Poland, last year's export amount surged to 193.7 billion KRW. Once the Poland-bound K2 tank contracts signed last year are fully reflected in performance, Hyundai Rotem's defense sector sales this year are expected to reach around 1.6 trillion KRW.

LIG Nex1, which recorded its best performance last year, also expects additional growth this year. LIG Nex1's sales last year reached 2.2207 trillion KRW, surpassing 2 trillion KRW for the first time since its founding. Operating profit also increased by 84.3% from the previous year to 179.1 billion KRW. Including the 2.6 trillion KRW order for the mid-range surface-to-air missile Cheongung-II for the United Arab Emirates (UAE), the order backlog exceeded 12 trillion KRW for the first time at the end of last year. With the possibility of expanding orders to other Middle Eastern regions starting with the UAE, the atmosphere is optimistic that this year's performance will surpass last year's.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.