More than twice the target volume was received in Kakao's tender offer to secure management rights of SM Entertainment (SM).

As the application volume exceeded the target, shareholders participating in the tender offer will be able to sell only 44% of their applied shares at the tender offer price, while the remaining 56% must be retained.

According to Korea Investment & Securities on the 27th, Kakao's tender offer to purchase 35% of SM's issued shares at 150,000 KRW per share received applications for 18,880,227 shares (final competition rate of 2.2655436 to 1, allocation ratio of 44.1395170%).

This is approximately 2.27 times the target volume of 8,333,641 shares, and the allocation ratio was set at 44.1%.

Since the target level was exceeded, Kakao will not purchase the excess shares and will allocate the purchase volume proportionally.

Proportional allocation means dividing the shares equally by ratio. In this case, with a competition rate of 2.27 to 1, shareholders who applied can only dispose of 44% of their applied shares through the tender offer.

The remaining shares must be either retained or sold on the open market.

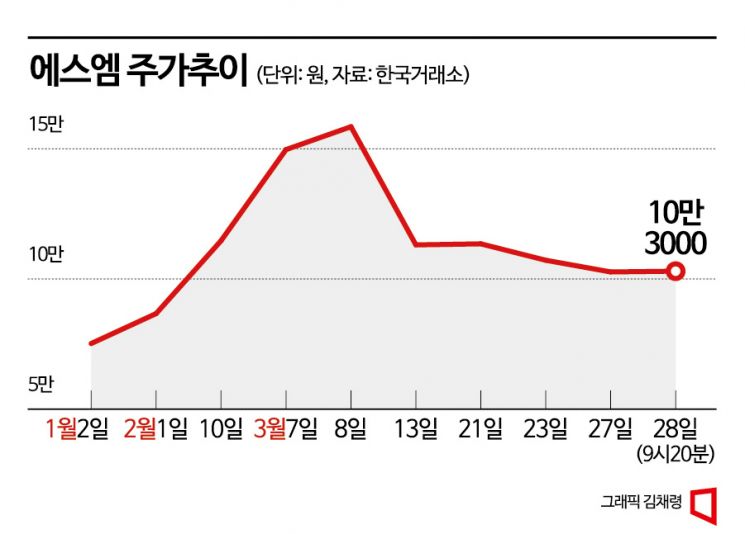

Meanwhile, as of 9:46 AM on the 27th, SM shares were trading on the KOSDAQ market at 97,200 KRW, down 10,000 KRW (9.33%) from the previous trading day.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.