KIRI Analyzes Domestic and US Situations

Overlooks Impact of Interest Rate Hikes...No Regulatory Application

Strict Risk Management Regulations Domestically...Insurers Must Prepare

An analysis has emerged stating that incidents like the bankruptcy of the U.S. Silicon Valley Bank (SVB) are unlikely to occur in South Korea. This is attributed to the very strict risk management practices, such as Asset-Liability Management (ALM), employed by domestic banks.

On the 26th, Senior Research Fellow Yoon Seong-hoon and Research Fellow Choi Seong-il of the Korea Insurance Research Institute emphasized this in their report titled "SVB Bankruptcy and the Importance of ALM."

SVB Overlooked the Impact of Rising Interest Rates

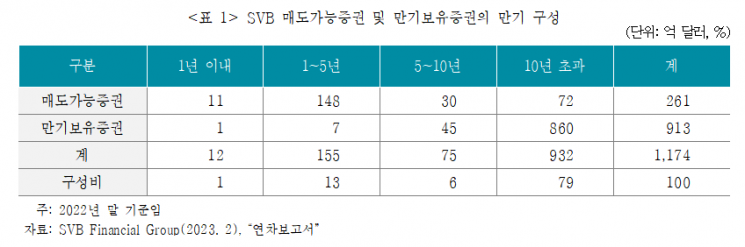

According to the report, SVB experienced a massive increase in deposits from technology companies?up 250%?during the tech industry boom from 2019 to 2022, but loans did not increase proportionally. As a result, SVB increased its investment in securities, mainly U.S. Treasury bonds and government-backed mortgage-backed securities. In particular, to boost investment returns, the proportion of securities with maturities exceeding 10 years was raised to as high as 79%.

This ultimately became problematic. Assuming a 10-year maturity, a 1 percentage point rise in interest rates posed a risk of over $10 billion (approximately 13 trillion KRW) in unrealized losses. The U.S. Federal Reserve (Fed) raised the benchmark interest rate from 0.25% in February 2022 to 4.75% in February this year, causing the value of SVB’s bond-heavy securities portfolio to plummet. Additionally, the end of the tech industry boom led technology companies to withdraw large amounts of deposits.

Consequently, SVB was forced to quickly sell off a large volume of securities. Unrealized losses on held-to-maturity securities reached $17 billion, and sales of available-for-sale securities resulted in $1.8 billion in losses. SVB later announced plans to raise $2 billion in capital, but this only exposed issues with its soundness and inducement, leading federal regulators to ultimately decide on SVB’s bankruptcy.

The report diagnosed, "If the durations of assets and liabilities do not match, as with SVB, capital fluctuates with interest rate changes. When asset duration is longer than liability duration, rising interest rates cause assets to decrease more sharply than liabilities, worsening financial soundness. SVB failed to properly manage interest rate risk and liquidity risk and fundamentally lacked comprehensive asset-liability management."

U.S. Small and Medium Banks Not Subject to Regulation... Poor Management

The report also analyzed that the lack of strict implementation of Basel Committee regulations in the U.S. contributed to such incidents. In April 2016, the Basel Committee on Banking Supervision announced standards for managing interest rate risk in the banking book (IRRBB), requiring disclosure of the impact on economic value of equity and net interest income under interest rate shock scenarios.

However, the U.S. has yet to adopt such disclosure standards. SVB Financial Group’s annual report only mentioned that it managed risks but did not provide actual management details. SVB was also not fully subject to liquidity regulations such as the Liquidity Coverage Ratio (LCR) and Net Stable Funding Ratio (NSFR). According to Basel III, internationally active banks are regulated, but in the U.S., banks with total assets under $250 billion and foreign risk exposure under $10 billion are subject to relaxed LCR standards. Banks with assets between $100 billion and $250 billion are completely exempt from NSFR regulation.

Strict Regulations in South Korea... SVB-like Incidents Highly Unlikely

In South Korea, Basel Committee regulations for managing interest rate risk and liquidity risk are strictly applied to all banks, unlike in the U.S. Therefore, the researchers judged that the probability of incidents like SVB occurring domestically is very low. However, since LCR and NSFR regulations currently apply only to banks and not yet to bank holding companies, they advised considering expanding the scope of application.

The report explained, "Under an upward-sloping yield curve, intermediating funds to gain interest rate spreads is common in the fund intermediation process of non-bank financial companies. Introducing LCR and NSFR on a consolidated basis for bank holding companies would indirectly regulate these non-bank financial companies."

It also added that institutional preparations for insurance companies are necessary. The new accounting standard for insurers, IFRS 17, effective this year, highlights managing insurers’ interest rate risk through mark-to-market valuation of liabilities and assets as a core part of capital regulation. Given that liquidity risks for insurance companies increased due to bond market tightening in the second half of last year, the report emphasized the need to discuss improvement measures considering this.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)