Highlighting Credit Risk Boundaries in Financial Institutions

Realization of Risks in Vulnerable Sectors with High Real Estate Exposure

Possibility of Foreign Capital Outflow Also Present

Deputy Prime Minister for Economy Choo Kyung-ho, Bank of Korea Governor Lee Chang-yong, Financial Services Commission Chairman Kim Ju-hyun, and Financial Supervisory Service Governor Lee Bok-hyun attended the 'Emergency Macroeconomic and Financial Meeting' held at the Bankers' Hall in Jung-gu, Seoul on the 23rd, and are seen conversing before the meeting started. Photo by Yoon Dong-joo doso7@

Deputy Prime Minister for Economy Choo Kyung-ho, Bank of Korea Governor Lee Chang-yong, Financial Services Commission Chairman Kim Ju-hyun, and Financial Supervisory Service Governor Lee Bok-hyun attended the 'Emergency Macroeconomic and Financial Meeting' held at the Bankers' Hall in Jung-gu, Seoul on the 23rd, and are seen conversing before the meeting started. Photo by Yoon Dong-joo doso7@

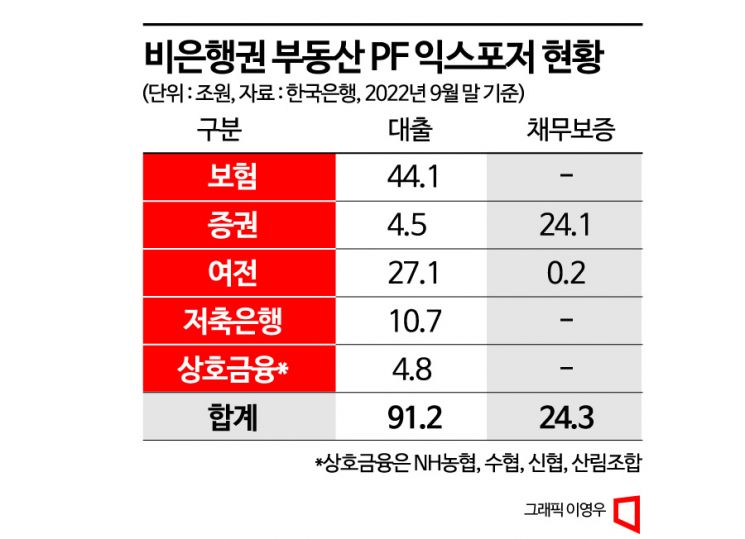

Concerns have been raised that if the bankruptcy crisis of the U.S. Silicon Valley Bank (SVB) worsens, credit caution toward vulnerable financial institutions in South Korea could intensify, amplifying instability. In particular, it has been pointed out that high-risk households, construction industry companies, marginal firms, and non-bank financial institutions with high delinquency rates or significant real estate exposure could be severely shaken.

According to the Financial Stability Report released by the Bank of Korea on the 23rd, when global financial conditions change rapidly due to incidents like the SVB crisis, the volatility of financial market price variables expands and credit caution toward some financial institutions becomes prominent, increasing the likelihood that latent risks in vulnerable sectors will materialize.

Kim In-gu, Director of the Financial Stability Department at the Bank of Korea, stated, "When domestic financial instability expands, such as during a global financial crisis, issues in vulnerable sectors like high-risk households, construction industries, and non-bank financial institutions can become significantly pronounced. If external instability intensifies, economic agents’ risk aversion may weaken investment sentiment toward startups, virtual assets, and fintech."

In particular, as global financial market instability spreads, it is difficult to rule out the possibility of foreign investor capital outflows amid strengthened risk aversion and reduced global liquidity. In fact, due to the bankruptcies of U.S. small and medium-sized banks like SVB and concerns related to Credit Suisse (CS), institutions’ demand for cash has increased, causing a sharp rise in dollar funding costs. The FRA (Forward Rate Agreements)-OIS (Overnight Index Swap) spread, a representative short-term financial indicator, has risen by about 60 basis points?the largest increase since the early days of the COVID-19 outbreak when it was around 80 basis points (1bp = 0.01 percentage points).

However, the Bank of Korea views the liquidity concerns related to SVB and CS as having a limited impact on the domestic system. Domestic financial institutions have asset and liability structures different from those of SVB and others, and liquidity and soundness conditions are expected to remain at a good level, making it unlikely that the situation will escalate into systemic risk. In fact, following the SVB crisis earlier this month, the stock market initially rose slightly due to net foreign purchases but has since fluctuated.

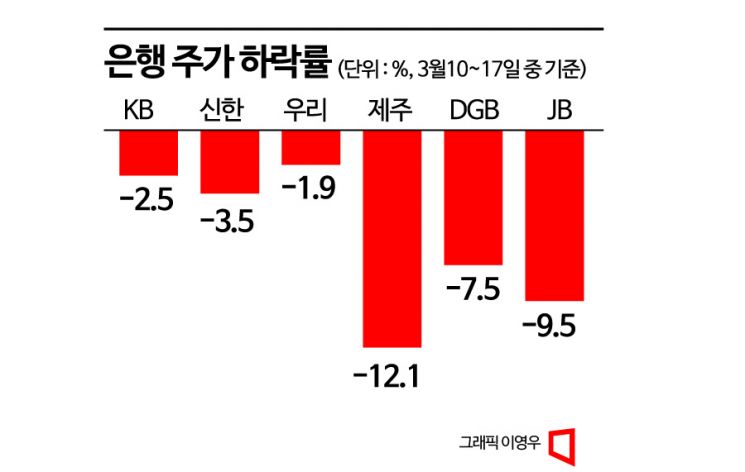

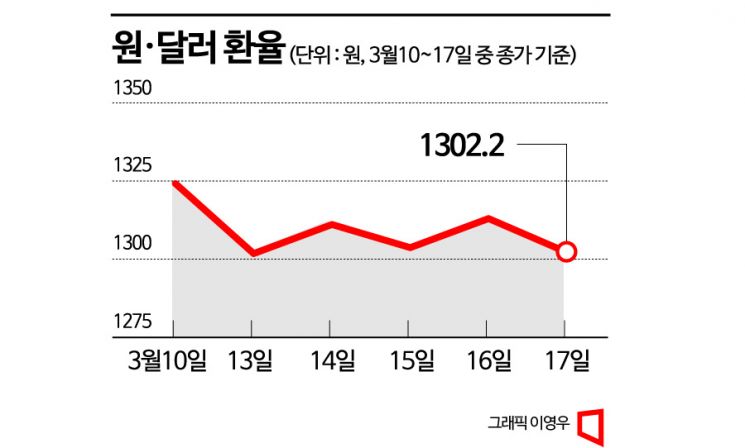

Although the decline in stock prices of financial sectors such as banks has been limited, regional banks have fallen somewhat more sharply compared to large banks. In the virtual asset market, Bitcoin fell sharply to 27.34 million KRW (Upbit closing price) on the 10th, before the SVB crisis fully unfolded, but rose to 36.21 million KRW on the 17th. The KRW-USD exchange rate rose from 1,324.2 KRW on the 10th to 1,302.2 KRW on the 17th amid expectations of a weakening tightening stance by the U.S. Federal Reserve (Fed).

Director Kim analyzed, "Domestic financial institutions have a business structure focused on deposit and loan operations, with a low proportion of bonds in total assets, and related interest rate risks are being managed stably. Even when reflecting unrealized gains and losses on held-to-maturity bonds of general banks, capital ratios are expected to decline by only about 1 percentage point." He explained that the likelihood of cases like the SVB crisis?'expanded losses on operating assets → bank run → liquidity shortage'?occurring is limited.

The government and supervisory authorities are monitoring the ripple effects of the SVB and CS crises while planning to strengthen on-site information collection activities for vulnerable financial institutions and review and implement measures to enhance the soundness of financial institutions. Lee Jong-ryeol, Deputy Governor of the Bank of Korea, emphasized, "Since changes in global financial conditions have a significant impact on domestic financial stability, monitoring of financial stability situations in major countries must be further strengthened. In particular, early warning activities and soundness inspections of financial institutions should focus on sectors with high real estate exposure and vulnerability to domestic and external shocks."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.