Bank of Korea 'Financial Stability Report'

High-risk households with large debts and insufficient capacity to repay even after asset disposal

Rising interest rates and falling asset prices increase the likelihood of delinquency

The likelihood of loan delinquency has increased among high-risk households that have a large amount of debt to repay and insufficient capacity to repay even after liquidating assets. In particular, the proportion of unsecured loans from high-risk households is high in the secondary financial sector, such as savings banks and credit specialized companies, raising concerns that the recovery rate of loan assets may be lower than expected.

According to the 'Financial Stability Report' released by the Bank of Korea on the 23rd, the delinquency rate on household loans for high-risk households has gradually increased since the second half of last year, heightening concerns about the risk of insolvency. The Bank of Korea evaluates households with a debt service ratio (DSR)?which refers to the ratio of principal and interest repayment to the borrower's income?exceeding 40% as over-indebted households with relatively high delinquency risk. As of last month, 24.7% of all households holding financial debt in South Korea and 30.9% of self-employed households exceeded a DSR of 40%.

Rising Debt to Repay, Falling Asset Prices

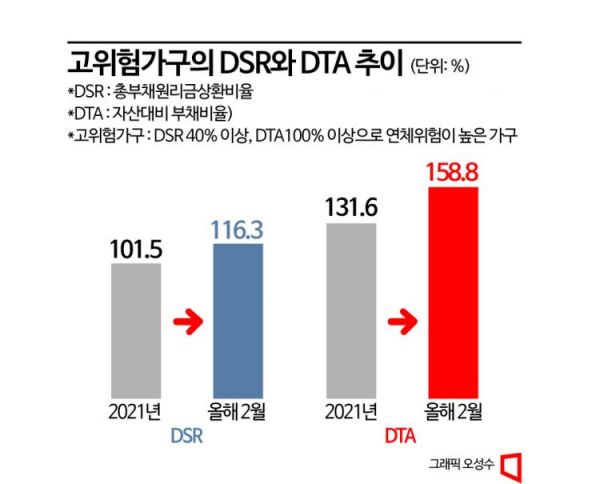

The Bank of Korea specifically defines households with both a DSR over 40% and a debt-to-asset ratio (DTA) exceeding 100% as 'high-risk households.' These high-risk households have become more vulnerable since last year due to increased interest burdens and falling asset prices. Compared to 2021, as of February this year, the DSR rose from 101.5% to 116.3%, indicating an increased loan proportion relative to income. The DTA also increased from 131.6% to 158.8%, reflecting a higher repayment ratio relative to held assets.

As of February, 5% of households holding financial debt in South Korea are classified as high-risk households, and their debt accounts for 9% of total household financial debt. The average debt of high-risk households was 250 million KRW, significantly higher than the 100 million KRW average for non-high-risk households. The Bank of Korea stated, "7% of high-risk households have experienced short-term delinquency of less than 30 days, and 5.3% of high-risk households who have never been delinquent responded that they expect difficulty in repaying their debts in the future, suggesting that their debts are likely to lead to delinquency gradually."

High-Risk Household Risks Concentrated in Savings Banks and Credit Specialized Companies

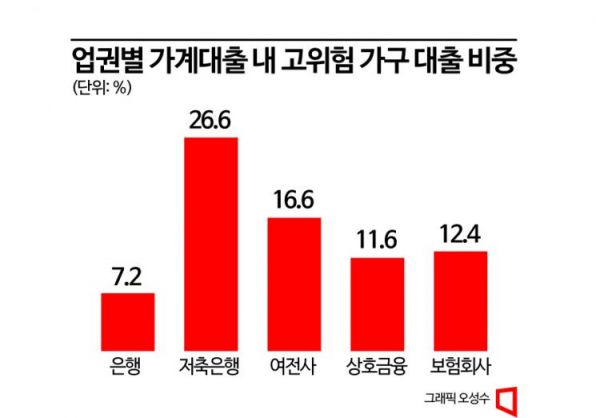

Looking at the sectors, red flags have been raised for delinquency rates in savings banks and credit specialized companies. While the delinquency rate for banks is 0.2%, savings banks recorded 4.7%, and credit specialized companies 2.4%. The proportion of loans to high-risk households among household loans was also 26.6% for savings banks and 16.6% for credit specialized companies, higher than banks (7.2%), mutual finance (11.6%), and insurance companies (12.4%).

The Bank of Korea added, "Furthermore, the proportion of unsecured loans to high-risk households among household loans in savings banks and credit specialized companies reached 34.1% and 41.1%, respectively, raising concerns that the recovery rate of loan assets may be lower than expected." However, it added, "The loss absorption capacity of these sectors is sound, so concerns about institutional insolvency due to an increase in household loan delinquencies are not significant." As of the end of last year, the capital adequacy ratio was 13.3% for savings banks and 17.8% for credit specialized companies, which is high compared to the regulatory ratio of around 7-8%.

Meanwhile, compared to the end of December last year, the delinquency rate in the banking sector rose by 0.07 percentage points to 0.24% from 0.17% at the end of June last year. The delinquency rate for non-bank financial institutions also increased from 1.23% to 1.40% during the same period. The average DSR for all households holding financial debt rose from 29.4% in 2021 to 34.5% as of February this year, and the average DSR for self-employed households reached 40%, indicating excessive debt holdings.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)