Full-Scale Sale Process Begins After 7 Years

Challenges Include High Prices, Declining Ocean Freight Rates, and Perpetual Bond Handling

National shipping company HMM has selected Samsung Securities as its lead manager for the sale and has officially begun the process of transferring management rights. However, the investment banking (IB) industry predicts that the process will not be smooth until the actual sale is completed. This is because HMM is a large-scale asset with cash equivalents exceeding 14 trillion won, and there are numerous issues to resolve, such as the perpetual bonds problem.

According to the Korea Exchange on the 23rd, based on the closing price the previous day, HMM's market capitalization is 9.9275 trillion won. According to the audit report, as of the end of last year, current assets amounted to 14.28 trillion won.

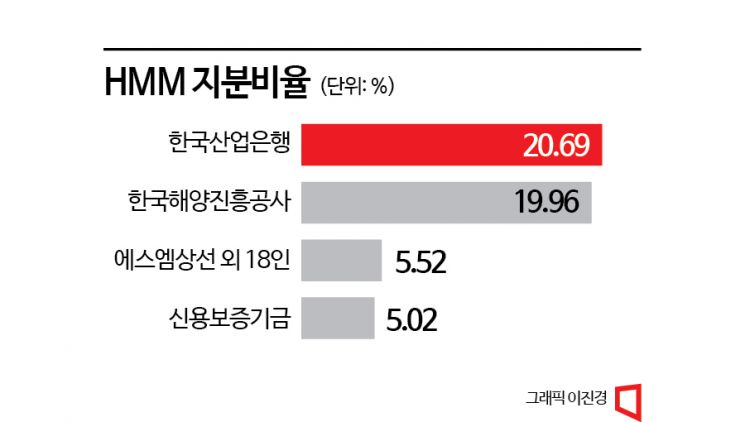

HMM has secured record-high liquidity due to the freight rate boom that lasted for the past two years. This aspect is analyzed to rather raise the company’s valuation, becoming a stumbling block for mergers and acquisitions (M&A). An IB industry insider said, "I don’t know how much of the shares will be sold, but considering the management premium, the valuation could reach up to 10 trillion won, and there are few buyers who can afford such an amount." He added, "If the perpetual bonds held by KDB Industrial Bank (20.69% stake), HMM’s largest shareholder, and Korea Ocean Business Corporation (19.96%), the second-largest shareholder, are all converted into common stock, the government’s stake alone would reach 74%."

Potential buyers for HMM include Hyundai Motor, CJ, POSCO, LX, SM, Harim Group, and Samsung SDS. However, it is expected to be difficult to boldly jump into a 10 trillion won scale M&A in a poor economic situation. A senior business official said, "It seems that Samsung, LG, SK, and Lotte have no interest at all. The only party showing some interest is LX Group, which has logistics and trading divisions, but if they buy it, it would be a purchase made by stretching their limits," expressing concern.

The downturn in the shipping industry is also cited as a major factor causing hesitation for bold bets. A decline in container ship freight rates is expected this year, signaling a cold wave in the shipping market. Due to the global recession, maritime freight rates have been steadily declining. The Shanghai Containerized Freight Index (SCFI) dropped to 909.72 on the 17th, about one-fifth of the peak of 5109.60 in January last year. The industry estimates the breakeven point for small and medium shipping companies at 1500 and for large shipping companies at 1000, but currently, companies are operating at a loss regardless of their size.

Besides the price, issues such as the handling of perpetual bonds and the future position of Korea Ocean Business Corporation are also obstacles. From 2018 to 2020, HMM issued convertible bonds (CB) and bonds with warrants (BW) worth 2.68 trillion won to KDB Industrial Bank and Korea Ocean Business Corporation. Although the maturity is long, if all CBs and BWs held by the two institutions are converted into shares, their stake would increase from 40.65% to 74%.

There is market skepticism about whether Korea Ocean Business Corporation will sell all or only part of its HMM shares. An IB industry insider said, "Most of Korea Ocean Business Corporation’s work is related to HMM, so if it sells all its shares, the corporation’s reason for existence would disappear."

HMM is coming to market for sale for the first time in seven years since 2016. It had served as a core affiliate of the Hyundai Group for a while but was incorporated as a subsidiary of the Korea Development Bank in 2016 after receiving 6.8 trillion won in public funds following a liquidity crisis at the end of 2013. HMM’s sales last year were 18.5868 trillion won, and operating profit was 9.9455 trillion won, both increasing by 35% compared to the same period the previous year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.