Detailed Provisions of Semiconductor Support Act Guardrail Released

Production Capacity Limited but Technology Upgrades Allowed

Domestic Industry: "Reduced China Business Risk"

Discussion on Export Controls for Semiconductor Equipment to China Remains a Challenge

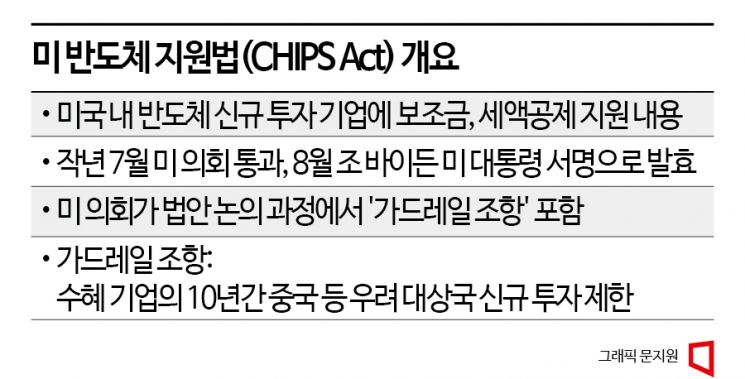

The United States has announced the detailed provisions of the guardrail clause in the Semiconductor Support Act. South Korean semiconductor companies, who had been anxiously awaiting the announcement, view the conditions as better than expected. While the U.S. has imposed restrictions on expanding production capacity at semiconductor factories in China, it has allowed technological upgrades. Samsung Electronics, SK Hynix, and others responded that the risks associated with operating factories in China have been significantly reduced. The government plans to focus on handling related matters such as extending the exemption period for export restrictions on semiconductor equipment to China.

The U.S. Department of Commerce announced on the 21st (local time) the guardrail clause restricting investments in China and other countries of concern for companies receiving subsidies under the Semiconductor Support Act. U.S. Secretary of Commerce Gina Raimondo stated, "The guardrail clause will help the U.S. stay one step ahead of its rivals for decades to come," while revealing the details.

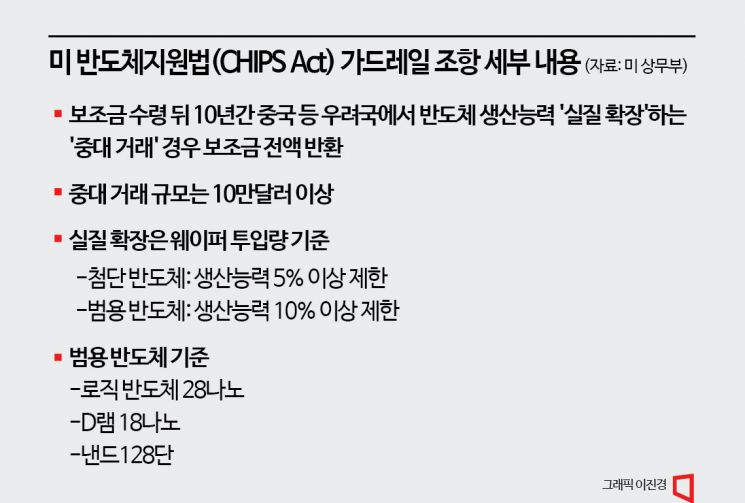

First, companies receiving subsidies must return the full amount of the subsidy if they engage in a significant transaction that materially expands semiconductor production capacity in China within the next 10 years. A significant transaction is defined as one exceeding $100,000, and material expansion is defined as a quantitative increase in wafer input volume.

At this time, there is also a restriction that advanced semiconductor production capacity in Chinese factories must not increase by more than 5%, and general-purpose semiconductor production capacity must not increase by more than 10%. The criteria for general-purpose semiconductors are ▲logic semiconductors of 28 nanometers (nm; 1 nm = one billionth of a meter) or larger ▲DRAM exceeding 18 nm ▲NAND below 128 layers.

Domestic semiconductor companies, if they receive subsidies, will not be able to increase production capacity in Chinese factories by more than 5% for 10 years. Nevertheless, they are responding positively to the announcement of the guardrail clause. Although there are restrictions on expanding production capacity such as line expansions, it is evaluated that the worst-case scenario has been avoided.

In particular, the industry is relieved that there is no restriction on investment in technological upgrades, which was the greatest concern. This is because investments are possible not only for upgrading production equipment technology and processes in China but also for replacing equipment necessary for facility operation. By increasing integration through technological upgrades, more chips can be produced from the same wafer input.

An industry official said, "Although there is a 5% limit, so expansion or a large increase in production capacity is not possible, if there had been restrictions on technological upgrades as well, the risk would have been much greater," adding, "Some factories in China could have suffered significant damage if upgrades were not possible." Another official also said, "Uncertainties in Chinese business are gradually being resolved through negotiations between the two governments," and "The risks have been greatly reduced compared to previous concerns."

However, if domestic companies fall under the scope of export restrictions on semiconductor equipment to China, there may be limitations on technological upgrades. Since October last year, the U.S. has restricted the export of advanced equipment to prevent production in China of DRAM below 18 nm, NAND with 128 layers or more, and logic semiconductors below 14 nm. However, Samsung Electronics and SK Hynix were granted a one-year exemption from these regulations. If the exemption period is not extended, there could be disruptions in advanced semiconductor production in China after October this year.

The Ministry of Trade, Industry and Energy plans to engage in additional consultations as the U.S. finalizes the guardrail clause after a 60-day public comment period. Discussions regarding subsidy payments and the guardrail clause are scheduled with key U.S. Semiconductor Support Act officials visiting Korea on the 23rd. A ministry official said, "We will make every effort to minimize the burden on our semiconductor industry from major issues such as the U.S. Semiconductor Support Act and U.S. export controls on semiconductor equipment to China."

Samsung Electronics and SK Hynix both stated, "We will carefully review the U.S. government’s announcement and establish future response directions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)