Low Volume of Non-Apartment Jeonse Transactions in Seoul

Apartment Jeonse Transactions Recover Amid High Interest Rates

"Apartment Jeonse Prices Are Cheap, So Why Move?" Shift in Villa Demand

"Two years ago, with a jeonse deposit of 320 million won for a villa, I could live in a newly built apartment. The jeonse market has completely changed."

Kim, a newlywed in his 30s, plans to move in April from his current villa in Sindang-dong, Jung-gu, Seoul, to a newly built apartment in Eungam-dong, Eunpyeong-gu. Two years ago, when jeonse prices were at their peak, he chose an old villa instead of an old apartment, but recently, as apartment jeonse prices have dropped, there is no longer a reason to stay in the villa.

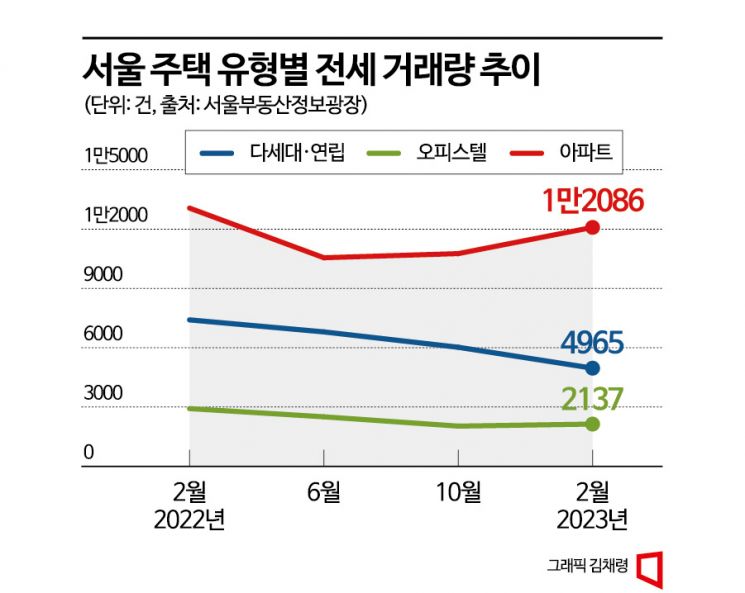

The non-apartment jeonse market in Seoul, including multi-family houses, row houses, and officetels, is struggling with a transaction cliff. This contrasts with the apartment jeonse market, which has recovered transaction volume earlier this year after a long cold spell. It is analyzed that tenant demand is shifting to apartments as avoidance of non-apartment jeonse continues due to the 'Villa King Scam' and apartment jeonse prices have plunged.

According to the Seoul Real Estate Information Plaza on the 22nd, the number of multi-family and row house jeonse transactions in Seoul in February totaled 4,965. Compared to 7,408 in February last year, this is a decrease of 2,443 transactions, about 33%. The volume of multi-family and row house jeonse transactions has been declining since June last year due to the impact of high interest rates increasing loan interest burdens, dropping to the 6,000 range (6,800 transactions), and further decreasing to 4,626 in December, maintaining the 4,000 range since then.

February officetel jeonse transactions were 2,309, slightly higher than 2,137 the previous month but about 27% lower than 2,920 a year ago.

This is in contrast to the apartment jeonse market, which had also been struggling but is now showing a sharp recovery. In February, Seoul apartment jeonse transactions totaled 12,086, slightly less than 13,061 a year ago but the highest since March last year when there were 12,697 transactions. Compared to the lowest point in November with 9,385 transactions, this is 2,701 transactions, about 29% more.

The prolonged transaction cliff in the non-apartment jeonse market has a complex background. First, the negative perception of villa and officetel jeonse has spread due to the 'Villa King' jeonse scams that occurred consecutively at the end of last year in Gangseo-gu, Seoul, and Michuhol-gu, Incheon, shrinking the market. Additionally, as the real estate market stagnated and housing prices plummeted, the risk of 'empty jeonse' increased, intensifying avoidance of non-apartment jeonse.

To make matters worse, the sharp drop in apartment jeonse prices, which are substitutes, has dealt a heavy blow to the non-apartment market. As newly built apartments continue to be supplied but landlords unable to find tenants drastically reduce apartment jeonse prices, villas and officetels have lost price competitiveness.

A representative of a real estate brokerage firm mainly handling villas in northern Seoul said, "After the new lease law, jeonse prices surged, and competition was so fierce that newly built three-room villas were contracted over the phone without even seeing the house," adding, "But recently, due to the impact of jeonse scams and the completely changed apartment jeonse price situation, villa landlords are struggling to attract tenants."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.