Korea International Trade Association International Trade and Commerce Research Institute Q2 EBSI Announcement

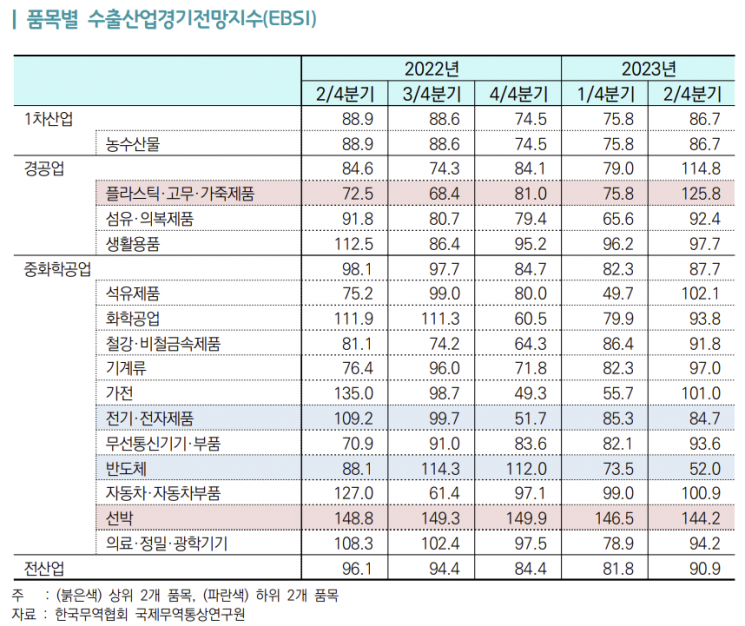

The 'Export Industry Business Sentiment Index (EBSI),' an indicator reflecting companies' export business outlook, rose for the first time in three quarters. Positive forecasts emerged for items such as ships, home appliances, and automobiles. The semiconductor sector, however, showed the opposite trend. Its decline has been pronounced since the beginning of this year.

On the 21st, the Korea International Trade Association's International Trade and Commerce Research Institute announced the '2023 Q2 EBSI' reflecting these findings. EBSI is a quarterly export business outlook index based on companies' perspectives. A value above 100 indicates that more companies have a positive outlook for the next quarter's export business. A value below 100 means negative outlooks are more prevalent.

The survey results showed that the Q2 EBSI stood at 90.9, still below 100. However, the downward trend has halted. Last year, the index consecutively fell in Q3 (94.4), Q4 (84.4), and this year's Q1 (81.8).

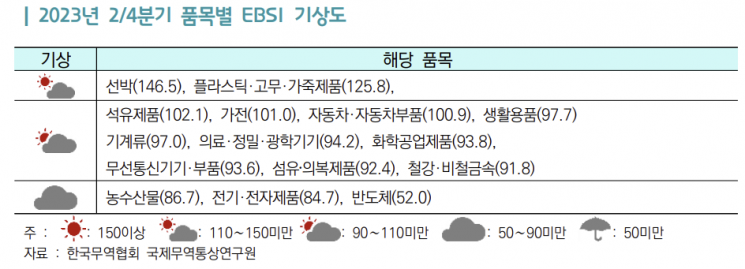

By item, ▲ships ▲plastics, rubber, leather ▲petroleum products ▲home appliances ▲automobiles and parts all exceeded 100, showing positive outlooks. In contrast, ▲semiconductors ▲electrical and electronics ▲agricultural and marine products fell well below 100.

In particular, the semiconductor sector's outlook has sharply worsened this year. After surpassing 100 in Q3 (114.3) and Q4 (112.0) of last year following Q2 (88.1), it plunged to 73.5 in Q1 this year. The Q2 figure also declined to 52.0, continuing the downward trend.

Various indices related to the business outlook for Q2, as anticipated by companies, also showed negative forecasts with values below 100. The export destination countries' economy recorded 79.8, international supply and demand 83.0, and financial conditions 85.3. Among the export difficulties voiced by companies in this survey were burdens from raw material prices and market encroachment by developing countries.

Kim Kkotbyeol, senior researcher at the Korea International Trade Association, said, "Although companies still face cost burdens and recession concerns, the fact that EBSI exceeded 90 after three quarters is positive, but challenges such as financial difficulties, concerns over trade frictions, and deteriorating profitability remain deep," adding, "policy support such as easing interest burdens and expanding credit guarantees for export companies is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)