Recommendations for Additional Corporate Tax Rate Reduction and Expansion of R&D Tax Credit Rates

On the 21st, the Federation of Korean Industries (FKI) recently submitted the "2023 Tax Law Amendment Proposal," which contains a total of 106 tasks across 9 laws, to the Ministry of Economy and Finance after collecting opinions from member companies and major domestic corporations.

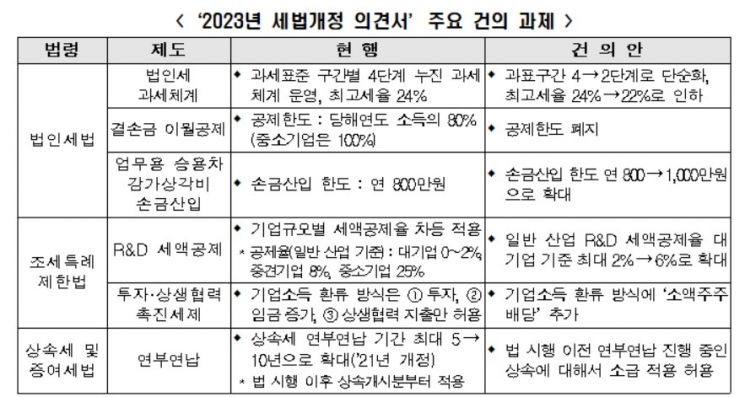

The main proposals from the FKI include ▲ further reduction of the corporate tax rate, ▲ allowing retroactive application of the extended installment payment period for inheritance tax, ▲ abolition of the limit on the carryforward deduction of losses for large corporations, ▲ expansion of the general research and development (R&D) tax credit rate, ▲ inclusion of 'minority shareholder dividends' in the corporate income recirculation method under the investment and win-win cooperation promotion tax system, and ▲ expansion of the deductible limit for depreciation expenses on company passenger cars.

Korea’s corporate tax system is a four-tier progressive tax system. Last year’s tax law amendment reduced the corporate tax rate by 1 percentage point for each taxable income bracket (with the top rate lowered from 25% to 24%). The FKI pointed out that the 1 percentage point reduction is minimal and limits the enhancement of corporate global competitiveness, proposing to lower the top rate from 24% to 22% (from 26.4% to 24.2% including local taxes) and simplify the taxable income brackets from four tiers to two.

The FKI also stated that since the death of the decedent is a situation beyond the heir’s choice, applying different installment payment periods depending on the timing of occurrence undermines tax burden fairness among taxpayers. They argued that the extension of the installment payment period should be applied retroactively to inheritances currently undergoing installment payments.

They further argued that differentiating the carryforward deduction of losses based on company size is undesirable. The expected effect of the loss carryforward deduction system is the rapid normalization of management for deficit companies and the maintenance of the tax base through this, so there is no reason to discriminate by company size. They also proposed abolishing the limit on the carryforward deduction of losses. The loss carryforward deduction allows companies to carry forward losses incurred to the next fiscal year (up to 15 years) and deduct them from taxable income. Currently, companies except for small and medium enterprises (SMEs) are limited to deducting up to 80% of the current year’s income (SMEs can deduct 100%).

The FKI claimed that tax support for large corporations leading private R&D is insufficient compared to major countries and proposed raising the general industrial R&D tax credit rate from 2% to 6% for large corporations. The R&D tax credit system allows companies to deduct a certain amount of the costs invested in research and human resource development from corporate tax. The current tax credit rates are differentially applied as 0-2% for large corporations, 8% for mid-sized companies, and 25% for SMEs in general industries.

Additionally, they requested including dividends paid to minority shareholders in the corporate income recirculation method under the investment and win-win cooperation promotion tax system to alleviate unreasonable tax burdens on companies, and also proposed raising the deductible limit for depreciation expenses on company passenger cars from the current annual 8 million KRW to 10 million KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)