Change Maturity Operation Frequency from 'Weekly to Daily'

Strengthening Dollar Liquidity Supply Measures

Maintained at Least Until the End of Next Month

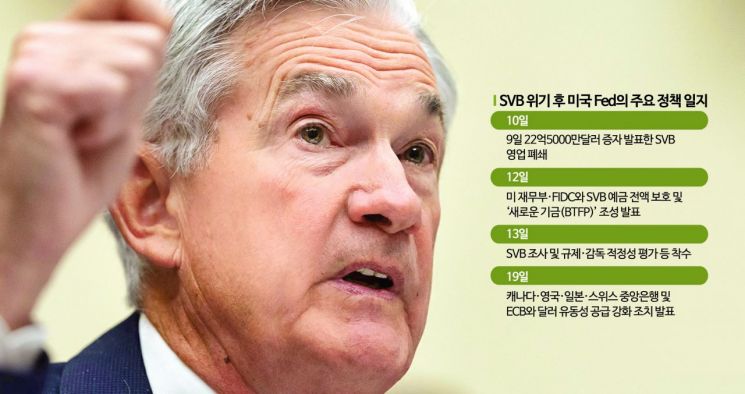

On the 19th (local time), the U.S. Federal Reserve (Fed) and five major central banks jointly announced measures to expand dollar liquidity through currency swap agreements. This move aims to alleviate fears of global financial system instability spreading following the recent collapse of Silicon Valley Bank (SVB).

On the same day, the Fed issued a joint statement with the Bank of Canada (BOC), the Bank of England (BOE), the Bank of Japan (BOJ), the European Central Bank (ECB), and the Swiss National Bank. The key point is changing the maturity operation frequency of dollar swaps from the current 'weekly' basis to a 'daily' basis. This measure will begin on the 20th and continue at least until the end of April. Detailed operational plans will be disclosed on the 20th.

This measure is expected to improve efficiency in dollar funding for countries included in the U.S. currency swap lines. It will also facilitate smoother dollar liquidity supply for banks belonging to these countries.

A currency swap agreement is an arrangement between two countries to exchange different currencies at an agreed exchange rate at a certain point in time. In emergencies such as financial crises, countries can deposit their own currency with the counterpart and borrow dollars, thereby preparing for liquidity risks caused by dollar outflows. Since its launch in 2007, the Fed’s swap line network has played a crucial funding role for banks in member countries whenever global financial market tensions peaked. Banks outside the U.S. can provide collateral to their central banks through this swap line to secure dollars.

This measure was prompted by concerns that the ripple effects of the recent SVB collapse could spread to the global financial sector, increasing the risk that major countries’ banks might face liquidity shortages, including in dollars. Notably, it was announced just before the opening of major Asian stock markets alongside UBS’s acquisition of Credit Suisse (CS). It is interpreted as a move to minimize the impact on global financial markets.

The Fed explained, "This is a measure to strengthen liquidity supply through dollar swap agreements," adding, "It will enhance the critical role of dollar liquidity support to ease pressures in global funding markets and contribute to alleviating credit supply constraints for households and businesses."

Following the collapse of the U.S. SVB on the 10th, Signature Bank in the U.S. also failed, and in Europe, CS faced funding difficulties. In CS’s case, it was eventually acquired by Switzerland’s UBS, and the global financial sector is closely monitoring how far the repercussions of this incident will spread.

The Fed, together with the U.S. Treasury and others, is making every effort to prevent the SVB incident from escalating into global financial system instability. On the 12th, it collaborated with the Treasury and the Federal Deposit Insurance Corporation (FDIC) to fully protect SVB deposits and establish a new fund called the Bank Term Funding Program (BTFP). The BTFP, an unusual facility created by the Fed, lends funds for one year to banks that pledge U.S. Treasury securities and mortgage-backed securities (MBS) as collateral. This measure is designed to meet depositors’ cash withdrawal demands, with a key feature being that collateral is valued at face value rather than market value. This aims to prevent banks from having to sell Treasury securities at prices below face value amid falling Treasury prices, which move inversely to interest rates.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.