Production Declines, Inventory Accumulates

"Customized Support Measures Needed for Manufacturing Items"

More than 70% of South Korea's manufacturing sector has yet to recover to pre-COVID-19 production levels. The decline in production reflects sluggish domestic consumption and exports, highlighting a facet of the slowdown in the Korean economy.

According to the Bank of Korea's Economic Statistics System on the 20th, the manufacturing production index (original index) stood at 95.0 in January 2023, down 3 points from 98.0 in January 2019. By product category, 17 out of 24 items (70.8%) including food and beverages, textiles, wood, chemicals, non-metallic minerals, and primary metals showed a downward trend.

Professor Emeritus Shin Sedon of the Department of Economics at Sookmyung Women’s University pointed out, "The most serious problem in the Korean economy is the sluggishness of manufacturing," adding, "While the real GDP growth rate shows growth of 4.1% in 2021 and 2.6% in 2022 after a -0.7% contraction in 2020, the decline in manufacturing production by item is a serious situation."

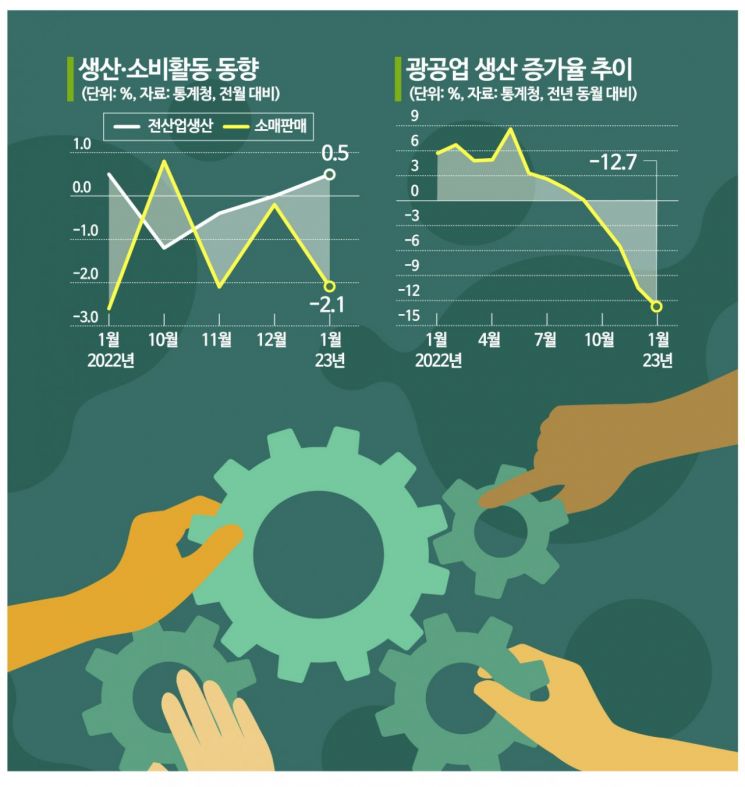

In particular, looking at the past year alone, the weakness in Korea’s key manufacturing sectors is pronounced. In January this year, the industrial production index including manufacturing fell 12.7% year-on-year. Manufacturing dropped sharply by 13.2%. Although production increased in sectors such as automobiles (10.9%), it significantly decreased in semiconductors (-33.9%) and chemical products (-23.6%).

The decline in manufacturing production is due to sluggish domestic consumption and overseas exports. The Korea Development Institute (KDI) recently assessed the Korean economy, stating, "Recently, our economy has shown continued sluggishness as exports have contracted and domestic demand has weakened," and added, "Manufacturing, centered on semiconductors, has seen a sharp decline in production and a rapid increase in inventory, showing signs of contraction. This manufacturing slump has led to reduced facility investment and a slowdown in employment growth."

Consumer sentiment is actually frozen. The overall Consumer Confidence Index (CCSI) in February was 90.2, down 0.5 points from the previous month. A value above 100 indicates optimistic consumer sentiment compared to the long-term average (2003?2021), while below 100 indicates pessimism. Rising prices for public utilities and other goods, along with export declines due to global economic slowdown, have fueled pessimistic consumer sentiment. The Leading Composite Index’s cyclical component, which forecasts future economic conditions, also fell 0.3 points to 98.5 in January, marking a seven-month consecutive decline.

Exports are also sluggish. According to the Ministry of Trade, Industry and Energy, exports in February this year decreased by 7.5% compared to the same period last year. The trade deficit exceeded $5 billion, continuing for 12 consecutive months. The export slump is largely due to a decrease in semiconductor exports. Last month, semiconductor export value was $5.96 billion, down 42.5% year-on-year. Additionally, among Korea’s 15 major export items, nine?including petrochemicals (-18.3%), steel (-9.8%), displays (-40.9%), biohealth (-32.1%), computers (-66.4%), and ships (-10.7%)?failed to avoid downturns. As semiconductor exports declined, imports of semiconductor manufacturing equipment also shrank from $106.5 million in December last year to $61 million in January this year.

With both domestic consumption and exports sluggish, manufacturing inventories are accumulating. As of January this year, manufacturing inventory increased by 10.0% year-on-year. Consequently, the inventory ratio (inventory relative to shipments) surged from 96.2% in January 2019 to 120.0% in January this year.

Professor Shin advised, "For the Korean economy to shake off the aftermath of COVID-19 and achieve sustained growth, recovery in the manufacturing sector is paramount," and urged, "The government must urgently prepare tailored measures for items with sluggish production."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)