The Bank of Korea: "Real Estate Market and Export Slump to Ease After the Second Half of the Year"

China's private consumption is expected to support the economic recovery this year, with infrastructure and manufacturing investments projected to maintain steady growth for the time being. While the real estate market and export downturn are anticipated to ease in the second half of the year, uncertainties regarding the timing and extent of the recovery remain high.

On the 19th, the Bank of Korea stated in its Overseas Economic Focus report titled "Trends and Evaluation of the Chinese Economy After Reopening" that "China's domestic demand, including consumption and investment, is currently driving the recent economic recovery, mainly through service consumption and infrastructure investment," and added, "Exports continue to decline due to sluggish global demand for semiconductors and other products."

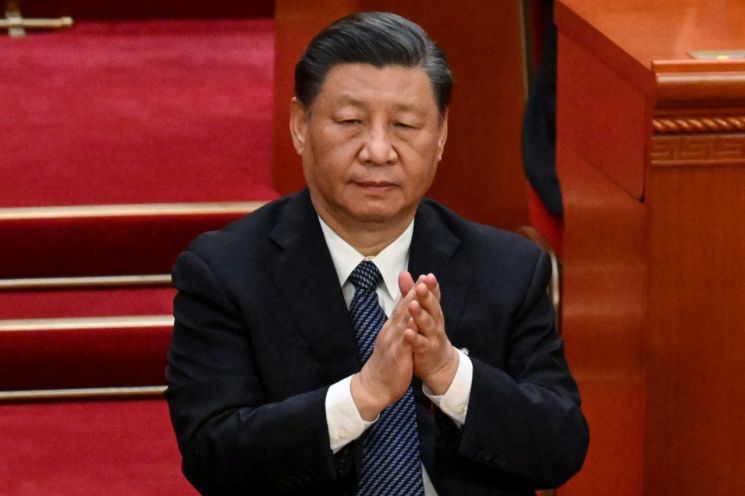

At this year's Two Sessions (Lianghui: the National People's Congress and the Chinese People's Political Consultative Conference), the Chinese government set the economic growth target at around 5%, lower than last year's approximately 5.5%, reflecting increased external uncertainties and concerns related to government debt. The report forecasts, "This year, the Chinese government will focus on expanding domestic demand, industrial upgrading, and preventing financial and economic risks, while supporting stable economic growth rather than full-scale stimulus, considering fiscal sustainability."

In particular, since the Chinese authorities have prioritized domestic demand expansion as the top economic policy goal this year, private consumption is expected to underpin the economic recovery. However, the additional savings accumulated during the pandemic remain lower compared to advanced countries, and the high youth unemployment rate is likely to constrain consumption, resulting in significant uncertainty regarding the future consumption recovery path.

Moreover, as the Chinese government emphasized the importance of infrastructure and high-tech industry investment at the Central Economic Work Conference last December and this year's Two Sessions, infrastructure and manufacturing investments are expected to show steady growth for the time being. However, considering the significantly expanded fiscal deficit and concerns about overinvestment since COVID-19, and the authorities' emphasis on fiscal policy efficiency, the Bank of Korea believes that the government is likely to monitor the private sector's recovery and adjust the pace of investment growth in the second half of the year.

Furthermore, although the real estate market and export downturn are expected to ease after the second half of this year, uncertainties regarding the timing and extent of the recovery remain high. Exports face ongoing issues related to the US-China trade conflict, as well as high uncertainty concerning the recovery of major economies and global semiconductor demand.

Lee Jun-young, head of the China Economy Team at the International Economy Department of the Bank of Korea's Research Division, said, "There is expected to be a considerable time lag before the recent recovery in real estate prices, mainly in some major cities, translates into an investment rebound," adding, "Considering the oversupply centered in third-tier cities and the government's 'common prosperity' policy stance, a significant rebound in the real estate market is unlikely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)