National Assembly Legislative Research Office 'Policy Trends and Issues for Reasonable Interest Rate Calculation' Report

South Korea's Loan-Deposit Interest Rate Spread at 2.5% Notably High Level

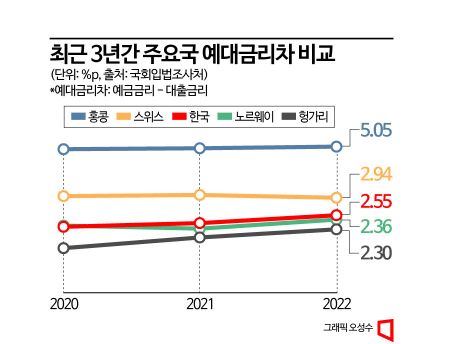

Are the interest rate spreads between deposits and loans of banks in our country larger compared to other countries? According to the report titled 'Policy Trends and Issues for Rational Interest Rate Calculation' released on the 18th by the National Assembly Legislative Research Office, the interest rate spread between deposit and loan rates of domestic banks has been on an increasing trend over the past three years. However, the level was not noticeably large. It was recorded as 2.05 percentage points in 2020, 2.21 percentage points in 2021, and 2.55 percentage points in 2022.

In comparison, Hong Kong's spread (4.94 percentage points → 4.98 percentage points → 5.05 percentage points) was much higher than that of our country. Singapore also showed an interest rate spread exceeding 5 percentage points (5.07 percentage points → 5.13 percentage points → before aggregation). Switzerland (3.01 percentage points → 3.06 percentage points → 2.94 percentage points) also surpassed the level of our country's interest rate spread.

Financial authorities are currently conducting policy discussions to ensure that interest rates are calculated rationally as the burden on financial consumers increases due to recent interest rate hikes. The bank mortgage loan interest rate, which has the greatest impact on household interest burden, jumped from 2.50% in 2020 to 4.24% in 2022, and accordingly, banks' interest income increased significantly. To curb this, authorities are pressuring banks to lower their interest rates.

The authorities have announced plans to introduce additional comparative disclosures of interest rate spreads based on balance by bank, comparative disclosures of jeonse loan interest rates, and even explanatory notes on factors affecting interest rate changes by bank. Lee Bok-hyun, Governor of the Financial Supervisory Service, is 'visiting' commercial banks to encourage interest rate reductions. In the National Assembly, a 'Bank Act amendment bill' has been proposed that requires disclosure of loan interest rates distinguishing between base rates and additional rates, as well as revealing banks' target profit margins.

The National Assembly Legislative Research Office report stated, "It is necessary to review the economic impact of policy intervention in the interest rate calculation system on the loan market," adding, "If policy intervention becomes stronger and acts as a kind of loan interest rate ceiling regulation on banks, banks' incentives to lend may decrease, making it harder to obtain loans than before, or it may expand lending practices focused on high-credit borrowers due to banks' risk-avoidance tendencies."

It also stated, "The operating costs, risk premiums, and target profit margins reflected in the calculation of loan additional interest rates are internal management matters of banks, and if the government controls these matters, criticism may arise that it infringes on banks' management autonomy."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)