March Recent Economic Trends (Greenbook)

"Export Slump Slowdown is the Decisive Factor"

The government recently assessed that the economic slowdown trend has continued following last month. While the situation appears to be progressing according to the plan that growth can occur in the second half of the year if inflation is controlled in the first half, exports remain sluggish and external uncertainties such as the Russia-Ukraine war still persist.

On the 17th, the Ministry of Economy and Finance released the ‘March Recent Economic Trends (Green Book)’ stating, “Recently, our economy has seen a somewhat slowed inflation rate, a gradual pace of domestic demand recovery, and a continued trend of economic slowdown due to sluggish exports and weakened manufacturing business sentiment.”

The term “economic slowdown” was first used with the expression “concern” in the Green Book in June last year. Then, in January this year, concerns about the economic slowdown were diagnosed as “expanding,” and in February, the economic trend was described as “slowing down.” This time, the economic slowdown maintained the same level as last month.

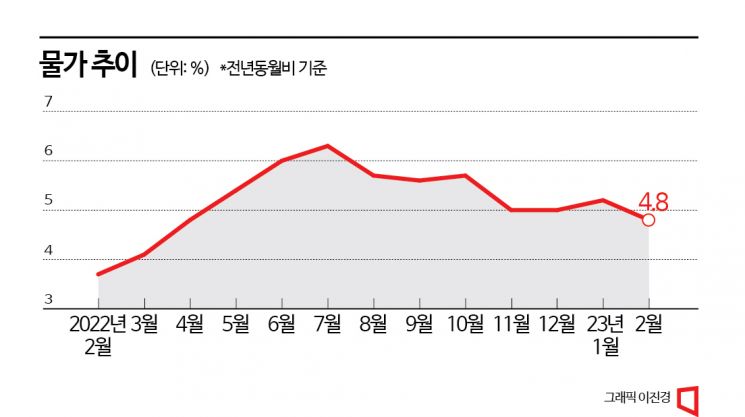

The consumer price inflation rate, which rose to 6.3% in July last year, dropped to 4.8% last month, falling into the 4% range for the first time in 10 months. Although inflation remains high, it decreased by 0.4 percentage points from 5.2% the previous month within just one month. Stabilization of international oil prices helped petroleum product prices regain stability, and large-scale discount events led to price declines in livestock products such as beef and pork.

Despite improvements in inflation indicators, the diagnosis of economic slowdown was maintained due to sluggish exports and the worst trade deficit. Last month, export value decreased for the fifth consecutive month, recording $50.1 billion. This is a 7.5% decrease compared to the same period last year. The trade balance has recorded a deficit for 12 consecutive months and is worsening. From January this year to the 10th of this month, the trade deficit amounted to $22.775 billion, about four times more than the same period last year and half of the total trade deficit in 2022.

Lee Seung-han, head of economic analysis at the Ministry of Economy and Finance, explained, “The decisive factor for diagnosing the economic slowdown was sluggish exports,” adding, “Exports continue to show poor performance until a rebound appears due to the China reopening effect.” However, he also said, “Although cautious, we expect that the semiconductor sector and global economic conditions will improve in the second half of the year, and Korea will benefit accordingly.”

The gradual pace of domestic demand recovery also influenced the economic slowdown assessment. At the beginning of this year, sales of durable goods, semi-durable goods, and non-durable goods all decreased, causing retail sales in January to shrink by 2.1% compared to the previous month. Although domestic sales of Korean passenger cars and department store sales increased last month, the consumer sentiment index fell from 90.7 to 90.2.

The employment market also froze. In February, the number of employed persons increased by only 312,000 compared to the same month last year. The increase has been shrinking for nine consecutive months. Notably, employment among youth aged 15 to 29 decreased by 125,000 compared to the previous year, the largest decline since February 2021 when it fell by 142,000.

In the external sector, financial instability and downside risks intersected, leading to continued global economic uncertainty. Particularly regarding the U.S. economy, it was analyzed that “there are existing risk factors.” Although U.S. consumer prices have fallen for eight consecutive months, core inflation rose by 0.5% month-on-month, exceeding market expectations of 0.4%. Recently, risks such as the bankruptcy of Silicon Valley Bank (SVB) have also emerged, and the government is closely monitoring the situation.

The China reopening effect was also seen as still limited. Although real indicators generally show a recovery this year, it remains centered on domestic demand and services. Lee Seung-han explained, “The number of overseas tourists to China is increasing, and the service sector is active, but industrial production is lagging behind,” adding, “It will take more time to recover to previous levels.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.