Fear of Financial Sector Crisis Spreads, Private Capital Steps in as Firefighter

'Wall Street Emperor' Dimon, JP Morgan Chairman, Persuades Banks

US Government Prevents Chain Collapse, Avoids Bailout Criticism

Yellen Emphasizes "US Financial System Remains Strong" Amid Ongoing Fear

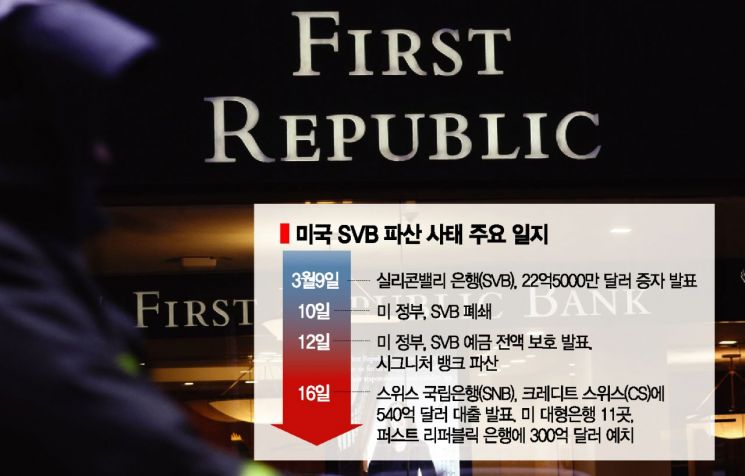

Eleven major U.S. banks are injecting an emergency $30 billion (approximately 39 trillion won) to rescue First Republic Bank, which has been plagued by crisis rumors following the collapse of Silicon Valley Bank (SVB). Private capital has been deployed as a 'firefighter' to quell fears that liquidity crises in small and medium-sized banks could spread throughout the entire financial sector. This move is seen as a measure by the U.S. government to calm financial instability while avoiding criticism for using taxpayers' money to save financial companies. U.S. Treasury Secretary Janet Yellen also repeatedly sought to block anxiety by asserting that the financial system remains sound. However, First Republic Bank's stock price plunged about 20% in after-hours trading on the 16th (local time) compared to the closing price.

Eleven Major U.S. Banks Provide $30 Billion Support to First Republic

According to local media such as The Wall Street Journal (WSJ) on the day, 11 major banks including JPMorgan and Bank of America (BoA) announced they would deposit $30 billion into First Republic. JPMorgan, Citigroup, BoA, and Wells Fargo will each contribute $5 billion. Goldman Sachs and Morgan Stanley will put in $2.5 billion each, while U.S. Bancorp, Truist Financial, PNC Financial Services Group, State Street, and BNY Mellon will each contribute $1 billion. These deposits are not insured.

The banks stated, "This action reflects the confidence that major U.S. banks have in First Republic and banks of all sizes," adding, "Regional and small banks are very important to maintaining the soundness and functionality of the U.S. financial system." They emphasized, "We (major U.S. banks) stand with all banks to support the U.S. economy and everyone around us."

The U.S. Treasury Department, Federal Reserve (Fed), Federal Deposit Insurance Corporation (FDIC), and Office of the Comptroller of the Currency (OCC) also immediately issued a joint statement welcoming the move, saying, "The support from this group of major banks demonstrates the resilience of our banking system."

Thanks to the large-scale support from private banks, First Republic, which had been experiencing a liquidity crisis due to sharp stock price drops and bank runs (massive deposit withdrawals), was able to breathe a sigh of relief. The market had been deeply concerned that First Republic would follow the same path as SVB and Signature Bank after their bankruptcies. The liquidity crisis of U.S. banks spread to the global financial sector, causing Credit Suisse (CS) to face a liquidity crisis as well, receiving an emergency $50 billion injection from the central bank the day before. However, with the announcement on this day, market sentiment somewhat stabilized, and First Republic's stock closed at $34.27, up 9.52% from the previous session.

Private Capital Injection... Stabilizing Finance While Avoiding Bailout Controversy

This move is significant in that it is not a government bailout involving direct government funds but rather private major banks acting as white knights. Foreign media such as The Washington Post (WP) and WSJ reported that Jamie Dimon, chairman of JPMorgan, known as the 'Emperor of Wall Street,' played a decisive role in bringing about this measure. Treasury Secretary Yellen discussed the plan to inject private funds into First Republic with Dimon over the phone, and Dimon persuaded other banks. It is reported that CEOs of major U.S. banks gathered at Yellen's office in the afternoon to discuss measures until just before the announcement.

For the U.S. government, by injecting private bank capital, it can avoid criticism of using taxpayers' money for bailouts while aiming to prevent a domino collapse of the financial system. After the SVB incident, the U.S. government repeatedly drew a line against government fund injections into banks, stating "there will be no bailouts." On the 12th, authorities announced full protection of SVB deposits but emphasized again that it was not a bailout. This is analyzed as a measure considering the trauma from the global financial crisis when the Obama administration injected massive taxpayer money to save financial companies and suffered severe political backlash. WSJ evaluated, "This agreement is part of a special effort to turn First Republic into a 'firewall' to protect the entire banking system from widespread fear."

However, some analysts interpret the involvement of private banks as an indication that the U.S. government's crisis response level has escalated. With financial system instability intensifying in Europe following the U.S., the government has played an additional card. This measure was government-led, and if the situation worsens, it will be difficult for private major banks to continue acting as problem solvers. Foreign media also noted that this move recalls the 2008 financial crisis. At that time, Dimon acted as a white knight by acquiring Bear Stearns and Washington Mutual but later faced shareholder backlash, lawsuits, losses, and political pressure.

Yellen Emphasizes "U.S. Financial System Remains Sound" but...

Just before the announcement of this measure, Secretary Yellen appeared before Congress and emphasized regarding the SVB incident that "the U.S. financial system remains sound." She also reiterated that there would be no bailouts.

Yellen, the first government official to testify before Congress after SVB's collapse, reaffirmed, "We confirm that our banking system is sound," and promised, "Americans can be confident that their deposits will be available when needed." She added, seemingly hinting at the private bank support announced later that day, "The actions to be taken this week will confirm our firm commitment that depositors' assets are safe."

Yellen stressed, "The government has taken decisive and strong actions to strengthen confidence in the banking system," adding, "Shareholders and bondholders will not be protected by the government. It is important that not a single penny of taxpayer money is used for these measures." Regarding the SVB collapse, she explained, "The bank was closed because it could not handle withdrawals," and said, "We will thoroughly investigate what happened at the bank and why such problems occurred."

Despite Yellen's confidence, the crisis at First Republic Bank has not completely subsided. Although First Republic's stock closed higher in regular trading following the support announcement, it plunged about 20% again in after-hours trading. Analysts say that fears about financial system instability have not yet dissipated.

Banks are securing funds, anticipating that they are currently experiencing or are likely to experience liquidity crises in the future. According to Bloomberg, U.S. banks borrowed $152.85 billion last week from the Fed's existing lending window, the discount window. This is a significant increase from the $4.58 billion borrowed the previous week and exceeds the record during the 2008 financial crisis ($111 billion). Bloomberg analyzed, "Some declare the financial sector crisis over with the rescue of First Republic, but that is not the case."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.