Resolving Supply Uncertainty of Photoresists with 70% Dependency Rate

Japan's Cooperation Amid US-China Hegemony Struggle... "Positive Opportunity for Domestic Investment Attraction"

Japan's lifting of export restrictions on three key semiconductor materials (hydrofluoric acid, polyimide fluoride, and photoresist) to South Korea has provided relief to the Korean semiconductor industry, which is in the process of domesticating these materials. There is great expectation that this recent Korea-Japan economic cooperation will enhance supply stability during the still incomplete localization phase of materials, parts, and equipment (SoBuJang).

President Yoon Suk-yeol, who visited Japan for a 2-day trip, is shaking hands and taking a commemorative photo with Japanese Prime Minister Fumio Kishida at the Prime Minister's Official Residence in Tokyo on the afternoon of the 16th, ahead of the expanded Korea-Japan summit.

President Yoon Suk-yeol, who visited Japan for a 2-day trip, is shaking hands and taking a commemorative photo with Japanese Prime Minister Fumio Kishida at the Prime Minister's Official Residence in Tokyo on the afternoon of the 16th, ahead of the expanded Korea-Japan summit. [Photo by Yonhap News]

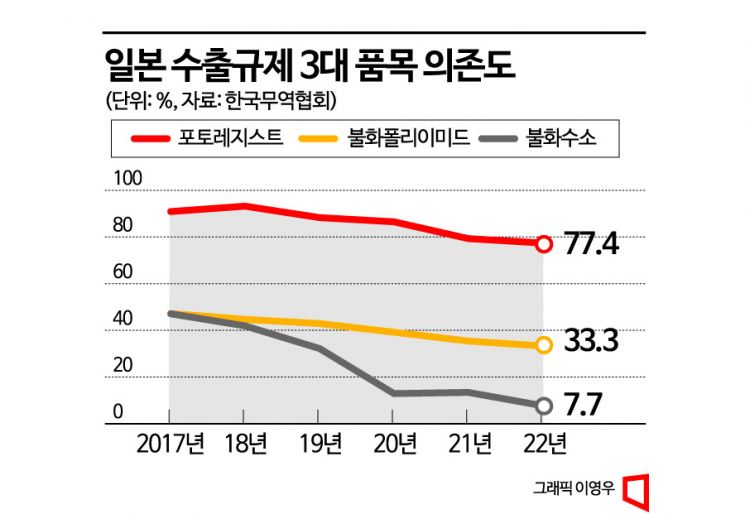

Since Japan's semiconductor core material export restrictions in 2019, the Korean semiconductor and display industries have worked hard for three and a half years to reduce dependence on Japan for key items and strengthen self-reliance, but there is still a long way to go before achieving 100% localization. So far, they have only managed to reduce Japan dependence by 9.6 to 24.5 percentage points.

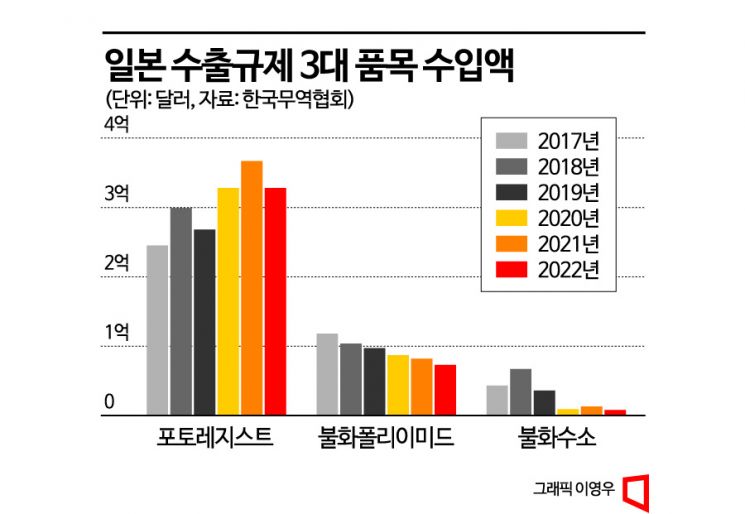

According to export-import statistics from the Korea International Trade Association, Japan's dependence on photoresist, used to etch semiconductor circuits, decreased from 88.3% in 2019 to 77.4% last year, a 10.9 percentage point drop, but still remains in the 70% range. Dependence on hydrofluoric acid, used in wafer etching and impurity removal processes, dropped from 32.2% to 7.7%, a 24.5 percentage point decrease during the same period. Dependence on polyimide fluoride, used in flexible display manufacturing, fell from 42.9% to 33.3%, a 9.6 percentage point decline.

The reduction in Japan's share of key semiconductor materials is largely due to the Korean government and companies' localization efforts. The most successful import substitution item has been hydrofluoric acid. In the early days of Japan's export restrictions, Korea imported hydrofluoric acid from Taiwan, but now uses a significant amount produced domestically. Solbrain and SK Materials have begun mass-producing high-purity products. As of last year, the import value of semiconductor manufacturing hydrofluoric acid from Japan was $8.3 million, and import volume was 3,451 tons, representing decreases of 87.6% and 91%, respectively, compared to 2018 before the export restrictions began.

Localization efforts for semiconductor materials have provided growth opportunities for domestic companies. Solbrain, funded by Samsung Electronics, completed a liquid hydrofluoric acid plant early in 2020 and succeeded in mass-producing ultra-high-purity liquid hydrofluoric acid. As a result, the company's sales soared from 470.1 billion KRW in 2020 to around 1 trillion KRW last year. SK Specialty (formerly SK Materials) also began mass-producing ultra-high-purity hydrofluoric acid, which is difficult to develop, in mid-2020. This year, the localization rate target for hydrofluoric acid is 70%. For polyimide fluoride, Kolon Industries and SKC have secured their own technology and production bases, reducing dependence on Japanese products. In particular, Kolon Industries is known to have significantly narrowed the technology gap with Japan's Sumitomo Chemical.

The domestic industry welcomes Japan's lifting of export restrictions on key semiconductor materials, as it will help secure a stable supply chain, although 100% localization has not yet been achieved. For photoresist, the localization rate was 0% before the export restrictions, but Dongjin Semichem succeeded in mass production at the end of last year, marking the beginning of localization possibilities. Until now, efforts to diversify supply chains, such as rerouting imports through Belgium, have continued to reduce dependence on Japan. Since Japan's import dependence still remains in the 70% range, lifting the restrictions is expected to change the individual import permit system for each item to a general permit system, improving supply conditions.

Professor Jeong In-gyo of Inha University's Department of International Trade said, "So far, the three materials have not been perfectly replaced domestically but have been rerouted through other countries or procurement sources changed. We used to import at 110 or 120 won when it could have been 100 won, but with the normalization of Korea-Japan relations, there is an advantage of importing at the original 100 won."

For Samsung Electronics and SK Hynix, whose semiconductor factories in China have become new risks amid the US-China hegemonic rivalry, cooperation with Japan, which possesses world-class SoBuJang technology, can be reassuring. Kim Dong-hwan, director of the Institute for International Strategic Resources, said, "In a situation where China risks have increased, reducing risk on at least one side is welcome news for Korea," adding, "Japanese SoBuJang companies still have high technological capabilities, and the agreement opens opportunities to attract Japanese corporate investment in Korea, which is positive."

Active private exchanges are also good news. Business organizations from both countries (Federation of Korean Industries - Keidanren) have each contributed 1 billion KRW to create a future partnership fund, pledging not only technology but also talent exchanges. Professor Jeong In-gyo said, "It is undeniable that the two advanced East Asian countries must cooperate closely during a time when the global order and industries are being reorganized," adding, "This is not just about lifting export restrictions; if industrial cooperation increases in the future, additional benefits can be expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.