[Upcoming Hydrogen Economy]

South Korea Leads in Hydrogen Vehicle Adoption

Charging Infrastructure Still Insufficient

Charging Operators' Profits Not Guaranteed

High Vehicle Prices Also a Barrier

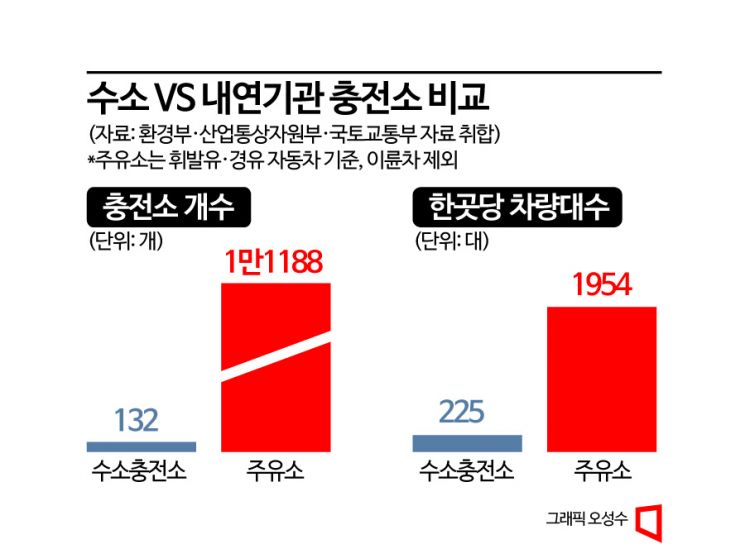

About 1,954 vehicles pass through a single gas station. This average is calculated based only on gasoline and diesel cars, excluding two-wheelers. For hydrogen charging stations, the number of vehicles per station is about 225. This means that the number of operating vehicles, which could be considered a source of revenue, is only about one-ninth. Operators running gas stations are already concerned about profitability, and hydrogen vehicles are far fewer in number. At this point, hydrogen charging stations cannot naturally increase based solely on market logic. Those who drive hydrogen vehicles feel there are not enough charging stations, while operators of charging stations inevitably feel that the spread of hydrogen vehicles is slow.

Hydrogen vehicles, which are attracting attention as the next-generation power source, started running in Korea earlier than in any other country. Hydrogen-powered vehicles have existed as prototypes since the 1960s and 1970s. Since then, global automakers have also released various prototypes, but the first to establish a proper mass production system was Hyundai Motor Company's Tucson ix fuel cell electric vehicle (FCEV), based on a sports utility vehicle (SUV), in 2013.

The hydrogen SUV Nexo, also released by the same company later, is among the pioneers of hydrogen vehicles. Hyundai was also the first to produce commercial vehicles. The existing large truck-based Xcient hydrogen electric truck was the first mass-produced commercial vehicle to appear on the market. According to data from the market research firm SNE Research, a total of 10,336 hydrogen vehicles were sold in Korea last year. South Korea is the only country in the world where more than 10,000 hydrogen vehicles have been sold. Globally, about 20,000 hydrogen vehicles have been sold.

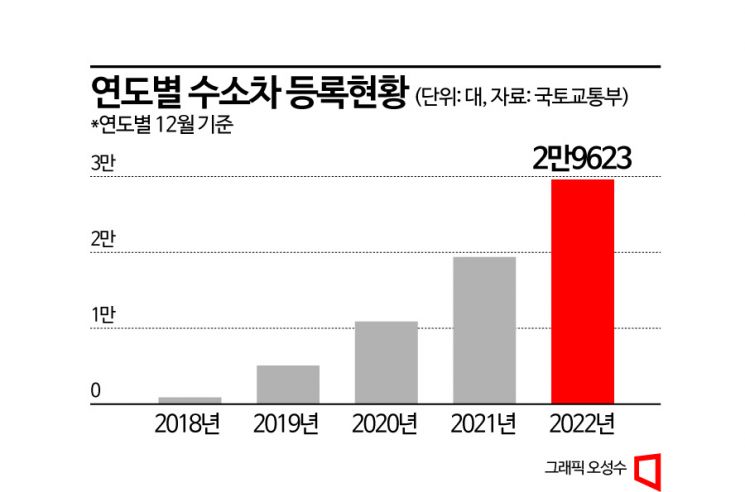

Although hydrogen vehicles began to be distributed early, they have not become widespread. Based on vehicles registered domestically over the past five years, hydrogen vehicles increased from about 5,000 to just over 30,000. In comparison, pure electric vehicles, also considered next-generation power vehicles, increased from 56,000 to 390,000 during the same period.

The biggest reason for the slow spread of hydrogen vehicles is the lack of charging infrastructure. Compared to pure electric vehicles, charging time is shorter, but the number of charging stations is too small. The Anti-Corruption and Civil Rights Commission reviewed complaints related to hydrogen and other eco-friendly vehicles in the past and found that the most common complaints were about charging. Hydrogen vehicle users complain that charging facilities are insufficient and that even the existing charging stations are not properly maintained.

The high vehicle price is also an obstacle. The Nexo currently on sale is a compact SUV priced around 67.65 million to 70.95 million KRW. The hydrogen electric trucks, which began domestic sales at the end of last year, cost between 610 million and 666 million KRW. Compared to internal combustion engine vehicles of similar size or purpose, these are more than twice as expensive. However, considering various tax cuts and subsidies amounting to tens of millions or even hundreds of millions of KRW, the actual amount consumers pay when purchasing the vehicle is similar to or less than that of conventional internal combustion engine vehicles. This indicates a significant dependence on subsidies.

Industry insiders believe that since the market is not yet mature, it will be difficult to lower vehicle prices immediately. Geum Woo-yeon, head of Hyundai Motor's LCM Commercial Center, said, "Since suppliers produce parts on a small scale, it is difficult to reduce production costs," adding, "The supply of rare earth elements needed for motors and various battery materials is also hindered by export regulations, which is another obstacle."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.