Starting July, 50% Rule to be Applied

Life Insurers' Self-Ratio Exceeds 80%

Busy Downsizing Subsidiaries and Seeking Independent Corporations

Financial Authorities: "A Natural Change... Need to Enhance Expertise and Scale in Loss Adjustment"

The 'preferential treatment of loss adjustment subsidiaries' by insurance companies is being put on hold. Unlike non-life insurers who have steadily reduced the proportion of work assigned to subsidiaries, life insurers are now under pressure. Since they still entrust more than half of their loss adjustment tasks to subsidiaries, it is expected that they will inevitably need to downsize their subsidiaries and consider third-party entities to reorganize the situation.

According to the industry on the 17th, the Financial Supervisory Service (FSS), after consultations with the industry, plans to announce next week a revised version of the "Model Guidelines on Outsourcing Loss Adjustment Work and Appointment of Loss Adjusters," which includes provisions preventing large insurers from entrusting more than 50% of their work to subsidiary loss adjustment corporations. (Reference: The '50% Rule' to Stop Large Insurers' Self Loss Adjustment to Take Effect This Year) Loss adjustment involves investigating and analyzing insurance claims and calculating the amount of loss to determine the scope of compensation.

The revised guidelines, scheduled to be applied from July, recommend that insurers entrust loss adjustment-related work to their loss adjustment subsidiaries up to only 50% of the previous year's level. If the outsourcing exceeds this standard, the selection criteria and results must be reported to the board of directors once a year and disclosed publicly. Although not legally mandated yet, insurers cannot ignore the financial authorities' recommendations, effectively limiting the 'self loss adjustment' ratio to half.

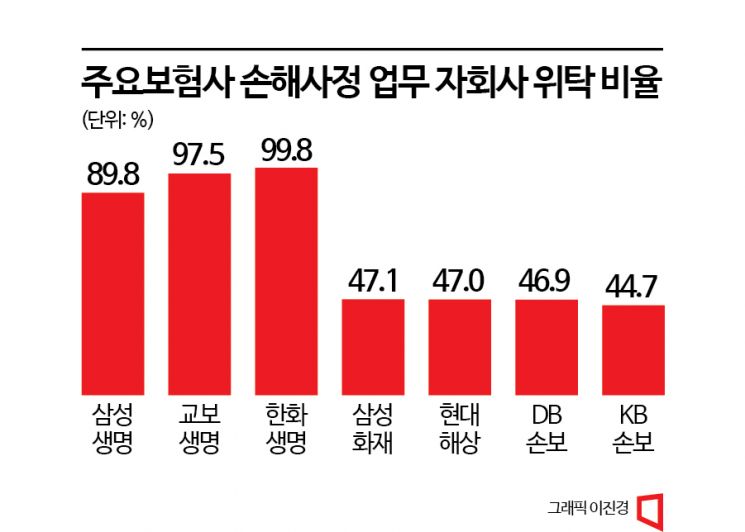

Accordingly, insurers are rushing to prepare. Life insurers are in a more urgent situation than non-life insurers. Most non-life insurers have adjusted to below the 50% level, but life insurers still entrust the majority of their tasks to subsidiaries. In fact, in 2021, the outsourcing ratio to subsidiary loss adjustment corporations (based on the number of cases) was 89.8% for Samsung Life, 99.8% for Hanwha Life, and 97.5% for Kyobo Life. The industry estimates that although this ratio decreased compared to the previous year, it still exceeded 80% for life insurers last year.

Life insurers are concerned that rapidly reducing this ratio could cause various side effects. They particularly argue that the quality of loss adjustment will decline. A representative from a major life insurer said, "Due to member information, sales competition, and other circumstances, we cannot outsource to other companies' subsidiaries and ultimately have no choice but to entrust independent loss adjustment corporations. These entities currently lack the scale and capability to handle the workload assigned by each insurer, so the quality of loss adjustment itself may decline in the future, and insurers increasing outsourcing will face higher costs, which could lead to consumer harm."

The authorities dismissed these concerns. While acknowledging that confusion due to changes is inevitable, they maintain that the change itself cannot be reversed. An FSS official explained, "Loss adjustment has a significant impact on consumers and has been criticized as unfair due to self loss adjustment, so it is natural to make it fair. Independent loss adjusters will need time to secure expertise and sufficient personnel, but overall change in the loss adjustment industry is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.