Seoul Apartment Jeonse Listings Decrease by 13% in Two Months

Jeonse Prices Drop, Wolse Prices Rise Causing Demand Shift

Transaction Volume Increases, Jeonse Price Decline Slows Down

Due to the impact of high interest rates, the number of Seoul apartment jeonse listings, which had been accumulating in the 50,000 range, has fallen below 50,000 and entered the 40,000 range. This is interpreted as landlords facing reverse jeonse difficulties lowering jeonse prices, and many cost-effective jeonse listings being depleted as demand shifted to monthly rent, which has become expensive.

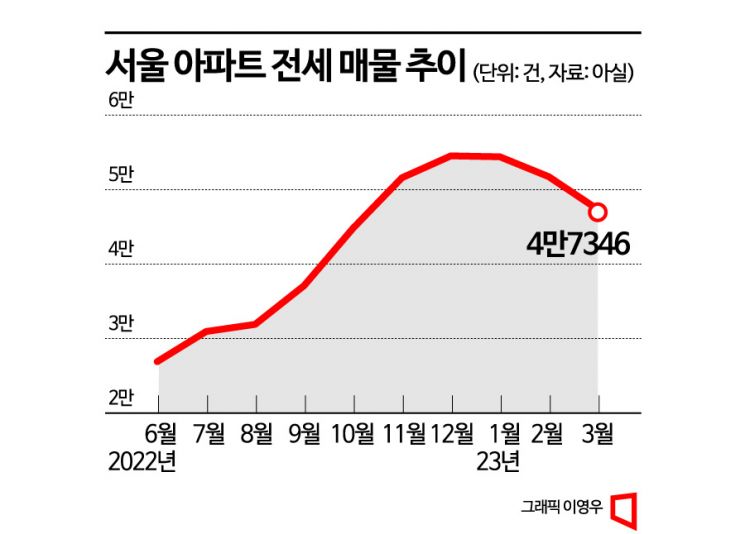

According to Apartment Real Transaction Price (Asil), a real estate big data company, as of the 16th, the total number of Seoul apartment jeonse listings was 47,346. This is a 13% decrease compared to 54,411 listings two months ago and an 8.5% decrease compared to 51,736 listings one month ago.

Seoul apartment jeonse listings had been severely backlogged for a while due to the US-originated interest rate hikes pushing the upper limit of domestic jeonse loan interest rates close to 7% per annum. Tenants burdened by excessive interest moved from jeonse to monthly rent. Jeonse listings, which were only in the 30,000 range in August last year, rose to the 40,000 range in September due to 'jeonse avoidance and monthly rent preference,' and entered the 50,000 range in November. In January, listings accumulated to around 55,000.

The recent decrease in accumulated jeonse listings is thanks to increased transaction volume. According to the Seoul Real Estate Information Plaza, a total of 11,746 jeonse contracts were signed in Seoul last month. Recovering transaction volume to the 11,000 range is the first time in six months since August last year. In November last year, when jeonse avoidance was severe, it was only around 900 contracts.

It is analyzed that as landlords alarmed by reverse jeonse difficulties competed to lower jeonse prices, rental demand that had shifted to monthly rent moved back to jeonse. In fact, jeonse prices in major areas of Seoul have noticeably fallen back to levels from about two years ago. For example, an 84㎡ (exclusive area) unit in Godeok Gracium, Gangdong-gu, Seoul, was contracted for 1 billion KRW in August last year, but recently has mostly been traded in the 600 to 700 million KRW range, and on the 8th, a first-floor unit was contracted for 450 million KRW. Similarly, an 84㎡ unit in Jamsil L’centz, Songpa-gu, dropped from a peak of 1.47 billion KRW in August last year to around 900 million to 1 billion KRW recently. On the 14th, a unit that was contracted for 950 million KRW two years ago was renewed at 880 million KRW, a decrease of 70 million KRW.

As demand gradually recovers, the rate of jeonse price decline has also slowed. According to the Korea Real Estate Board’s nationwide housing price trend, Seoul apartment jeonse prices fell by 3.34% in February compared to the previous month. Although the decline is still steep, it has moderated compared to -4.97% in December last year and -4.65% in January this year.

There is still a strong preference for monthly rent due to concerns about jeonse fraud and “empty jeonse” (kan-tong jeonse), and with supply concentrated mainly in the Gangnam area, jeonse prices are expected to continue declining for the time being. However, since transaction volume is gradually recovering and domestic banks are lowering jeonse loan interest rates, the sharp decline is likely to stop. If the US Federal Reserve slows the pace of interest rate hikes due to the impact of the SVB bankruptcy, domestic banks are also likely to lower jeonse loan interest rates further.

Yoon Ji-hae, head of the research team at Real Estate R114, explained, “Tenants moved to the monthly rent market not because they preferred it, but because the loan burden increased,” adding, “Recently, monthly rent prices have risen to a burdensome level, causing rental demand to shift back to jeonse.” She also predicted, “Since the jeonse market moves in tandem with the sales market, jeonse prices can stabilize at the current level if the sales market recovers.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.