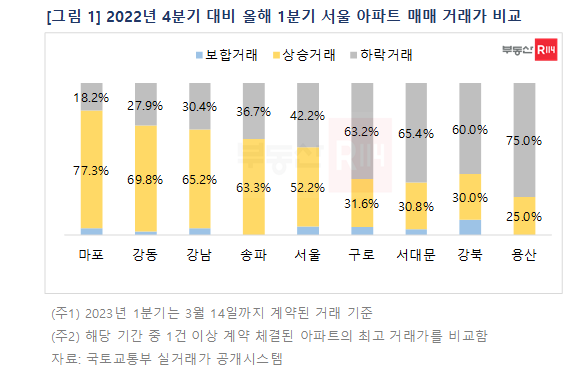

In the first quarter of this year, the proportion of Seoul apartment transactions that increased compared to the fourth quarter of last year exceeded half.

According to Real Estate R114 on the 16th, out of 531 Seoul apartment transactions recorded this year, 277 transactions, or 52.5%, showed price increases compared to the previous quarter, the fourth quarter of last year. Transactions with price decreases accounted for 224 cases (42.2%), and transactions with no price change were 30 cases (5.6%).

The district with the highest proportion of price-increasing transactions was Mapo-gu at 77.3%. This was followed by Gangdong (69.8%), Gangnam (65.2%), and Songpa (63.3%). On the other hand, Yongsan, Gangbuk, Seodaemun, and Guro districts had lower proportions of price-increasing transactions.

Looking at the 277 Seoul apartment transactions with price increases by price range, the highest transaction prices in the previous quarter were distributed as follows: 9 billion to 15 billion KRW at 32.9% (91 cases), under 6 billion KRW at 29.6% (82 cases), 6 billion to 9 billion KRW at 26.7% (74 cases), and over 15 billion KRW at 10.8% (30 cases). Notably, in the 9 billion to 15 billion KRW and under 6 billion KRW ranges, the proportion of transactions with price increases exceeding 5% surpassed 30%.

This is interpreted as being influenced by the sale of large-scale urgent sale properties in Gangdong-gu and Songpa-gu, where price declines were significant, as well as continued transactions of small and reconstruction apartments in Nowon-gu and Dobong-gu, which are eligible for public housing and special public housing loans.

A representative from Real Estate R114 explained, “Since the beginning of this year, buyer sentiment has improved due to the lifting of regulation zones and improved loan conditions, and with the anticipated decline in official prices of multi-family housing, the burden of owning a home is expected to decrease.” They added, “As a result, sellers who lower their asking prices and choose to observe the market rather than rush to sell are expected to increase.” They further forecasted, “However, this is likely to be limited to areas where demand has increased and transactions have risen, so differences in market temperature by location and price range may appear even within Seoul.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.