Semiconductor Industry: "Samsung Electronics, Opportunity to Reverse Competition with TSMC"

Display Sector: "Welcomes Customized Support for Automotive, XR, and Transparent Technologies"

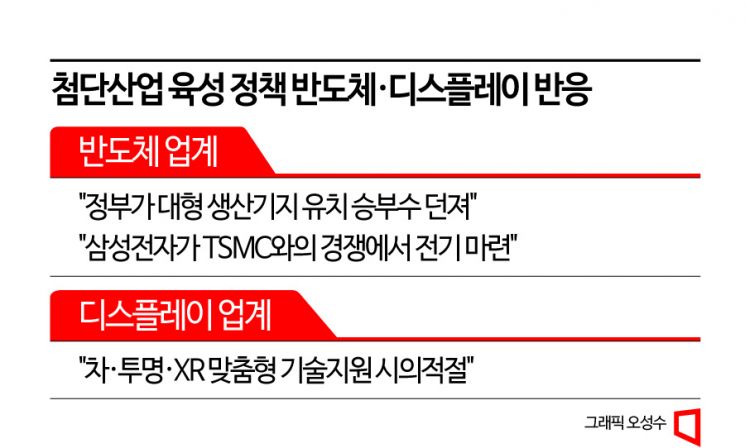

The semiconductor and display industries welcomed the 'National Advanced Industry Development Strategy' announced by the government on the 15th. They said both the timing and content of the policy were timely.

The semiconductor industry viewed the government's plan to create the world's largest mega cluster positively. They calculated that if the facility investment tax credit bill passes in the National Assembly, it would mean capturing both infrastructure and tax benefits simultaneously.

Particularly, they attached significance to the news of the Yongin semiconductor cluster development. This means creating an industrial ecosystem centered on system semiconductors, including memory, foundry, and materials, parts, and equipment.

President Yoon Suk-yeol speaking at the 14th Emergency Economic and Livelihood Meeting held at the Blue House State Guesthouse on the 15th. [Image source=Yonhap News]

President Yoon Suk-yeol speaking at the 14th Emergency Economic and Livelihood Meeting held at the Blue House State Guesthouse on the 15th. [Image source=Yonhap News]

The Yongin cluster is the world's largest, covering 7.1 million square meters (approximately 2.15 million pyeong). By 2042, five Samsung Electronics foundry factories (fabs) are scheduled to be established. 150 domestic and foreign materials, parts, and equipment companies, as well as fabless (design) companies, will also be located there. The private investment alone for cluster development exceeds 300 trillion won (Samsung Electronics). The expected direct and indirect production inducement effect after investment reaches 700 trillion won. The employment inducement effect is about 1.6 million people.

The Korea Semiconductor Industry Association stated in a press release on the 15th, "We expect this comprehensive support strategy to help create a robust ecosystem for the domestic semiconductor industry." Within the industry, there was also an interpretation that "our government has made a decisive move to attract a large semiconductor production base."

At the "World's First GAA-Based 3nm Mass Production Shipment Ceremony" held on the morning of July 25 last year at Samsung Electronics Hwaseong Campus in Hwaseong-si, Gyeonggi-do, Samsung Electronics officials unveiled the 3nm wafer. [Hwaseong=Photo by Kim Hyun-min kimhyun81@]

At the "World's First GAA-Based 3nm Mass Production Shipment Ceremony" held on the morning of July 25 last year at Samsung Electronics Hwaseong Campus in Hwaseong-si, Gyeonggi-do, Samsung Electronics officials unveiled the 3nm wafer. [Hwaseong=Photo by Kim Hyun-min kimhyun81@]

Above all, there is high expectation that once production at the Yongin cluster foundry factories begins in earnest, Samsung Electronics will gain a favorable position in competition with Taiwan's TSMC. Currently, only Samsung Electronics and TSMC have foundry process technology below 5 nanometers (nm; 1 nm = one billionth of a meter). Samsung Electronics is trailing TSMC in terms of production scale and customer acquisition. According to the fourth quarter foundry global market share announced by Taiwanese market research firm TrendForce last year, Samsung Electronics' share was 15.8%, only about one-quarter of TSMC's 58.5%. If the government policy is properly implemented, it will secure an opportunity to catch up with TSMC in production scale.

The industry expects the facility investment tax credit bill to be processed. To realize the investment attraction strategy announced this time, the tax incentive law amendment proposed by the Ministry of Economy and Finance in January must be passed by the National Assembly. The bill includes raising the tax credit rates for large and medium-sized enterprises (from 8% to 15%) and small and medium enterprises (from 16% to 25%) investing in national strategic technology facilities. Although there have been difficulties in passing it in the National Assembly, the possibility of passage this month has increased.

Lee Chang-han, Vice Chairman of the Korea Semiconductor Industry Association, said, "It is welcome that the importance of system semiconductors is emphasized while strengthening links with other industries," adding, "If it leads to tax reductions, it could be beneficial to the industry in many ways."

The display industry welcomed the government's announcement of customized support policies for automotive, extended reality (XR), and transparent displays. The government plans to invest 62 trillion won in the display industry by 2026 to promote three major technology demonstration and pilot projects.

The industry evaluated as "timely" the government's clear goal to outpace China and assist in the commercialization of next-generation display technologies. The government announced it will invest 420 billion won in OLED technology innovation funds and 950 billion won in next-generation inorganic light-emitting display research and development (R&D). It also plans to promote specific demonstration and pilot projects such as transparent OLED subway screen doors, XR for logistics warehouses, and automotive displays for tourist buses.

The Korea Display Industry Association said that China's growth speed is very fast not only in LCD but also in OLED. China's OLED panel market share rose from 4% in 2018 to 18% in 2021. According to global market research firm Omdia, the mobile OLED market share is expected to increase from 11% in 2019 to 30% this year. An association official said, "It is welcome that R&D support has been increased so that Korea can have price competitiveness in OLED compared to LCD," adding, "Inorganic light-emitting displays are a key area where we must outpace China and secure independent technology, so the government's large-scale investment is timely."

Regarding workforce support policies, there was a response that the success or failure of the policy will depend on how many specialized personnel can be deployed on-site at materials, parts, and equipment companies. The government has pledged to train 9,000 people by 2032, but pointed out that securing 7,000 specialized personnel is an urgent task. Currently, LG Display operates display contract departments linked to recruitment at Yonsei University, Hanyang University, and Sungkyunkwan University graduate schools. An association official said, "There is an urgent need for OLED and next-generation display specialized personnel supply in materials, parts, and equipment companies," adding, "It is necessary to re-educate on-site personnel through company-specific customized education and to foster specialized personnel who will develop core technologies."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)