Bitcoin Rises 13% While Increasing 58%

Surge Driven by Popularity of Bitcoin-Based NFT Protocols

Upbit Accounts for Over 55% of Total Exchange Volume

As the prices of virtual assets, which are representative risk assets, show an upward trend, Stacks has surged, attracting attention. Following the bankruptcy of the U.S. Silicon Valley Bank (SVB), expectations that the pace of interest rate hikes will slow down have led to a rise in virtual asset prices. In particular, Stacks has shown a remarkable increase, rising more than 58% over the past week.

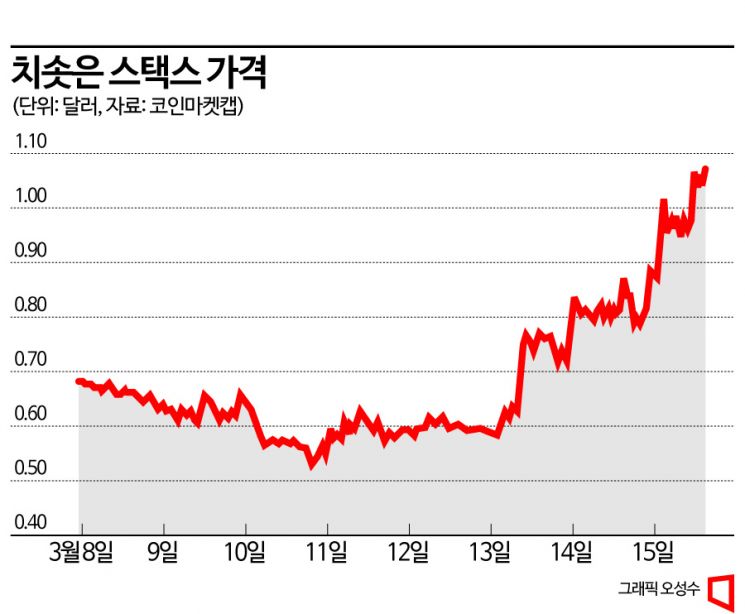

According to CoinMarketCap, a global virtual asset market tracking site, as of 2:46 PM on the 15th, the price of Stacks was $1.05 (approximately 1,368 KRW), up 25.23% from the previous day. Compared to a week ago, it rose 58.55%. Until the 10th, it remained around $0.5, but it started to rise from the 13th and eventually recovered to the price level of April last year. Compared to Bitcoin’s approximately 13% increase over the week, Stacks showed a sharp surge.

The price of Stacks has recently surged as Ordinals, an NFT open-source protocol based on the Bitcoin blockchain, gained popularity. When the NFT company Yuga Labs issued Bitcoin NFTs, some were auctioned for over 200 million KRW. Stacks is a programmable platform on the Bitcoin network. It executes smart contracts on a separate chain and stores the contracts generated through this on the Bitcoin blockchain. As the utility of Bitcoin increases, the Stacks ecosystem grows accordingly. It is evaluated to have strengths in security and stability by utilizing the representative blockchain Bitcoin, and also has scalability by executing smart contracts on a separate chain.

Additionally, the fact that Stacks is a coin approved by the U.S. Securities and Exchange Commission (SEC) is also a factor in its popularity. Its predecessor, Blockstack, legally conducted an Initial Coin Offering (ICO) after receiving approval from the SEC in 2019. Since then, it has been classified as a security-type virtual asset. However, this caused difficulties in listing, but it was reborn as Stacks and is now supported for trading on several virtual asset exchanges, including those in Korea.

Moreover, last month, Binance, the world’s largest exchange, listed Stacks’ perpetual futures on its affiliated futures trading platform, which is also analyzed as a positive factor. Also, the fact that the Bitcoin halving and Stacks halving are scheduled for the first half of next year is attracting investors’ attention. When the issuance quantity and mining rewards decrease due to halving, scarcity increases, leading to price rises.

Thanks to these positive factors, the sharply rising Stacks is especially attracting great interest from domestic investors. According to CoinMarketCap data, more than 55% of the total Stacks trading volume is accounted for by Upbit, a domestic exchange. At the same time, on Upbit’s KRW market, Stacks was traded at 1,370 KRW, up 7.87% from the previous day. This is 2 KRW higher than the CoinMarketCap aggregated price of 1,368 KRW.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.