'Expectations Reflect Slower Pace of Fed Rate Hikes'

Concerns Over Negative Impact if Institutions Investing in Virtual Assets Face Crisis

Amid the turmoil caused by the bankruptcy of Silicon Valley Bank (SVB) in the United States, the leading cryptocurrency Bitcoin surged sharply. This is largely interpreted as a result of expectations that the Federal Reserve's (Fed) pace of interest rate hikes will slow down due to the bank failures.

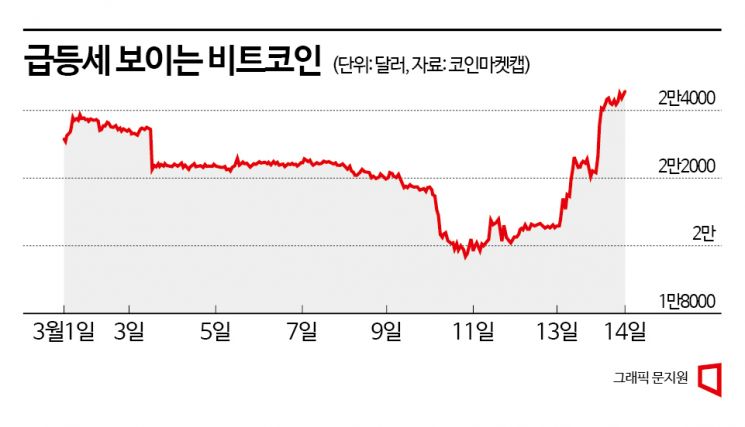

As of 6:20 a.m. on the 15th (Korean time), according to the cryptocurrency market tracking site CoinMarketCap, Bitcoin was trading at $24,469, up 0.75% from 24 hours earlier. On the same day, Bitcoin surged past $26,000, marking two consecutive days of sharp increases, before profit-taking sales brought it back down to the $24,000 range. As of 2:42 p.m. on the 14th, Bitcoin's price was recorded at $24,435 (approximately 31.96 million KRW), a sharp increase of 8.86% compared to the previous day. Until the 10th of this month, Bitcoin had been below $20,000, but the recent surge pushed it back above $24,000 for the first time since the 23rd of last month.

Bitcoin's price had plunged after Fed Chair Jerome Powell delivered hawkish remarks during a Senate Banking Committee hearing on the 7th (local time), and following concerns of a massive bank run at Silvergate, a major bank dealing with cryptocurrencies, which subsequently decided to liquidate. Bitcoin prices were expected to fall further due to SVB's bankruptcy.

However, the bankruptcy of SVB and Signature Bank turned out to be a positive factor. Expectations grew that the Fed would not raise the benchmark interest rate at this month's Federal Open Market Committee (FOMC) meeting. It has been confirmed that rapid rate hikes are damaging not only the real economy but also the financial system, increasing voices that a return to big steps (0.5 percentage point rate hikes) is unlikely.

Some predict that if institutions investing in cryptocurrencies fall into crisis due to SVB's bankruptcy, negative effects will emerge over time. However, due to the nature of cryptocurrencies being heavily influenced by U.S. benchmark interest rates, it is explained that buying momentum will continue amid this situation.

As prices rose, trading volume also surged. The daily trading volume as of the previous day was $49.46636 billion (approximately 64.702 trillion KRW), an increase of 68.95% compared to the 12th. Compared to early this month, it more than doubled.

Cryptocurrency Investor Sentiment Greatly Improved

Investor sentiment improved to a level of greed. According to cryptocurrency data provider Alternative, the Fear & Greed Index, which measures investor sentiment, rose 7 points from 49 (neutral) the previous day to 56 (greed) on the same day. Alternative’s Fear & Greed Index ranges from 0, indicating extreme fear and pessimism about investing, to 100, indicating strong optimism.

Other indicators also improved. According to data from cryptocurrency analytics firm CryptoQuant, Bitcoin’s MVRV (Market Value to Realized Value) ratio rose from 1.02 on the 10th to 1.22 the previous day. Bitcoin MVRV is an indicator estimating price undervaluation by dividing market capitalization by realized capitalization; generally, a value below 1 indicates a price bottom.

Additionally, Bitcoin’s NUPL (Net Unrealized Profit and Loss) indicator also increased during the same period. It recorded 0.019 on the 10th, the lowest since January 13, but then rose to 0.18 as of the previous day. NUPL represents unrealized net profits, showing whether investors are in profit or loss. A positive or increasing value means more coins are in profit territory.

Lee Miseon, head of research at Bithumb Economic Research Institute, said, "If concerns about the U.S. banking system continue, the recent Bitcoin buying momentum is likely to persist." She explained, "Realistically, the Fed is likely to continue providing emergency liquidity to banks to prevent bank runs from materializing, which means monetary policy will have to change." She added, "As the Fed’s monetary policy shifts toward supplying liquidity, it is expected to act as a positive factor for prices of Bitcoin, gold, and other assets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.