[Impact and Outlook of China's Reopening] Semiconductor Effects

Demand Recovery Expected with Smartphone Market Recovery

Global Recession and US Sanctions Are Concerns

The domestic semiconductor industry is paying close attention to China's reopening (resumption of economic activities), which is the largest consumer market. With China lifting restrictions, there are predictions that semiconductor demand could increase alongside economic recovery. On the other hand, there are negative forecasts due to the poor global economy and the intensifying US sanctions against China.

China ended its COVID-19 lockdown policy last December and has recently been focusing on economic recovery. The semiconductor industry is expecting a recovery in demand for IT devices within China under these circumstances. As IT device production and consumption increase locally, the semiconductors embedded in them also increase.

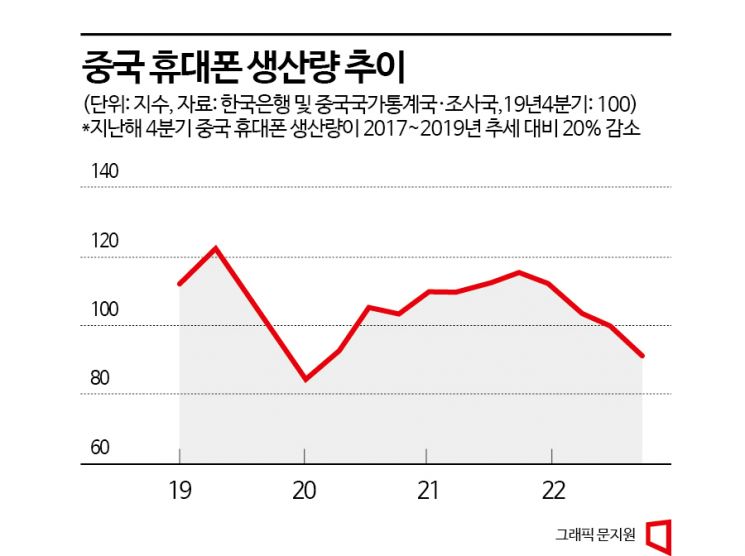

The industry is particularly focusing on mobile demand. Market research firm TrendForce sees China's reopening as a major factor in increasing global smartphone shipments. For the semiconductor industry, which has a high proportion of mobile products, this represents a significant opportunity. The proportion of mobile products in total DRAM was 38.5% last year, the highest.

Park Myung-soo, Vice President in charge of DRAM marketing at SK Hynix, said in a conference call last month, "If there are changes such as economic stimulus measures in the Chinese smartphone market after reopening, for example smartphone subsidies, high-capacity mobile (semiconductor) demand will increase mainly for new products released in the second half of the year."

Domestic semiconductor exports are also within the sphere of influence. The Bank of Korea recently stated in a report, "Exports to China are expected to gradually recover after the second half of the year due to the reopening effect," adding, "IT exports such as mobile phones and semiconductors are expected to recover with some delay." China accounts for about 40% of domestic exports.

However, there are also many forecasts that the reopening effect may be minimal. For China's reopening to be effective, economic growth must be supported. But China is projecting an economic growth rate of around 5% this year, the lowest since it first announced growth forecasts in 1994. China had expected a 5.5% growth rate last year but actually recorded only 3.0%, marking the second-lowest growth rate in 46 years.

The global market situation is even worse. The International Monetary Fund (IMF) has projected the global economic growth rate at 2.9% this year. Investment banks (IBs) and various national economic institutions also forecast growth rates in the 1-2% range. This is due to ongoing adverse factors such as inflation, recession, interest rate hikes, and the Russia-Ukraine war continuing from last year into this year.

Kim Yang-peng, a senior researcher at the Korea Institute for Industrial Economics and Trade, explained, "Chinese companies sell electronic products equipped with our semiconductors not only locally but also in global markets such as the US and Japan," adding, "It is not enough for only China to reopen; the tight consumer sentiment in the global market must also ease."

The US increasing the intensity of sanctions against China is also a negative factor. An industry official said, "Under normal circumstances, the reopening could have a significant impact, but now the situation is complicated due to US sanctions and other issues, making it difficult to make a clear judgment," adding, "Not only Korean companies but also US companies are cautious in China, so it is hard to view the market positively."

The US is blocking exports of equipment used in advanced semiconductor production in China. The US government is expected to soon announce a new regulation that more than doubles the number of semiconductor equipment sanction items from 17. This is a burden for Samsung Electronics and SK Hynix, which produce a significant amount of memory at their Chinese factories.

The US also passed the CHIPS Act last year, which includes guardrail provisions restricting investments in China by semiconductor companies receiving subsidies and other benefits in the US. Detailed guidelines for the guardrails are expected to be released this month. With the US continuously tightening regulations, concerns about the Chinese market are inevitably greater than expectations.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)