Safe Conversion Loan MBS Issued at 4.4% Interest Rate

Raising Funds at High Rates to Lend at Low Rates

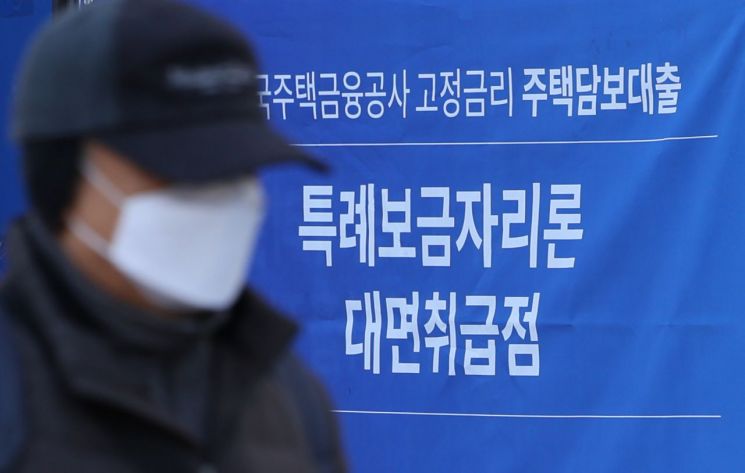

What Will Happen to the 17 Trillion Won Special Bogeumjari Loan Applications?

'Worry if it goes well, worry if it doesn't.' This is the current sentiment at the Korea Housing Finance Corporation (KHFC), which has hit the jackpot with the Special BoGeumjari Loan. The Special BoGeumjari Loan is a product that allows borrowers to switch from a variable-rate mortgage loan to a long-term low fixed-rate loan. It can be applied for regardless of income and applies to homes priced up to 900 million KRW, attracting significant interest with application amounts reaching 17.5 trillion KRW by the end of last month, just one month after its launch.

The problem lies in the structure where the more people choose this product when bond market interest rates are high, the more KHFC risks bearing losses. The budget for this policy financial product is raised by KHFC issuing mortgage-backed securities (MBS) in the bond market. When the Special BoGeumjari Loan opens, banks first provide refinancing loans with long-term low fixed rates to eligible applicants. After about three months, KHFC issues MBS to raise funds, which are then used to purchase the loan receivables from the banks.

Ultimately, the MBS issuance interest rate must be lower than the Special BoGeumjari Loan interest rate for the structure to be profitable. However, in unstable bond market conditions like now, the issuance rate of MBS could be higher than the loan rate, which KHFC is concerned about.

In fact, the predecessor to the Special BoGeumjari Loan, the Anshim Conversion Loan, incurred some losses. This was because funds were raised at a high interest rate but lent out at a lower rate. According to KHFC on the 15th, on the 10th of this month, KHFC issued MBS worth 2.2 trillion KRW to raise funds for the Anshim Conversion Loan, with a weighted average interest rate of 4.406%. Compared to the Anshim Conversion Loan interest rates of 3.8?4.0%, this was significantly higher, resulting in a deficit.

The total application amount for the Anshim Conversion Loan, which operated from September to December last year, was 9.4787 trillion KRW. Besides the MBS issued on the 10th, KHFC must issue additional MBS equivalent to the actual loan amount from the application total. A KHFC official said, "Since government bond yields have recently declined, there is a possibility that bond interest rates will fall in the future," adding, "If bond interest rates decrease, it will be possible to generate profits going forward."

KHFC will need to issue MBS to raise funds for the Special BoGeumjari Loan as early as next month. Although loan interest rates can be adjusted once a month, as a policy financial product, the range for interest rate adjustments is inevitably limited. Currently, the Special BoGeumjari Loan interest rates are 4.25?4.55% annually for the general type and 4.15?4.45% annually for the preferential type. A financial sector official commented, "Since loan interest rates cannot be freely raised even if funding costs increase, KHFC must closely monitor the bond market situation," and added, "With application amounts exceeding 17 trillion KRW, if bond interest rates rise, KHFC's burden to issue MBS for this amount will increase significantly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)